Financial Advisor Answering Service: 2025 Complete Guide to Never Missing Another Client Call

Executive Summary

Financial advisors lose an average of $50,000 annually from missed client calls, making reliable phone coverage essential for business growth. Voctiv AI Phone Assistant revolutionizes client communication by ensuring 100% call handling without the costs or limitations of traditional solutions.

Voctiv’s unique advantages:

- Multilingual support – serve diverse client bases effortlessly

- Self-training capability – learns your business automatically from your website

- Instant SMS notifications – get alerted immediately about appointments and hot leads

- Zero missed calls – 100% availability without human limitations

- Professional financial knowledge – understands industry terminology and client needs

Discover how Voctiv AI transforms your client communication while dramatically reducing costs below.

For individuals and small teams (up to 5 persons), our mobile app provides the perfect solution to get started immediately.

The Hidden Cost of Missed Calls in Financial Advisory

You’ve built your reputation on trust and availability, but every missed call represents lost opportunity. Financial advisors typically handle 40-80 client calls monthly, with each conversation potentially worth $150-300 in immediate business value.

Here’s what happens when you can’t answer:

- Prospective clients call competitors who answer immediately

- Existing clients feel neglected and consider switching advisors

- Urgent financial decisions get delayed, costing clients money

- Your professional image suffers in a relationship-driven industry

The solution isn’t working longer hours – it’s ensuring every call gets answered professionally, even when you’re unavailable.

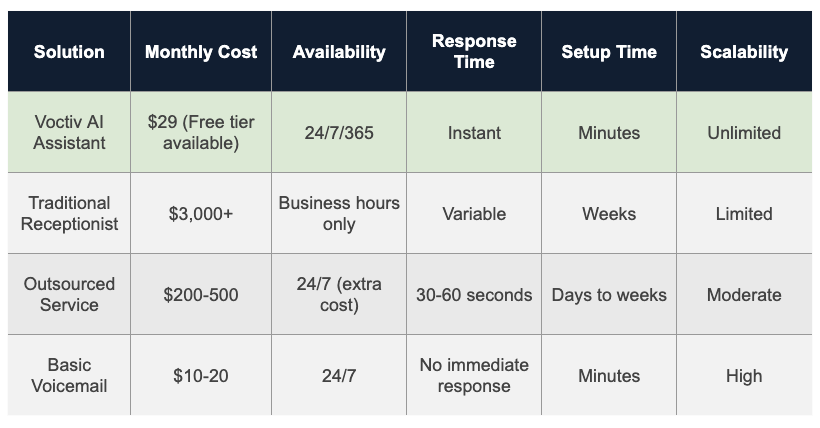

Traditional Financial Advisor Answering Service Options (And Their Limitations)

Option 1: Do Nothing (Voicemail Only)

How it works: Rely on voicemail when unavailable, hoping clients leave messages and wait for callbacks.

Pros:

- Minimal cost ($10-20/month)

- Easy setup

- No training required

Cons:

- 70% of callers hang up without leaving voicemail

- No immediate response capability

- Poor professional image

- Can’t handle urgent client needs

- No appointment scheduling assistance

Missed Revenue Calculation:

- Missed calls: 25% of total calls (industry average)

- Monthly call volume: 50 calls

- Missed calls per month: 12-13 calls

- Average value per call: $175

- Monthly lost revenue: $2,100-2,275

Option 2: Hire a Full-Time Receptionist

How it works: Employ a dedicated person to handle all incoming calls during business hours.

Pros:

- Personal touch with familiar voice

- Can handle complex scheduling

- Learns your specific procedures

- Can perform additional office tasks

Cons:

- High cost ($35,000-50,000 annually plus benefits)

- Limited to business hours only

- Sick days and vacation coverage needed

- Requires office space and equipment

- May lack financial industry knowledge

- Can’t scale during busy periods

Missed Revenue Calculation:

- After-hours missed calls: 15% of total calls

- Monthly call volume: 60 calls

- Missed calls per month: 9 calls

- Average value per call: $175

- Monthly lost revenue: $1,575

Option 3: Outsourced Answering Service

How it works: Third-party service answers calls using scripts you provide, then forwards messages or transfers important calls.

Pros:

- 24/7 availability possible

- Professional phone handling

- Multiple agents for busy periods

- Some industry specialization available

Cons:

- High monthly costs ($250-600+ per month)

- Per-minute charges add up quickly

- Generic scripts sound impersonal

- Long training periods (2-4 weeks)

- High agent turnover affects consistency

- Extra fees for after-hours service

- Limited understanding of complex financial topics

Missed Revenue Calculation:

- Script limitations cause: 10% of calls poorly handled

- Monthly call volume: 60 calls

- Poorly handled calls per month: 6 calls

- Average value per call: $175

- Monthly lost revenue: $1,050

Voctiv AI: The Perfect Financial Advisor Answering Service Solution

Voctiv AI Phone Assistant eliminates every limitation of traditional solutions while delivering superior results at a fraction of the cost. Here’s how it transforms your practice:

Intelligent Call Handling That Understands Finance

Unlike generic answering services, Voctiv AI trains itself on your specific services and industry knowledge. It understands financial terminology, can discuss your investment approaches, and handles client questions with the expertise they expect from your practice.

24/7 Availability Without Extra Costs

Your AI assistant never sleeps, takes breaks, or goes on vacation. Whether it’s a weekend emergency or an after-hours inquiry from an overseas client, every call gets answered professionally.

Instant Notifications for Hot Leads

When high-value prospects call, you’ll know immediately via SMS. This lets you follow up while their interest is peak, dramatically improving conversion rates.

Multi-Language Client Support

Expand your client base by serving non-English speaking prospects and clients. Voctiv AI handles multiple languages seamlessly, opening new market opportunities.

Setup in Minutes, Not Weeks

Connect Voctiv to your phone system and share your website or service information. The AI trains itself automatically – no lengthy onboarding processes or script writing required.

For businesses with teams over 5 persons requiring custom integrations, our enterprise solution provides comprehensive OMNI AI Assistant capabilities.

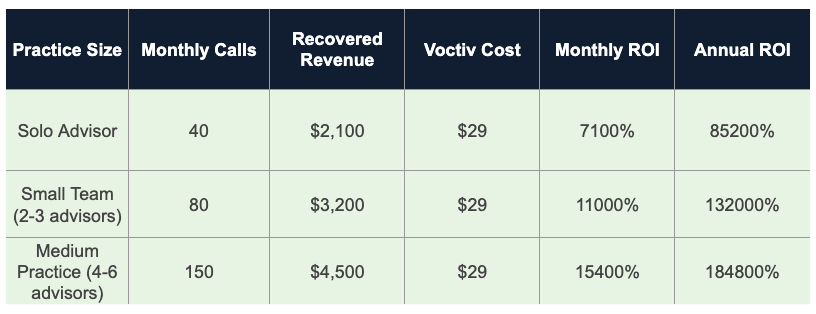

Real-World Financial Impact: ROI Analysis

Let’s calculate the actual return on investment for a typical financial advisory practice:

Conservative assumptions used:

- Only 15% of calls would have been missed without AI assistance

- Average value per call: $175 (accounting for mix of prospects and existing clients)

- Conversion rate factors in typical lead quality and market conditions

- Revenue calculations exclude referrals generated by improved client satisfaction

Even with these conservative estimates, Voctiv AI pays for itself within the first recovered call each month.

Implementation: Getting Started with Voctiv AI

Setting up your AI assistant takes just minutes:

- Connect your phone system – works with existing VoIP or traditional phone services

- Share your business information – upload your website URL or key service documents

- Customize notification preferences – choose how you want to receive alerts about important calls

- Test and refine – make practice calls to ensure optimal performance

The AI begins learning immediately and improves with every interaction. No technical expertise required.

Addressing Common Concerns

Will clients know they’re talking to AI?

Voctiv AI is designed to sound natural and professional. Most callers appreciate the immediate response and knowledgeable assistance, regardless of whether it’s AI or human.

What about complex financial questions?

The AI handles routine inquiries and appointment scheduling while seamlessly identifying when calls need your personal attention. You get notified immediately for complex situations.

Can it integrate with my existing calendar and CRM?

Yes, Voctiv AI works with popular financial advisor tools and can be customized for your specific workflow needs.

Frequently Asked Questions

How quickly can I start using Voctiv AI for my financial advisory practice?

You can have Voctiv AI answering your calls within minutes of signing up. The system trains itself automatically using your website content or any documents you share about your services.

What’s the difference between the free tier and premium version?

The free tier provides basic call handling capabilities, while the $29/month premium version includes advanced features like multilingual support, custom integrations, and priority SMS notifications for hot leads.

Does Voctiv AI understand financial industry terminology?

Yes, Voctiv AI is specifically trained to understand financial services terminology and can discuss investment approaches, retirement planning, and other advisory topics at an appropriate level for client interactions.

Can the AI handle appointment scheduling?

Absolutely. Voctiv AI can schedule appointments, send confirmation details via SMS, and integrate with your existing calendar system to prevent double-bookings.

What happens if a client has an urgent financial emergency?

The AI is programmed to recognize urgent situations and immediately notify you via SMS while keeping the client on the line. You can then take over the call directly or provide specific guidance through the AI.

Transform Your Financial Advisory Practice Today

The financial advisory industry is built on relationships and trust. Every missed call damages both. Voctiv AI ensures you never lose another opportunity while reducing costs and improving client satisfaction.

Your competitors are still using outdated phone systems or expensive human services. This gives you a significant advantage in client acquisition and retention.

Don’t let another valuable client call go to voicemail. Start capturing every opportunity with Voctiv AI’s intelligent financial advisor answering service.

For individuals and small teams (up to 5 persons), get started with our mobile app solution today.