Insurance Agency Answering Service: Stop Missing Calls & Losing Clients in 2025

Executive Summary

Missing a single call could cost your insurance agency thousands in lost revenue. When you’re juggling client meetings, reviewing policies, and handling claims, every missed call represents a potential client walking away to your competitor. Today’s insurance clients expect immediate response, and a traditional voicemail system simply won’t cut it anymore.

Here’s the reality: insurance agencies lose 30-40% of potential clients due to missed calls. That’s why smart agencies are turning to professional answering services that handle calls 24/7, capture leads, and keep your business running even when you can’t answer the phone.

Key Advantages of Professional Call Handling:

- Never miss a lead again – 24/7 coverage means zero missed opportunities

- Instant appointment booking – Clients can schedule immediately while interest is hot

- Bilingual support – Serve Spanish-speaking clients professionally

- Emergency call screening – Urgent claims get immediate attention

- Cost savings – Fraction of hiring full-time staff

Ready to discover which solution fits your agency best? Let’s dive into the complete comparison below.

The Hidden Cost of Missed Calls in Insurance

Let’s talk numbers. When a potential client calls your insurance agency and gets voicemail, only 25% actually leave a message. Of those who do leave messages, less than 40% wait for a callback if you don’t respond within 2 hours.

Here’s what this means for your bottom line:

- Average insurance policy value: $800-$1,500 annually

- Small agencies receive 50-100 calls monthly

- 30% of calls come after business hours or during meetings

- Without proper call handling, you’re losing 15-25 potential clients monthly

Monthly revenue loss calculation: 20 missed leads × $1,000 average policy = $20,000 in lost annual premiums. That’s over $1,600 in monthly recurring revenue walking away because nobody answered the phone.

The insurance business is all about trust and accessibility. When clients can’t reach you during their moment of need, they’ll find an agent who can answer their call. According to a research, 74% of consumers will switch providers after just one poor customer service experience.

Insurance Agency Answering Service Options: Complete Breakdown

Option 1: Do Nothing (Voicemail Only)

Many small agencies rely solely on voicemail, thinking it’s sufficient. Here’s the reality check:

How it works: Clients call, hear your voicemail greeting, and may or may not leave a message.

Pros:

- Costs almost nothing ($10-$50/month)

- Zero setup time

- Complete control over callback timing

Cons:

- Terrible first impression for new clients

- 75-85% of potential clients hang up without leaving messages

- Emergency calls go unanswered

- No appointment scheduling capability

- Competitors who answer calls immediately win your prospects

Missed Revenue Calculation:

Monthly calls: 75 | Missed calls: 60 (80%)

Average policy value: $100/month

Monthly lost revenue: $2,000-$3,000

Option 2: Hire a Full-Time Receptionist

The traditional approach that many established agencies still use.

How it works: You hire, train, and manage a dedicated person to answer phones and handle basic client inquiries.

Pros:

- Human touch and personalized service

- Can handle complex inquiries

- Learns your business over time

- Can perform additional office tasks

Cons:

- High cost: $35,000-$50,000 annually plus benefits

- Sick days and vacation time mean missed calls

- No after-hours coverage

- Recruitment and training time

- Potential employee turnover

Missed Revenue Calculation:

After-hours calls: 25 monthly | Weekend emergencies: 10 monthly

Vacation/sick coverage gaps: 5 business days monthly

Monthly lost revenue: $1,500-$2,500

Option 3: Traditional Answering Service

Many insurance agencies use human-operated answering services that specialize in professional call handling.

How it works: Professional operators answer your calls using customized scripts, take messages, and can route urgent calls to you.

Pros:

- Professional call handling

- Bilingual support available

- Custom scripts for your agency

- Emergency call screening

- After-hours coverage

Cons:

- High monthly costs ($200-$500+ per month)

- Setup takes 2-3 weeks

- Limited after-hours availability

- Per-call or per-minute charges

- Operators don’t know your business intimately

Missed Revenue Calculation:

Service limitations: 15% of calls during peak times

Weekend/holiday gaps: 8 calls monthly

Monthly lost revenue: $1,200-$1,800

Option 4: Voctiv AI Call Assistant (The Perfect Solution)

Modern insurance agencies are discovering that AI-powered call handling delivers superior results at a fraction of traditional costs.

How it works: Advanced AI answers every call instantly, handles common inquiries, books appointments, and immediately notifies you about hot leads via SMS.

Unique Advantages:

- Never misses a call – 100% availability

- Instantly learns your business from website content

- Handles multiple languages automatically

- Books appointments directly into your calendar

- Sends SMS notifications for urgent matters

- Works 24/7 with no breaks or sick days

Setup and Cost:

- Ready in minutes, not weeks

- Free tier available for testing

- Premium version: $29/month

- No per-call charges

- No training required

Revenue Impact:

Missed calls: 0% | Lead capture rate: 100%

Additional evening/weekend leads: 15-20 monthly

Monthly recovered revenue: $2,000-$3,500

ROI: 70-120x monthly investment

Why Insurance Agencies Need Specialized Call Handling

Insurance isn’t just another business – it’s a trust-based industry where timing matters. Here’s why generic answering services fall short:

Emergency Situations

When someone’s been in an accident or faces a home emergency, they need immediate assistance. A delayed response can mean:

- Lost client trust during their most vulnerable moment

- Clients switching to competitors who respond faster

- Potential legal issues from delayed claim reporting

- Negative reviews about poor responsiveness

Quote Requests

Insurance shopping happens when people need it, not during business hours. Studies show that 65% of insurance quote requests happen after 6 PM or on weekends. Miss these calls, and prospects will get quotes from agents who are available.

Policy Questions

Clients call with coverage questions, payment issues, and policy changes. Professional call handling ensures these routine inquiries don’t interrupt your important client meetings while still providing excellent service. Learn more about call handling best practices on our blog.

Implementation: What to Expect

Getting Started with Professional Call Handling

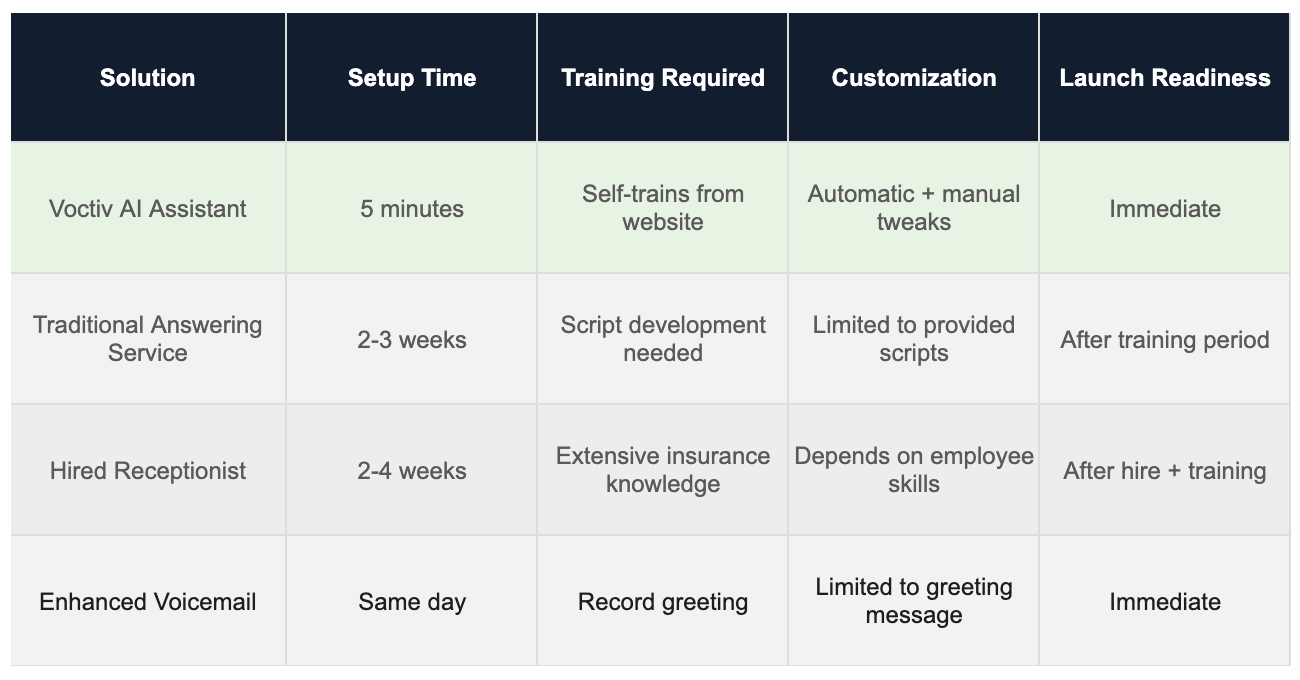

The setup process varies dramatically between solutions. Here’s what you can expect:

Traditional Services: Expect to spend 2-3 weeks in setup. You’ll need to provide detailed scripts, train operators on your services, and test the system before going live.

AI Solutions: Modern AI systems can be operational in minutes. They automatically learn from your website content and can handle calls immediately while continuously improving.

Ongoing Management: Traditional services require script updates and retraining. AI solutions adapt automatically and only need occasional refinements.

Frequently Asked Questions

Why do insurance agencies need specialized answering services?

Insurance clients call during emergencies, need immediate quotes, and require after-hours support. You can’t afford to miss these calls, and generic voicemail creates a poor first impression. Professional call handling ensures every client feels valued and receives prompt attention.

How much does a professional answering service cost compared to hiring staff?

A full-time receptionist costs $35,000-$50,000 annually plus benefits. Professional answering services start at $20/month, representing over 90% cost savings. Even premium AI solutions at $29/month deliver exceptional ROI through captured leads and improved client satisfaction.

Can answering services handle insurance-specific calls?

Yes, but capabilities vary. Traditional services use scripts you provide to handle basic questions, schedule appointments, and route emergency calls. AI solutions can learn your entire service catalog and handle complex inquiries while escalating specialized questions appropriately.

How are after-hours calls managed?

You maintain complete control. Options include routing to voicemail, forwarding to your mobile, or using emergency screening to identify urgent situations. The best systems notify you immediately via SMS when hot leads call or emergencies arise.

Do answering services support non-English speaking clients?

Many services offer bilingual support, particularly English and Spanish. AI solutions can often handle multiple languages automatically, ensuring you never lose prospects due to language barriers.

What happens if I need to update call handling procedures?

Traditional services require script updates and operator retraining, which can take days or weeks. Modern AI solutions allow instant updates and learn from your feedback, adapting to changes in your business without downtime.

Can these services integrate with my existing systems?

Integration capabilities vary. Basic services handle calls independently, while advanced solutions can connect to your calendar, CRM, and other business tools. Look for services that offer seamless integration with your existing workflow. Check out our full feature list for integration details.

The Bottom Line: Stop Losing Clients to Missed Calls

Every missed call is a missed opportunity. In the insurance business, trust and availability are everything. When potential clients can’t reach you, they’ll find an agent who answers their call.

The numbers don’t lie: professional call handling pays for itself within the first month through captured leads that would otherwise go to competitors.

Whether you choose a traditional answering service or modern AI solution, the key is taking action. Your competitors are already investing in professional call handling. Don’t let them capture your potential clients simply because they answered the phone and you didn’t.

The insurance agency answering service market has evolved dramatically. Today’s solutions offer more features, better reliability, and lower costs than ever before. The question isn’t whether you can afford professional call handling – it’s whether you can afford to keep missing calls.

Start capturing every lead, handle every emergency, and never miss another opportunity. Your clients deserve better than voicemail, and your business deserves every call it receives.