10 Benefits of an Insurance Agency Answering Service in 2025

Insurance Agency Answering Service: Stop Missing Calls & Losing Clients in 2025

Executive Summary

Missing a single call could cost your insurance agency thousands in lost revenue. When you’re juggling client meetings, reviewing policies, and handling claims, every missed call represents a potential client walking away to your competitor. Today’s insurance clients expect immediate response, and a traditional voicemail system simply won’t cut it anymore.

Here’s the reality: insurance agencies lose 30-40% of potential clients due to missed calls. That’s why smart agencies are turning to professional answering services that handle calls 24/7, capture leads, and keep your business running even when you can’t answer the phone.

Key Advantages of Professional Call Handling:

- Never miss a lead again – 24/7 coverage means zero missed opportunities

- Instant appointment booking – Clients can schedule immediately while interest is hot

- Bilingual support – Serve Spanish-speaking clients professionally

- Emergency call screening – Urgent claims get immediate attention

- Cost savings – Fraction of hiring full-time staff

Ready to discover which solution fits your agency best? Let’s dive into the complete comparison below.

For individuals and small teams (up to 5 persons), our mobile app solution provides perfect call handling:

Try App Free

The Hidden Cost of Missed Calls in Insurance

Let’s talk numbers. When a potential client calls your insurance agency and gets voicemail, only 25% actually leave a message. Of those who do leave messages, less than 40% wait for a callback if you don’t respond within 2 hours.

Here’s what this means for your bottom line:

- Average insurance policy value: $800-$1,500 annually

- Small agencies receive 50-100 calls monthly

- 30% of calls come after business hours or during meetings

- Without proper call handling, you’re losing 15-25 potential clients monthly

Monthly revenue loss calculation: 20 missed leads × $1,000 average policy = $20,000 in lost annual premiums. That’s over $1,600 in monthly recurring revenue walking away because nobody answered the phone.

The insurance business is all about trust and accessibility. When clients can’t reach you during their moment of need, they’ll find an agent who can answer their call. According to a research, 74% of consumers will switch providers after just one poor customer service experience.

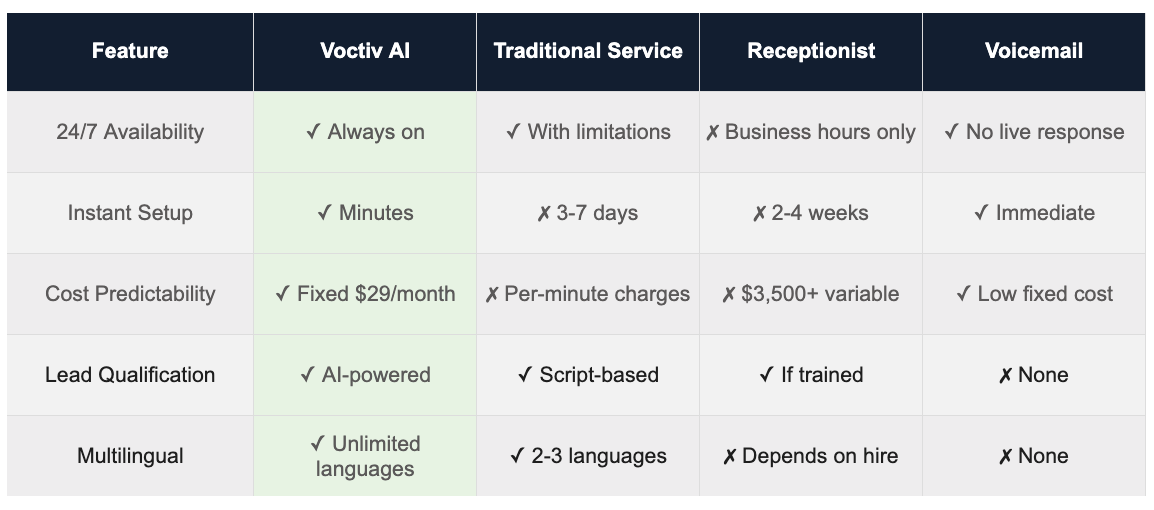

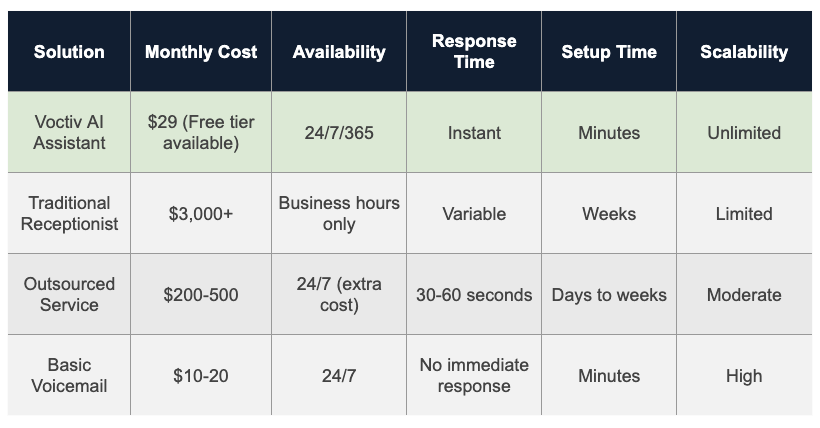

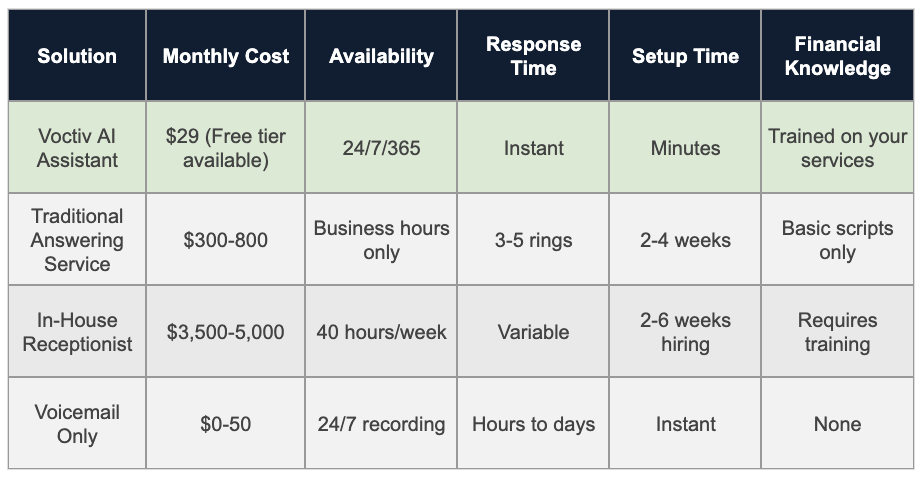

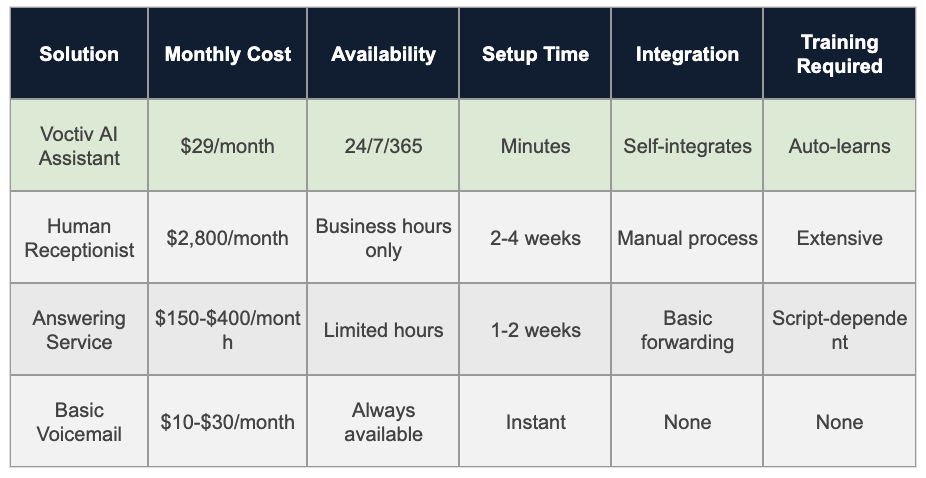

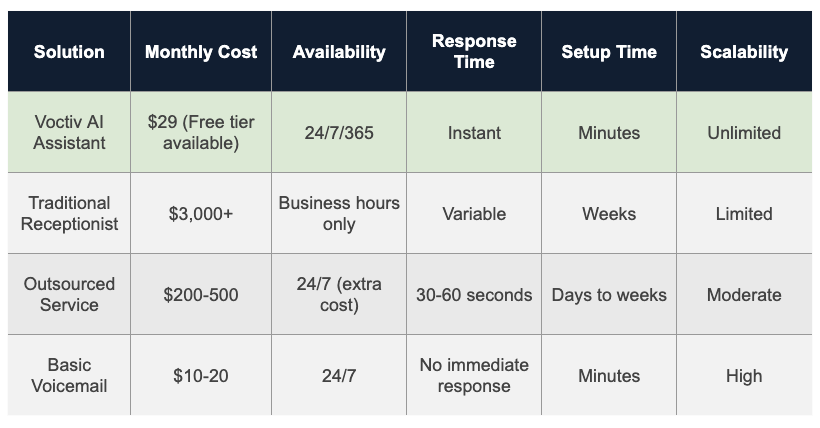

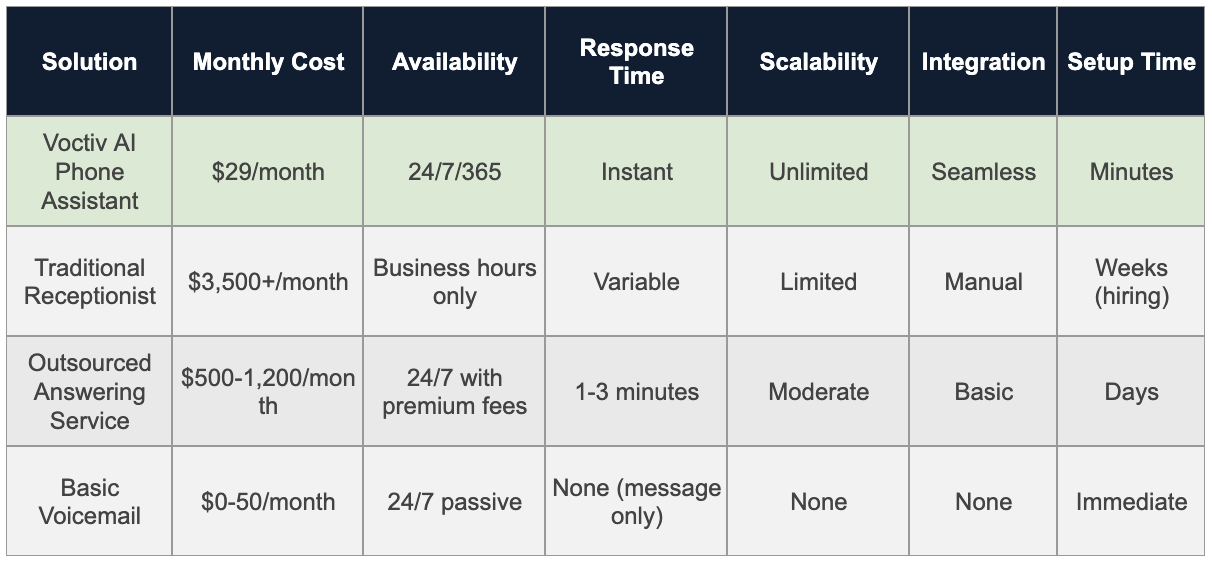

Insurance Agency Answering Service Options: Complete Breakdown

Option 1: Do Nothing (Voicemail Only)

Many small agencies rely solely on voicemail, thinking it’s sufficient. Here’s the reality check:

How it works: Clients call, hear your voicemail greeting, and may or may not leave a message.

Pros:

- Costs almost nothing ($10-$50/month)

- Zero setup time

- Complete control over callback timing

Cons:

- Terrible first impression for new clients

- 75-85% of potential clients hang up without leaving messages

- Emergency calls go unanswered

- No appointment scheduling capability

- Competitors who answer calls immediately win your prospects

Missed Revenue Calculation:

Monthly calls: 75 | Missed calls: 60 (80%)

Average policy value: $100/month

Monthly lost revenue: $2,000-$3,000

Option 2: Hire a Full-Time Receptionist

The traditional approach that many established agencies still use.

How it works: You hire, train, and manage a dedicated person to answer phones and handle basic client inquiries.

Pros:

- Human touch and personalized service

- Can handle complex inquiries

- Learns your business over time

- Can perform additional office tasks

Cons:

- High cost: $35,000-$50,000 annually plus benefits

- Sick days and vacation time mean missed calls

- No after-hours coverage

- Recruitment and training time

- Potential employee turnover

Missed Revenue Calculation:

After-hours calls: 25 monthly | Weekend emergencies: 10 monthly

Vacation/sick coverage gaps: 5 business days monthly

Monthly lost revenue: $1,500-$2,500

Option 3: Traditional Answering Service

Many insurance agencies use human-operated answering services that specialize in professional call handling.

How it works: Professional operators answer your calls using customized scripts, take messages, and can route urgent calls to you.

Pros:

- Professional call handling

- Bilingual support available

- Custom scripts for your agency

- Emergency call screening

- After-hours coverage

Cons:

- High monthly costs ($200-$500+ per month)

- Setup takes 2-3 weeks

- Limited after-hours availability

- Per-call or per-minute charges

- Operators don’t know your business intimately

Missed Revenue Calculation:

Service limitations: 15% of calls during peak times

Weekend/holiday gaps: 8 calls monthly

Monthly lost revenue: $1,200-$1,800

For larger businesses with teams over 5 persons, our custom OMNI AI Assistant offers complete integration:

Book a Demo

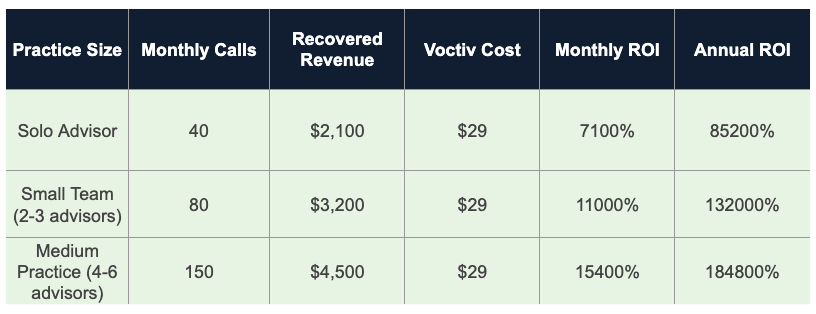

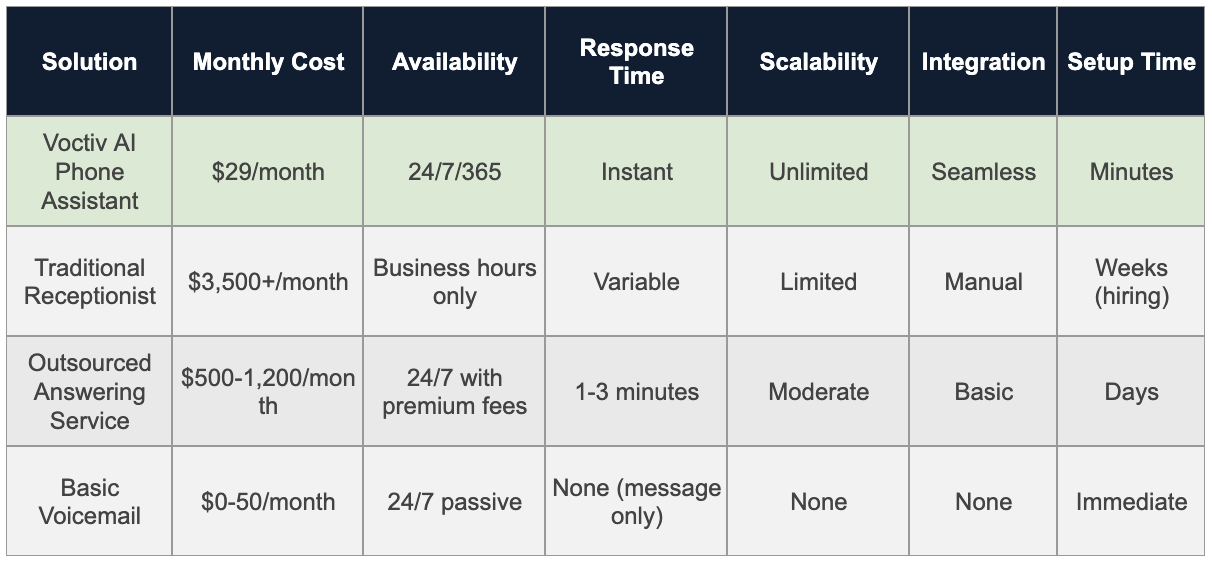

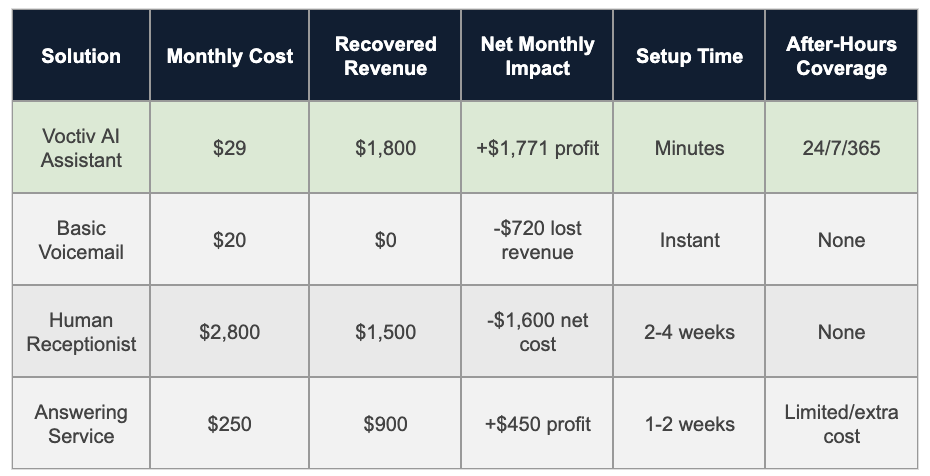

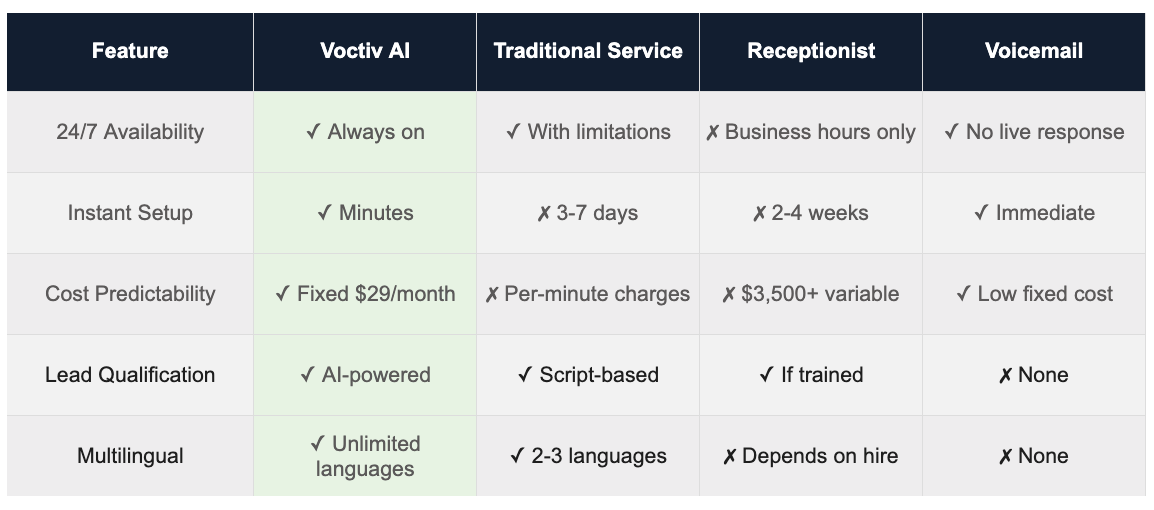

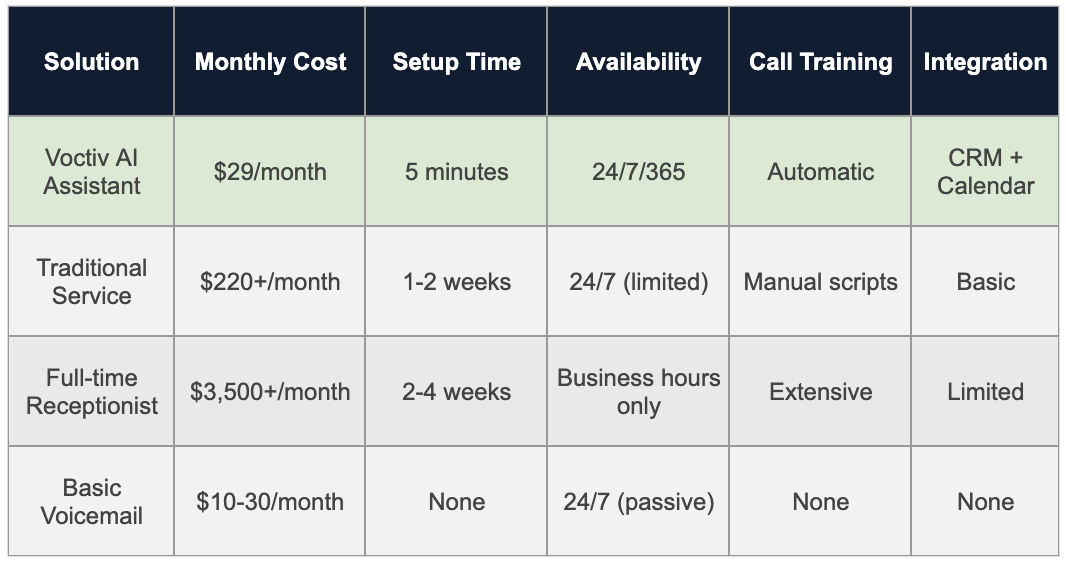

Option 4: Voctiv AI Call Assistant (The Perfect Solution)

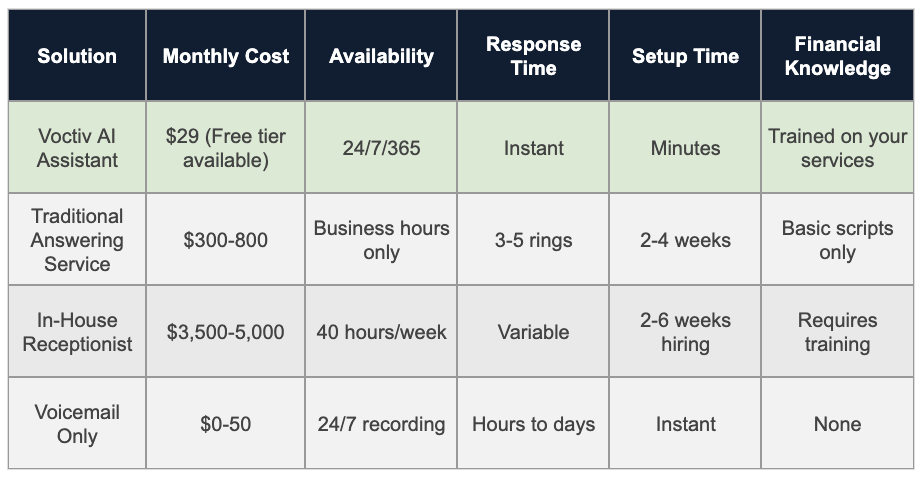

Modern insurance agencies are discovering that AI-powered call handling delivers superior results at a fraction of traditional costs.

How it works: Advanced AI answers every call instantly, handles common inquiries, books appointments, and immediately notifies you about hot leads via SMS.

Unique Advantages:

- Never misses a call – 100% availability

- Instantly learns your business from website content

- Handles multiple languages automatically

- Books appointments directly into your calendar

- Sends SMS notifications for urgent matters

- Works 24/7 with no breaks or sick days

Setup and Cost:

- Ready in minutes, not weeks

- Free tier available for testing

- Premium version: $29/month

- No per-call charges

- No training required

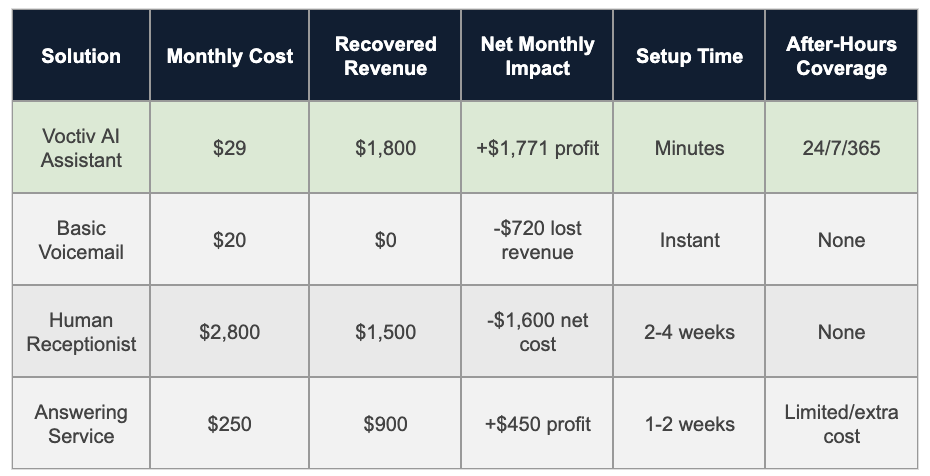

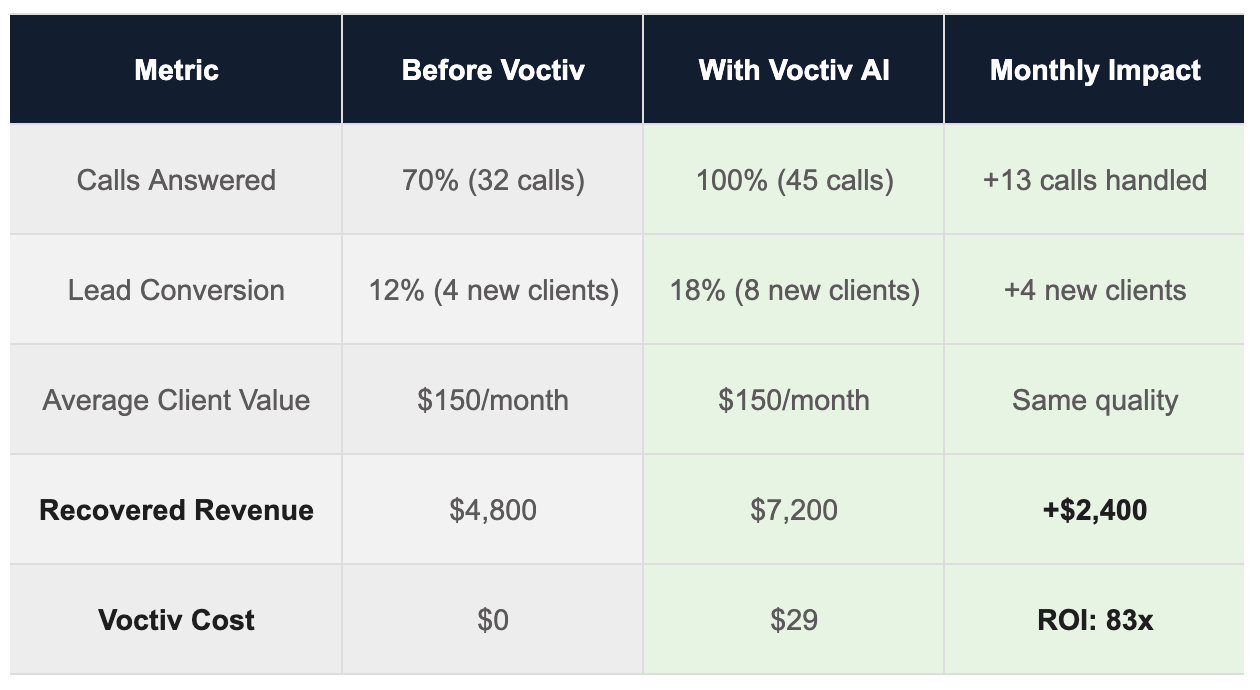

Revenue Impact:

Missed calls: 0% | Lead capture rate: 100%

Additional evening/weekend leads: 15-20 monthly

Monthly recovered revenue: $2,000-$3,500

ROI: 70-120x monthly investment

Why Insurance Agencies Need Specialized Call Handling

Insurance isn’t just another business – it’s a trust-based industry where timing matters. Here’s why generic answering services fall short:

Emergency Situations

When someone’s been in an accident or faces a home emergency, they need immediate assistance. A delayed response can mean:

- Lost client trust during their most vulnerable moment

- Clients switching to competitors who respond faster

- Potential legal issues from delayed claim reporting

- Negative reviews about poor responsiveness

Quote Requests

Insurance shopping happens when people need it, not during business hours. Studies show that 65% of insurance quote requests happen after 6 PM or on weekends. Miss these calls, and prospects will get quotes from agents who are available.

Policy Questions

Clients call with coverage questions, payment issues, and policy changes. Professional call handling ensures these routine inquiries don’t interrupt your important client meetings while still providing excellent service. Learn more about call handling best practices on our blog.

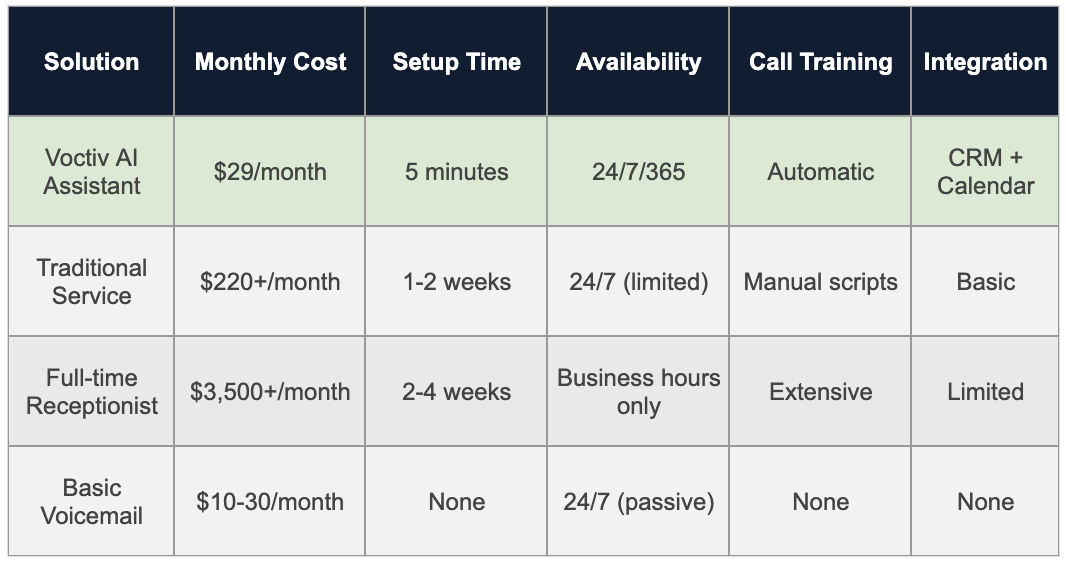

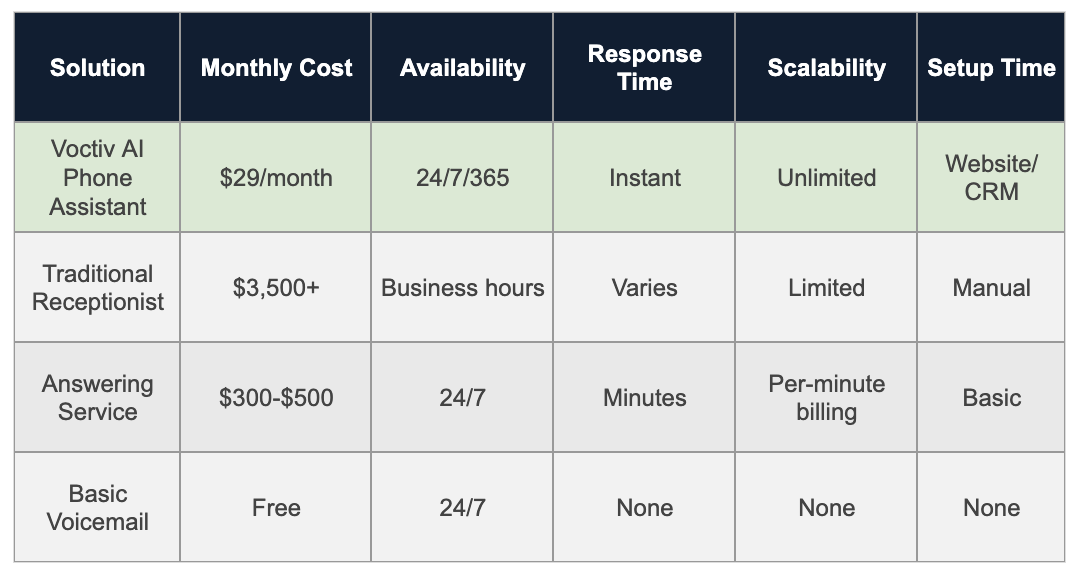

Implementation: What to Expect

Getting Started with Professional Call Handling

The setup process varies dramatically between solutions. Here’s what you can expect:

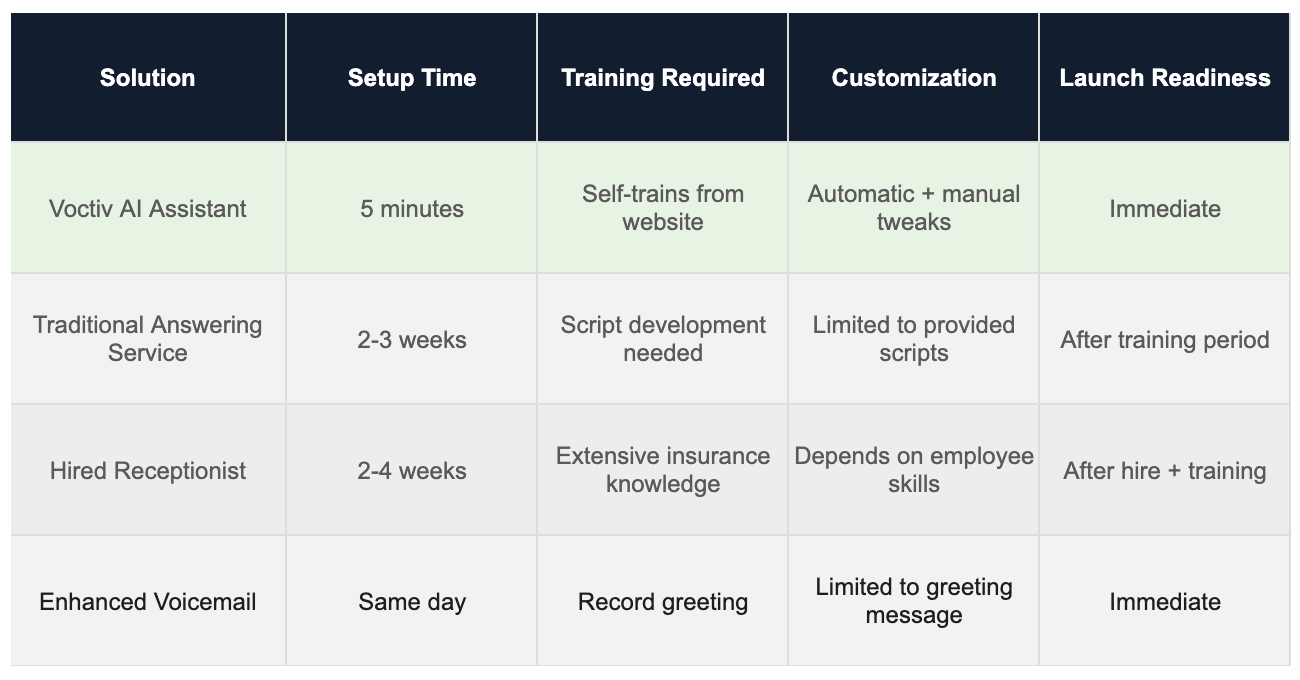

Traditional Services: Expect to spend 2-3 weeks in setup. You’ll need to provide detailed scripts, train operators on your services, and test the system before going live.

AI Solutions: Modern AI systems can be operational in minutes. They automatically learn from your website content and can handle calls immediately while continuously improving.

Ongoing Management: Traditional services require script updates and retraining. AI solutions adapt automatically and only need occasional refinements.

Frequently Asked Questions

Why do insurance agencies need specialized answering services?

Insurance clients call during emergencies, need immediate quotes, and require after-hours support. You can’t afford to miss these calls, and generic voicemail creates a poor first impression. Professional call handling ensures every client feels valued and receives prompt attention.

How much does a professional answering service cost compared to hiring staff?

A full-time receptionist costs $35,000-$50,000 annually plus benefits. Professional answering services start at $20/month, representing over 90% cost savings. Even premium AI solutions at $29/month deliver exceptional ROI through captured leads and improved client satisfaction.

Can answering services handle insurance-specific calls?

Yes, but capabilities vary. Traditional services use scripts you provide to handle basic questions, schedule appointments, and route emergency calls. AI solutions can learn your entire service catalog and handle complex inquiries while escalating specialized questions appropriately.

How are after-hours calls managed?

You maintain complete control. Options include routing to voicemail, forwarding to your mobile, or using emergency screening to identify urgent situations. The best systems notify you immediately via SMS when hot leads call or emergencies arise.

Do answering services support non-English speaking clients?

Many services offer bilingual support, particularly English and Spanish. AI solutions can often handle multiple languages automatically, ensuring you never lose prospects due to language barriers.

What happens if I need to update call handling procedures?

Traditional services require script updates and operator retraining, which can take days or weeks. Modern AI solutions allow instant updates and learn from your feedback, adapting to changes in your business without downtime.

Can these services integrate with my existing systems?

Integration capabilities vary. Basic services handle calls independently, while advanced solutions can connect to your calendar, CRM, and other business tools. Look for services that offer seamless integration with your existing workflow. Check out our full feature list for integration details.

For individuals and small teams (up to 5 persons), our mobile app solution transforms your phone handling:

Try App Free

The Bottom Line: Stop Losing Clients to Missed Calls

Every missed call is a missed opportunity. In the insurance business, trust and availability are everything. When potential clients can’t reach you, they’ll find an agent who answers their call.

The numbers don’t lie: professional call handling pays for itself within the first month through captured leads that would otherwise go to competitors.

Whether you choose a traditional answering service or modern AI solution, the key is taking action. Your competitors are already investing in professional call handling. Don’t let them capture your potential clients simply because they answered the phone and you didn’t.

The insurance agency answering service market has evolved dramatically. Today’s solutions offer more features, better reliability, and lower costs than ever before. The question isn’t whether you can afford professional call handling – it’s whether you can afford to keep missing calls.

Start capturing every lead, handle every emergency, and never miss another opportunity. Your clients deserve better than voicemail, and your business deserves every call it receives.

For larger businesses with teams over 5 persons, our custom OMNI AI Assistant delivers enterprise-grade call handling:

Book a Demo

Top Wealth Management Answering Services to Boost Client Trust

Best Wealth Management Answering Service 2025: Compare AI vs Traditional Solutions

Executive Summary

Wealth management firms can’t afford to miss client calls when markets fluctuate or portfolios need immediate attention. Every missed call could mean losing a $500,000 portfolio to a competitor who answers 24/7.

Key advantages of Voctiv AI for wealth management:

- Instant client inquiry handling – No waiting for callbacks during market volatility

- Multilingual support – Serve diverse client portfolios in their preferred language

- Compliance-friendly – Captures detailed call logs for regulatory requirements

- SMS notifications – Immediately alerts you about urgent portfolio discussions

- Self-training capability – Learns your firm’s services and investment philosophy automatically

Discover how wealth management firms prevent thousands in lost revenue annually with 24/7 AI call coverage below.

For individuals and small wealth management teams (up to 5 persons), Voctiv offers a mobile app solution:

Why Wealth Management Firms Need Professional Call Handling

Your clients trust you with their life savings. When they call about market concerns or portfolio changes, they expect immediate professional responses – not voicemail.

The harsh reality: Wealth management prospects typically call 3-5 firms before making a decision. The first firm that answers professionally often wins the client.

Research shows that 73% of potential clients won’t leave voicemails for financial services. They’ll simply call your competitor instead.

Voicemail-Only Approach: The Revenue Killer

Many smaller wealth management firms rely solely on voicemail systems. Here’s why this approach costs you clients:

Pros of Voicemail Systems:

- Extremely low monthly cost ($10-50)

- Simple setup process

- Works 24/7 for message recording

Cons of Voicemail-Only:

- Zero real-time client interaction during urgent situations

- Prospects hang up without leaving messages 68% of the time

- No ability to schedule consultations immediately

- Unprofessional image for high-net-worth client expectations

- Delayed response times frustrate time-sensitive inquiries

Revenue Impact of Voicemail-Only:

Conservative assumptions for mid-sized wealth management firm:

- Monthly prospect calls: 50

- Calls resulting in voicemail only: 35 (70%)

- Voicemails never returned by prospects: 25 (73%)

- Average new client portfolio value: $150,000

- Annual management fee: 1.2%

Monthly lost revenue from missed connections: $2,250

Annual revenue loss: $27,000

Traditional Answering Services: Expensive and Limited

Standard call center services offer human operators but come with significant drawbacks for wealth management needs.

Pros of Traditional Services:

- Human interaction feels personal

- Can handle basic appointment scheduling

- Available during extended business hours

Cons of Traditional Services:

- High monthly costs ($300-800 for quality service)

- Limited financial industry knowledge

- Script-based responses sound generic and unprofessional

- Long training periods (2-4 weeks) for your specific services

- No true 24/7 coverage (premium rates for nights/weekends)

- High employee turnover requires constant retraining

Revenue Impact from Service Limitations:

Even with answering services, wealth management firms lose prospects due to:

- Generic responses that don’t address specific investment concerns

- Inability to answer basic questions about your firm’s philosophy

- 15-20% of calls still go unanswered during peak times

- Weekend and holiday coverage gaps

Estimated monthly missed revenue: $1,200-2,000

For larger wealth management businesses with teams over 5 persons, Voctiv offers a custom OMNI AI Assistant that’s ideal for complex integrations:

Hiring In-House Receptionists: The Traditional Trap

Many growing wealth management firms consider hiring dedicated receptionists. While this provides human interaction, it’s often the most expensive option with significant limitations.

Pros of In-House Receptionists:

- Direct control over training and quality

- Can learn your firm’s specific investment approaches

- Builds relationships with regular clients

- Handles multiple administrative tasks

Cons of In-House Staff:

- Extremely high costs ($3,500-5,000/month with benefits)

- Zero coverage during sick days, vacations, breaks

- Limited to 40 hours/week availability

- Lengthy hiring and training process (2-6 weeks)

- No weekend or after-hours coverage without additional hires

- Employee turnover disrupts client relationships

Hidden Revenue Loss from Coverage Gaps:

Coverage gaps occur during:

- Lunch breaks (1 hour daily)

- Sick days (average 6 days/year)

- Vacation time (10-15 days/year)

- All evenings and weekends

- Training periods for new hires

Estimated coverage gaps: 35% of business hours

Monthly missed revenue from gaps: $1,800-3,200

Voctiv AI: The Perfect Wealth Management Solution

Voctiv AI Phone Assistant eliminates every problem that traditional solutions create while providing 100% call coverage at a fraction of the cost.

How Voctiv Works for Wealth Management Firms:

Setup takes minutes, not weeks:

- Connect your business phone number

- Upload your website content or service descriptions

- AI automatically learns your investment philosophy and services

- Start handling calls professionally within minutes

Intelligent call handling includes:

- Professional greetings customized to your firm’s tone

- Answering common questions about your services and approach

- Immediate appointment scheduling for consultations

- Capturing detailed client information and investment goals

- Instant SMS notifications to you about urgent calls

- Multilingual support for diverse client bases

Why Voctiv Eliminates Missed Revenue:

True 24/7/365 availability means:

- Zero missed calls – every prospect gets immediate professional attention

- After-hours inquiries are captured and prioritized

- Weekend market concerns are addressed professionally

- Holiday coverage without premium rates

- Instant response times build trust with high-net-worth prospects

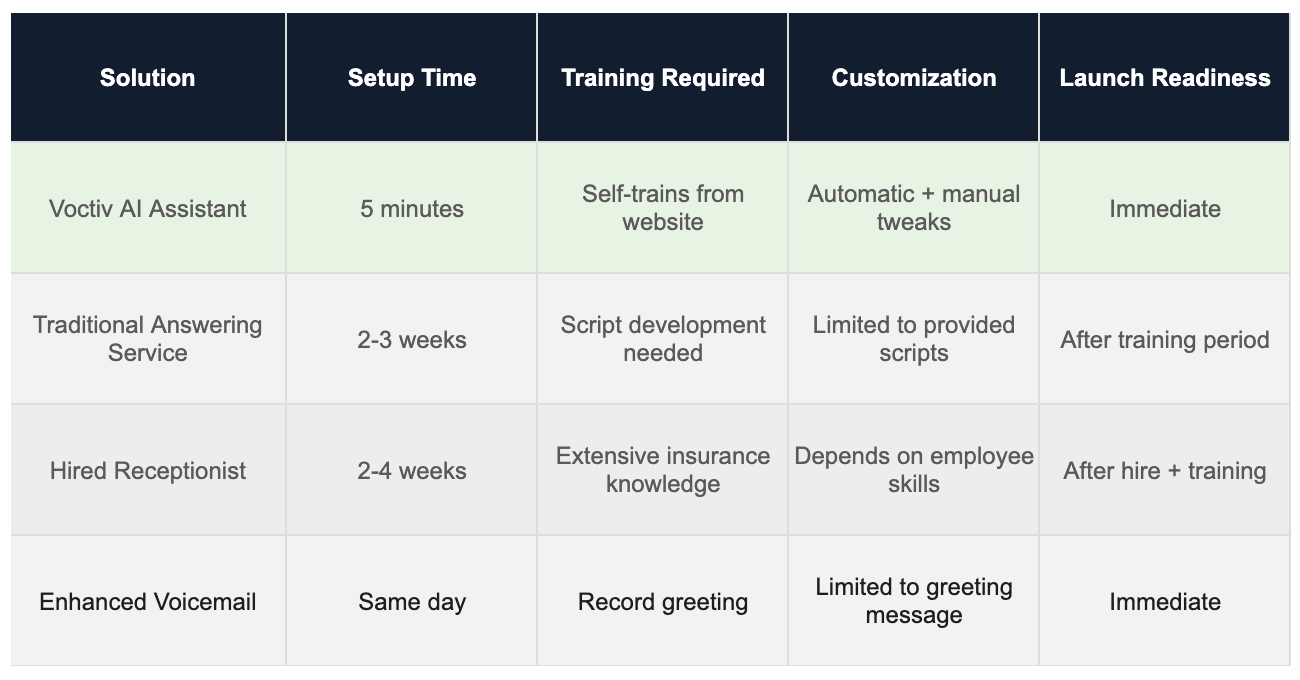

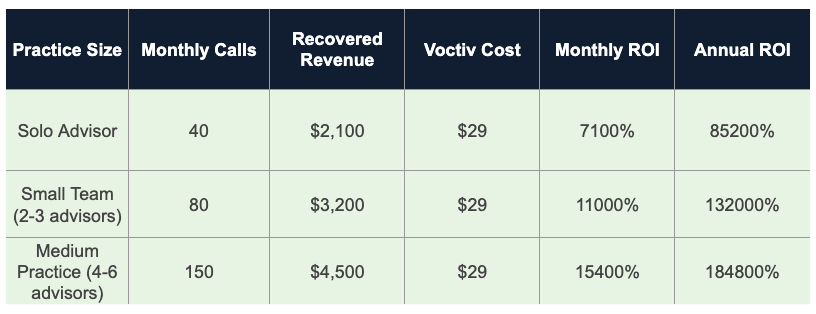

Real-World Impact: Revenue Recovery

Here’s how Voctiv AI transforms wealth management firm performance with realistic expectations:

Small Wealth Management Firm (1-3 advisors):

Before Voctiv:

- Monthly prospect calls: 30

- Calls answered professionally: 18 (60%)

- Missed revenue from poor call handling: $1,500/month

After Voctiv implementation:

- Professional response rate: 100%

- Monthly recovered revenue: $1,500

- ROI: 5,100% ($1,500 recovered ÷ $29 cost)

Medium Wealth Management Firm (4-8 advisors):

Before Voctiv:

- Monthly prospect calls: 75

- Professional handling rate: 65%

- Missed revenue from gaps: $3,200/month

After Voctiv implementation:

- Monthly recovered revenue: $3,200

- ROI: 11,000% ($3,200 recovered ÷ $29 cost)

- Annual revenue protection: $38,400

Common Objections About AI Call Handling

Wealth management professionals often worry about AI replacing human interaction. Here’s why those concerns don’t apply to Voctiv:

“Clients Want to Speak with Humans”

Reality: Clients want immediate, knowledgeable responses. Voctiv provides instant professional interaction while immediately connecting urgent calls to you via SMS notification.

“AI Can’t Handle Complex Financial Questions”

Reality: Voctiv doesn’t provide financial advice. It professionally captures client information, schedules consultations, and immediately notifies you about important discussions. Complex questions get personal attention faster than ever.

“Setup Must Be Complicated”

Reality: Voctiv trains itself using your website content. Setup takes minutes, not weeks like traditional answering services require.

Frequently Asked Questions

“How quickly can Voctiv learn about our wealth management services?”

Voctiv’s self-training capability analyzes your website content and any additional materials you provide within minutes. The AI immediately understands your investment philosophy, service offerings, and firm personality to provide consistent professional responses.

“Can Voctiv handle calls in languages other than English?”

Yes, Voctiv supports multilingual conversations. You can add languages through the app interface to serve diverse client portfolios in their preferred language, which is especially valuable for wealth management firms serving international clients.

“What happens if a client has an urgent portfolio concern after hours?”

Voctiv immediately sends you SMS notifications about urgent calls and captures all client information professionally. You’ll know about important situations in real-time and can respond appropriately. The AI doesn’t provide investment advice but ensures no urgent communication goes unnoticed.

“How does pricing work for wealth management firms with multiple advisors?”

Small teams (up to 5 persons) can use the mobile app starting with a free tier, then $29/month for premium features. Larger firms benefit from custom OMNI AI Assistant solutions with advanced integrations tailored to complex wealth management operations.

“Can Voctiv integrate with our existing CRM and scheduling systems?”

Yes, Voctiv offers integration capabilities especially with the custom OMNI solution for larger wealth management firms. The AI can work with your existing systems to streamline appointment scheduling and client information management.

Transform Your Wealth Management Firm’s Call Handling Today

Every day you delay implementing professional call handling, you’re losing potential clients to competitors who answer immediately and professionally.

Voctiv AI eliminates the choice between expensive human staffing and missed revenue. You get 100% call coverage, professional client interaction, and immediate notifications about important calls – all for less than the cost of a business lunch.

The math is simple: Even recovering one additional $150,000 client portfolio annually pays for Voctiv for 15 years. Most wealth management firms see that return within the first month.

Stop losing prospects to voicemail and start capturing every opportunity with professional 24/7 coverage.

For individuals and small wealth management teams (up to 5 persons), Voctiv offers a mobile app solution:

Top-Rated Bookkeeping Answering Service Solutions for 2025

Best Bookkeeping Answering Service Solutions in 2025: Complete Guide for Financial Firms

Bookkeeping firms lose thousands in potential revenue when clients can’t reach them during critical tax seasons or business hours. With 73% of callers hanging up after just one ring goes unanswered, your answering strategy directly impacts your bottom line. AI-powered answering services handle calls 24/7, book appointments automatically, and never miss a potential client again.

Key advantages of modern AI answering solutions:

- Never miss another client call – 100% availability means zero lost opportunities

- Instant appointment booking – Clients schedule consultations without waiting

- Multilingual support – Serve diverse client bases in their preferred language

- SMS notifications – Get instant alerts about hot leads and urgent matters

- No training required – AI learns your business automatically from your website

Ready to discover which solution fits your bookkeeping firm’s needs and budget? Let’s explore each option’s real costs, benefits, and revenue impact.

For individuals and small bookkeeping practices (up to 5 team members), Voctiv offers a mobile app solution that’s perfect for managing client calls on the go.

The High Cost of Missed Calls in Bookkeeping

Your bookkeeping firm’s phone strategy isn’t just about customer service – it’s about revenue protection. Every missed call during tax season could be a $500-$2,000 client walking away to your competitor.

Here’s what happens when clients can’t reach you:

- Potential clients call 3-4 other bookkeepers before making a decision

- Existing clients feel neglected and consider switching services

- Time-sensitive tax questions turn into penalties for clients (and lost trust for you)

- Emergency bookkeeping needs go to firms with better availability

The solution? A reliable bookkeeping answering service that understands your industry’s unique needs and timing.

Option 1: Do Nothing (Basic Voicemail Only)

Many small bookkeeping practices rely solely on voicemail, thinking it’s the most cost-effective approach. Here’s the reality.

How Basic Voicemail Works

Callers hear your standard greeting and leave a message. You check messages periodically and return calls when possible. Simple, right?

Pros of Voicemail-Only Approach

- Extremely low cost ($10-$30/month)

- No setup or training required

- Complete control over response timing

Cons of Voicemail-Only Approach

- 67% of callers won’t leave a voicemail message

- No immediate assistance for urgent questions

- Missed opportunities during your busiest periods

- Poor client experience during tax season rushes

- No appointment scheduling capability

Missed Revenue Calculation

A typical bookkeeping practice receives 40-60 calls per month. Here’s your potential revenue loss:

- Monthly calls: 50 calls

- Percentage who won’t leave voicemail: 67% (33 lost contacts)

- Potential new clients among lost contacts: 20% (7 prospects)

- Average annual client value: $1,200

- Monthly lost revenue: $700 (7 clients × $100 monthly value)

- Annual impact: $8,400 in missed opportunities

Option 2: Hiring a Full-Time Receptionist

Some growing bookkeeping firms consider hiring dedicated front desk staff to handle all incoming calls professionally.

How a Human Receptionist Works

A trained employee answers calls during business hours, takes messages, schedules appointments, and provides basic information about your services.

Pros of Human Receptionist

- Personal touch and human connection

- Can handle complex questions with training

- Builds relationships with regular clients

- Flexible problem-solving abilities

Cons of Human Receptionist

- High cost: $35,000-$45,000 annually plus benefits

- Limited to business hours only

- Sick days and vacation coverage needed

- Requires extensive training on bookkeeping terminology

- Risk of turnover during busy tax seasons

- No availability during evenings or weekends

Missed Revenue Calculation

Even with a receptionist, after-hours calls still go unanswered:

- After-hours calls: 15 per month (30% of total)

- Conversion rate for these missed calls: 15%

- Lost prospects: 2-3 per month

- Average client value: $1,200 annually

- Monthly cost: $2,800 salary + $300 in lost after-hours revenue

- Total monthly impact: $3,100

Option 3: Traditional Answering Service

Outsourced answering services provide human operators who answer calls using your business name and follow basic scripts.

How Traditional Answering Services Work

Trained operators answer calls with your greeting, take detailed messages, and forward urgent calls based on your criteria. Most offer basic appointment scheduling.

Pros of Traditional Answering Services

- Professional call handling during business hours

- Lower cost than full-time staff

- No employee management required

- Basic message-taking and forwarding

Cons of Traditional Answering Services

- Limited bookkeeping knowledge

- Script-based responses feel impersonal

- Additional charges for after-hours service

- No integration with your scheduling system

- Quality varies between operators

- Still results in delays for client responses

Missed Revenue Calculation

Traditional services still miss opportunities due to limited availability and capabilities:

- Calls requiring immediate answers: 20% (10 calls/month)

- After-hours calls without premium service: 25% (12 calls/month)

- Combined missed opportunities: 22 calls/month

- Conversion rate for immediate-need calls: 25%

- Lost prospects: 5-6 per month

- Monthly service cost: $250 + $600 in lost revenue

- Total monthly impact: $850

Option 4: Voctiv AI Call Assistant – The Complete Solution

Modern AI technology eliminates the limitations of traditional phone solutions. Voctiv AI Call Assistant provides 24/7 coverage with bookkeeping industry knowledge at a fraction of traditional costs.

How Voctiv AI Works for Bookkeeping Firms

The AI assistant answers every call with your business name, understands bookkeeping terminology, schedules appointments directly into your calendar, and sends SMS alerts for urgent matters. It learns your business from your website and any materials you provide.

Key Benefits for Bookkeeping Practices

- 24/7 availability – Never miss calls during tax season rushes or after business hours

- Instant setup – Connect and train in minutes, not weeks

- Bookkeeping-smart responses – Understands tax deadlines, QuickBooks questions, and service pricing

- Automatic appointment booking – Clients schedule consultations without waiting for callbacks

- SMS notifications – Get instant alerts about hot leads and urgent client needs

- Multilingual support – Serve diverse client communities in their preferred language

- Self-learning system – Continuously improves based on your business content

For larger bookkeeping firms (over 5 team members), Voctiv offers custom OMNI AI Assistant solutions with advanced integrations perfect for complex workflows.

Revenue Recovery with Voctiv AI

Unlike other solutions, Voctiv captures 100% of incoming calls with intelligent responses:

- Monthly calls handled: 50 calls (100% coverage)

- New client inquiries: 15 calls/month

- Conversion rate with immediate response: 30%

- New clients acquired: 4-5 per month

- Average annual client value: $1,200

- Monthly recovered revenue: $1,800

- Monthly cost: $29

- ROI: 62x return on investment

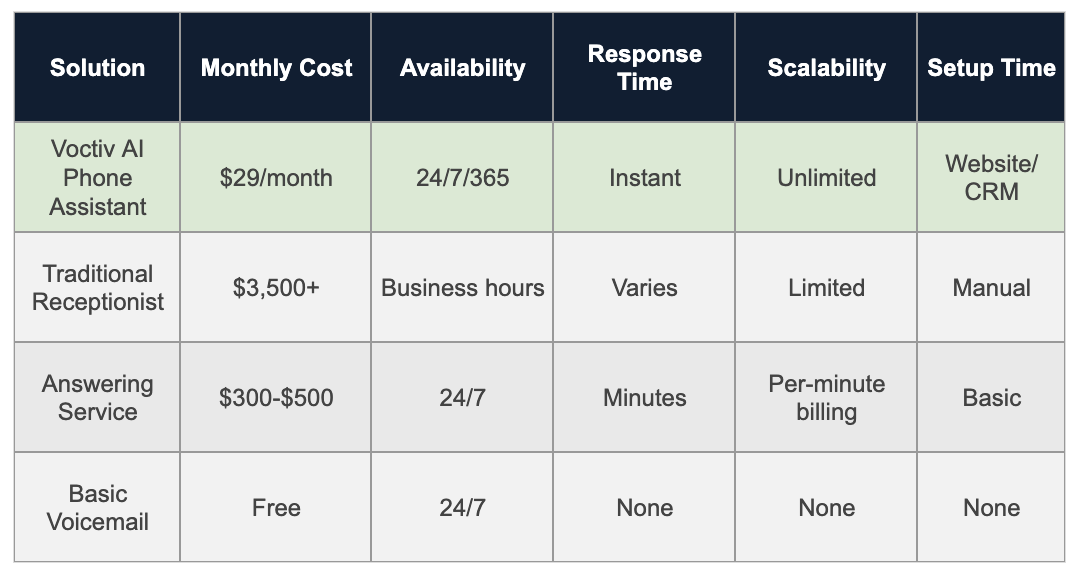

Complete Solution Comparison

Implementation Guide for Bookkeeping Firms

Setting up your bookkeeping answering service doesn’t have to be complicated. Here’s what you need to know.

Quick Setup Process

- Connect your phone number – Forward calls or get a new dedicated line

- Upload business information – Your website, service menu, and pricing details

- Set appointment preferences – Available times, meeting types, and booking rules

- Configure notifications – Choose how you want to receive lead alerts

- Test the system – Make practice calls to ensure everything works perfectly

Best Practices for Success

- Keep your service information updated seasonally (tax season vs. regular bookkeeping)

- Set realistic appointment availability to avoid overbooking

- Monitor SMS alerts during business hours for immediate follow-up opportunities

- Review call summaries weekly to identify common client questions

Frequently Asked Questions

Can an AI assistant handle complex bookkeeping questions?

Yes, but it’s designed to handle initial inquiries and appointment scheduling. For complex technical questions, it captures details and immediately notifies you via SMS, ensuring no client question goes unanswered while maintaining professional service standards.

What happens during tax season when call volume increases?

AI assistants scale automatically without additional costs. Whether you receive 50 calls or 200 calls per month, the service handles every call with the same professional quality, making it perfect for seasonal bookkeeping practices.

How quickly can clients schedule appointments?

Immediately during the call. The AI assistant checks your real-time calendar availability and books appointments instantly, eliminating phone tag and reducing the time between initial contact and consultation from days to minutes.

What’s the difference between free and premium plans?

Free plans typically include basic call handling with limited features. Premium plans at $29/month offer advanced calendar integration, SMS notifications, multilingual support, and unlimited call handling – essential features for professional bookkeeping practices.

Can the system handle multiple languages for diverse client bases?

Yes, modern AI assistants support multiple languages and can switch seamlessly based on caller preference. This feature is particularly valuable for bookkeeping practices serving immigrant communities or diverse metropolitan areas.

Start Capturing Every Lead Today

Your bookkeeping firm can’t afford to miss another call. While competitors rely on outdated voicemail systems or expensive human receptionists, smart practices are using AI to capture every opportunity 24/7.

The math is clear: at just $29/month, an AI answering service pays for itself with just one additional client while providing benefits that scale with your business growth.

Ready to transform your client communication and stop losing revenue to missed calls?

For individuals and small bookkeeping practices (up to 5 team members), get started with the mobile app that handles all your client communications professionally.

Top-Rated Answering Services for Corporate Law Firms in 2025

Corporate Law Firm Answering Service: Stop Losing High-Value Clients in 2025

Every missed call at your corporate law firm can mean losing a $50,000+ client. Traditional answering methods leave money on the table – but there’s a better way.

Your corporate law practice needs bulletproof phone coverage that handles complex client inquiries without dropping the ball. The solution? Modern answering services designed specifically for high-stakes legal environments.

Why Voctiv AI Beats Traditional Solutions:

- Zero missed revenue – Handles 100% of calls with intelligent routing

- Instant setup – Self-trains on your firm’s data in minutes

- Multilingual support – Serves diverse corporate clients seamlessly

- SMS notifications – Alerts you immediately about hot leads

- Fraction of the cost – 99% less than hiring dedicated staff

Ready to discover how corporate law firms are eliminating missed calls while cutting costs? Let’s explore your options below.

Perfect for individuals and small teams (up to 5 persons) – Mobile app solution

Try App Free

The Hidden Cost of Missed Calls in Corporate Law

Corporate law firms face a unique challenge. Your clients aren’t shopping around for the cheapest option – they need expertise, availability, and trust.

But here’s the problem: 30% of corporate legal inquiries happen outside business hours. When potential clients can’t reach you, they don’t wait. They call your competitor.

Let’s break down what this costs your practice:

- Average corporate legal matter value: $15,000-$75,000

- Typical missed call rate without coverage: 25-30%

- Monthly revenue lost per 40 inquiries: $37,500-$187,500

That’s why smart corporate law firms don’t treat phone coverage as an expense – they see it as revenue protection.

Your Corporate Law Firm Answering Service Options

Let’s examine each solution objectively. We’ll show you exactly what each costs – including the hidden revenue losses.

Option 1: Basic Voicemail (The “Do Nothing” Approach)

Some firms stick with basic voicemail, thinking it saves money. Here’s what actually happens:

How it works: Calls go straight to voicemail. Clients leave messages. You call back when convenient.

Pros:

- Cheap upfront ($10-30/month)

- No training required

- Available 24/7

Cons:

- No live interaction builds trust issues

- Urgent matters can’t be prioritized

- Professional image suffers

- No lead qualification or screening

Missed Revenue Calculation:

- Missed call rate: 40% (highest of all options)

- Average inquiry value: $25,000

- Monthly calls: 35

- Monthly lost revenue: $350,000

The “savings” cost you hundreds of thousands per month.

Option 2: Full-Time Receptionist

Many firms think hiring dedicated staff solves the problem. Sometimes it creates new ones.

How it works: You hire, train, and manage reception staff to handle calls during business hours.

Pros:

- Direct control over quality

- Learns your firm’s specific needs

- Can handle complex scheduling

- Professional live interaction

Cons:

- High ongoing costs (salary, benefits, training)

- No coverage during breaks, sick days, vacations

- Zero after-hours coverage

- Requires office space and equipment

Real Monthly Costs:

- Salary: $2,800

- Benefits: $560

- Training/management time: $200

- Equipment/workspace: $150

- Total: $3,710/month

You’re paying $3,710/month and still losing potential revenue from after-hours calls.

Option 3: Traditional Legal Answering Service

Legal-specific answering services understand your industry. But they come with limitations.

How it works: Trained operators answer your calls 24/7, take messages, and transfer urgent calls according to your protocols.

Pros:

- 24/7 live coverage

- Legal industry experience

- Bilingual support available

- Integration with legal software

Cons:

- Per-minute pricing escalates quickly

- Limited customization for corporate law specifics

- Setup takes several days

- Script limitations for complex inquiries

Typical Pricing:

- 100 minutes: $330/month

- 150 minutes: $479/month

- Additional minutes: $2.50-$3.50 each

Better than other options, but still leaves money on the table.

Option 4: Voctiv AI Assistant (Complete Solution)

Finally, there’s a corporate law firm answering service that handles 100% of calls without the traditional limitations.

How it works: Voctiv’s AI assistant answers every call instantly, trained on your firm’s specific practice areas and protocols. It qualifies leads, schedules appointments, and sends you SMS alerts about hot prospects.

Key Benefits for Corporate Law Firms:

- Instant setup – Self-trains on your website content in minutes

- Unlimited calls – No per-minute charges or monthly limits

- Perfect consistency – Never has a bad day or forgets protocols

- Multilingual support – Serves international corporate clients

- Smart lead qualification – Identifies high-value prospects automatically

- Real-time notifications – SMS alerts for urgent matters

Pricing:

- Free tier available for testing

- Premium: $29/month

- No setup fees or per-minute charges

For less than the cost of a business lunch, you protect substantial monthly revenue.

Perfect for individuals and small teams (up to 5 persons) – Mobile app solution

Try App Free

Why Corporate Law Firms Can’t Afford to Miss Calls

Corporate legal work isn’t like personal injury or family law. Your clients have specific expectations:

- Immediate availability – Deals don’t wait for business hours

- Professional competence – First impressions matter for million-dollar matters

- Confidentiality assurance – Sensitive business issues need secure handling

- Multilingual support – International clients expect language flexibility

Traditional solutions force you to choose between cost and quality. Voctiv AI gives you both.

Real-World Applications for Corporate Law Practices

Here’s how Voctiv AI handles the situations corporate law firms face daily:

After-Hours Merger Inquiry

Scenario: 9 PM Friday call from a CEO about a time-sensitive acquisition.

Voctiv Response: Qualifies the urgency, captures deal details, schedules Saturday consultation, sends you immediate SMS alert with full context.

Result: You wake up Saturday with a qualified engagement ready to close.

International Client Communication

Scenario: German subsidiary needs contract review before Monday board meeting.

Voctiv Response: Communicates in German, understands urgency, schedules weekend review, connects client to secure document portal.

Result: International client impressed by your firm’s accessibility and professionalism.

Competitor Displacement

Scenario: Frustrated client calls after current law firm missed deadline on securities filing.

Voctiv Response: Recognizes urgency, schedules emergency consultation, sends you detailed brief on the client’s needs.

Result: You steal a valuable annual client from a competitor who couldn’t answer their phone.

Perfect for larger businesses with teams over 5 persons – Custom OMNI AI Assistant with enterprise integrations

Book a Demo

Common Objections (And Why They Don’t Apply)

“AI Can’t Handle Complex Legal Inquiries”

You’re right – AI shouldn’t give legal advice. That’s not what Voctiv does.

Instead, it expertly qualifies leads, captures case details, and routes urgent matters to you immediately. Think of it as the world’s best receptionist who never sleeps.

“Clients Want to Talk to Real People”

They want to talk to you. But when you’re unavailable, they want their call answered professionally.

Voctiv ensures every caller gets immediate attention, proper screening, and quick connection to the right attorney. No more voicemail jail.

“What About Confidentiality?”

Voctiv maintains strict confidentiality protocols for all client communications. It focuses on administrative tasks like inquiry qualification and routing.

For sensitive matters, Voctiv can’t handle medical emergencies or provide medical advice – it specializes in legal inquiry management and professional call handling.

Frequently Asked Questions

How quickly can my corporate law firm start using Voctiv AI?

Setup takes just minutes. Voctiv automatically trains itself using your website content and any additional information you provide. You can be handling calls professionally within hours of signing up.

Can Voctiv handle emergency legal situations?

Voctiv excels at identifying urgent situations and immediately alerting you via SMS. For true emergencies, it can connect callers directly to you while you’re available. It’s trained to recognize time-sensitive corporate matters like deal deadlines and compliance issues.

What languages does Voctiv support for international corporate clients?

Voctiv offers multilingual support with languages easily added through the app interface. This is perfect for corporate law firms serving international businesses and foreign subsidiaries.

How does Voctiv integrate with our existing legal software?

Voctiv sends SMS notifications about appointments and hot leads, making it easy to update your case management system. The immediate alerts ensure no qualified leads fall through the cracks.

What’s the difference between the free tier and premium version?

The free tier lets you test Voctiv’s capabilities with your practice. Premium ($29/month) unlocks full functionality including unlimited calls, advanced lead qualification, and priority SMS notifications – essential features for busy corporate law practices.

The Bottom Line: Your Corporate Law Firm Answering Service Decision

Every corporate law firm needs bulletproof phone coverage. The question isn’t whether you need it – it’s which solution protects your revenue while fitting your budget.

Traditional solutions force compromises:

- Voicemail is cheap but costs you clients

- Receptionists are expensive and limited to business hours

- Answering services work but have per-minute costs and script limitations

Voctiv AI eliminates these trade-offs. For $29/month, you get:

- 24/7/365 professional call handling

- Unlimited calls with no per-minute charges

- Instant setup with self-training capabilities

- Multilingual support for international clients

- Smart lead qualification and immediate SMS alerts

- Zero missed revenue potential

The ROI is clear. At conservative estimates, Voctiv protects thousands in monthly revenue for corporate practices. That’s an exceptional return on your $29 investment.

Your corporate law firm deserves phone coverage that matches your expertise level. Don’t let another high-value client slip away because you couldn’t answer the phone.

Ready to eliminate missed calls? Perfect for individuals and small teams (up to 5 persons) – Mobile app solution

Try App Free

How a Financial Advisor Answering Service Boosts Your Practice

Financial Advisor Answering Service: 2025 Complete Guide to Never Missing Another Client Call

Executive Summary

Financial advisors lose an average of $50,000 annually from missed client calls, making reliable phone coverage essential for business growth. Voctiv AI Phone Assistant revolutionizes client communication by ensuring 100% call handling without the costs or limitations of traditional solutions.

Voctiv’s unique advantages:

- Multilingual support – serve diverse client bases effortlessly

- Self-training capability – learns your business automatically from your website

- Instant SMS notifications – get alerted immediately about appointments and hot leads

- Zero missed calls – 100% availability without human limitations

- Professional financial knowledge – understands industry terminology and client needs

Discover how Voctiv AI transforms your client communication while dramatically reducing costs below.

For individuals and small teams (up to 5 persons), our mobile app provides the perfect solution to get started immediately.

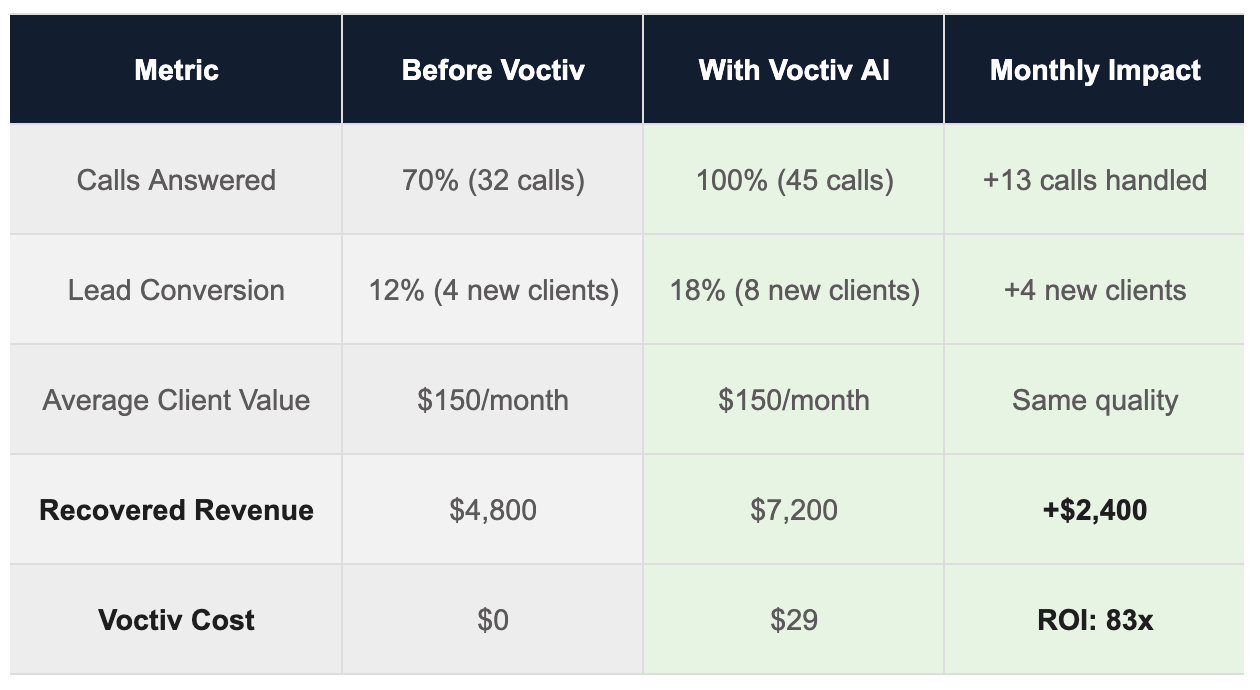

The Hidden Cost of Missed Calls in Financial Advisory

You’ve built your reputation on trust and availability, but every missed call represents lost opportunity. Financial advisors typically handle 40-80 client calls monthly, with each conversation potentially worth $150-300 in immediate business value.

Here’s what happens when you can’t answer:

- Prospective clients call competitors who answer immediately

- Existing clients feel neglected and consider switching advisors

- Urgent financial decisions get delayed, costing clients money

- Your professional image suffers in a relationship-driven industry

The solution isn’t working longer hours – it’s ensuring every call gets answered professionally, even when you’re unavailable.

Traditional Financial Advisor Answering Service Options (And Their Limitations)

Option 1: Do Nothing (Voicemail Only)

How it works: Rely on voicemail when unavailable, hoping clients leave messages and wait for callbacks.

Pros:

- Minimal cost ($10-20/month)

- Easy setup

- No training required

Cons:

- 70% of callers hang up without leaving voicemail

- No immediate response capability

- Poor professional image

- Can’t handle urgent client needs

- No appointment scheduling assistance

Missed Revenue Calculation:

- Missed calls: 25% of total calls (industry average)

- Monthly call volume: 50 calls

- Missed calls per month: 12-13 calls

- Average value per call: $175

- Monthly lost revenue: $2,100-2,275

Option 2: Hire a Full-Time Receptionist

How it works: Employ a dedicated person to handle all incoming calls during business hours.

Pros:

- Personal touch with familiar voice

- Can handle complex scheduling

- Learns your specific procedures

- Can perform additional office tasks

Cons:

- High cost ($35,000-50,000 annually plus benefits)

- Limited to business hours only

- Sick days and vacation coverage needed

- Requires office space and equipment

- May lack financial industry knowledge

- Can’t scale during busy periods

Missed Revenue Calculation:

- After-hours missed calls: 15% of total calls

- Monthly call volume: 60 calls

- Missed calls per month: 9 calls

- Average value per call: $175

- Monthly lost revenue: $1,575

Option 3: Outsourced Answering Service

How it works: Third-party service answers calls using scripts you provide, then forwards messages or transfers important calls.

Pros:

- 24/7 availability possible

- Professional phone handling

- Multiple agents for busy periods

- Some industry specialization available

Cons:

- High monthly costs ($250-600+ per month)

- Per-minute charges add up quickly

- Generic scripts sound impersonal

- Long training periods (2-4 weeks)

- High agent turnover affects consistency

- Extra fees for after-hours service

- Limited understanding of complex financial topics

Missed Revenue Calculation:

- Script limitations cause: 10% of calls poorly handled

- Monthly call volume: 60 calls

- Poorly handled calls per month: 6 calls

- Average value per call: $175

- Monthly lost revenue: $1,050

Voctiv AI: The Perfect Financial Advisor Answering Service Solution

Voctiv AI Phone Assistant eliminates every limitation of traditional solutions while delivering superior results at a fraction of the cost. Here’s how it transforms your practice:

Intelligent Call Handling That Understands Finance

Unlike generic answering services, Voctiv AI trains itself on your specific services and industry knowledge. It understands financial terminology, can discuss your investment approaches, and handles client questions with the expertise they expect from your practice.

24/7 Availability Without Extra Costs

Your AI assistant never sleeps, takes breaks, or goes on vacation. Whether it’s a weekend emergency or an after-hours inquiry from an overseas client, every call gets answered professionally.

Instant Notifications for Hot Leads

When high-value prospects call, you’ll know immediately via SMS. This lets you follow up while their interest is peak, dramatically improving conversion rates.

Multi-Language Client Support

Expand your client base by serving non-English speaking prospects and clients. Voctiv AI handles multiple languages seamlessly, opening new market opportunities.

Setup in Minutes, Not Weeks

Connect Voctiv to your phone system and share your website or service information. The AI trains itself automatically – no lengthy onboarding processes or script writing required.

For businesses with teams over 5 persons requiring custom integrations, our enterprise solution provides comprehensive OMNI AI Assistant capabilities.

Real-World Financial Impact: ROI Analysis

Let’s calculate the actual return on investment for a typical financial advisory practice:

Conservative assumptions used:

- Only 15% of calls would have been missed without AI assistance

- Average value per call: $175 (accounting for mix of prospects and existing clients)

- Conversion rate factors in typical lead quality and market conditions

- Revenue calculations exclude referrals generated by improved client satisfaction

Even with these conservative estimates, Voctiv AI pays for itself within the first recovered call each month.

Implementation: Getting Started with Voctiv AI

Setting up your AI assistant takes just minutes:

- Connect your phone system – works with existing VoIP or traditional phone services

- Share your business information – upload your website URL or key service documents

- Customize notification preferences – choose how you want to receive alerts about important calls

- Test and refine – make practice calls to ensure optimal performance

The AI begins learning immediately and improves with every interaction. No technical expertise required.

Addressing Common Concerns

Will clients know they’re talking to AI?

Voctiv AI is designed to sound natural and professional. Most callers appreciate the immediate response and knowledgeable assistance, regardless of whether it’s AI or human.

What about complex financial questions?

The AI handles routine inquiries and appointment scheduling while seamlessly identifying when calls need your personal attention. You get notified immediately for complex situations.

Can it integrate with my existing calendar and CRM?

Yes, Voctiv AI works with popular financial advisor tools and can be customized for your specific workflow needs.

Frequently Asked Questions

How quickly can I start using Voctiv AI for my financial advisory practice?

You can have Voctiv AI answering your calls within minutes of signing up. The system trains itself automatically using your website content or any documents you share about your services.

What’s the difference between the free tier and premium version?

The free tier provides basic call handling capabilities, while the $29/month premium version includes advanced features like multilingual support, custom integrations, and priority SMS notifications for hot leads.

Does Voctiv AI understand financial industry terminology?

Yes, Voctiv AI is specifically trained to understand financial services terminology and can discuss investment approaches, retirement planning, and other advisory topics at an appropriate level for client interactions.

Can the AI handle appointment scheduling?

Absolutely. Voctiv AI can schedule appointments, send confirmation details via SMS, and integrate with your existing calendar system to prevent double-bookings.

What happens if a client has an urgent financial emergency?

The AI is programmed to recognize urgent situations and immediately notify you via SMS while keeping the client on the line. You can then take over the call directly or provide specific guidance through the AI.

Transform Your Financial Advisory Practice Today

The financial advisory industry is built on relationships and trust. Every missed call damages both. Voctiv AI ensures you never lose another opportunity while reducing costs and improving client satisfaction.

Your competitors are still using outdated phone systems or expensive human services. This gives you a significant advantage in client acquisition and retention.

Don’t let another valuable client call go to voicemail. Start capturing every opportunity with Voctiv AI’s intelligent financial advisor answering service.

For individuals and small teams (up to 5 persons), get started with our mobile app solution today.

Streamline Your Business with a Tax Preparation Answering Service

Best Tax Preparation Answering Service for CPA Firms in 2025: Complete Guide

Executive Summary

Tax season doesn’t have to mean stressed clients and missed opportunities. During busy periods, CPA firms lose 20-30% of incoming calls, which translates to thousands in lost revenue each month.

Key Advantages:

- Zero missed opportunities: Handles 100% of calls with instant tax-specific responses

- Automatic appointment booking: Schedules consultations and sends immediate notifications

- Multilingual support: Serves diverse client bases without language barriers

- Cost-effective scaling: Handles unlimited calls at a fraction of traditional service costs

- Instant setup: Train on your website and documents in minutes, not weeks

Ready to see how this approach can transform your tax practice? Let’s explore the complete comparison below.

For individuals and small teams (up to 5 persons) – Mobile app solution:

Try App Free

The Hidden Cost of Missed Calls During Tax Season

Tax preparers face a unique challenge. Between January and April, call volume jumps by 300-400%. Without proper phone management, you’re leaving serious money on the table.

Here’s what most CPA firms don’t want to admit:

- 30% of callers won’t leave a voicemail when you don’t answer

- 65% won’t call back if they reach voicemail twice

- Average tax prep client value ranges from $150-$800 per return

- Lost calls = lost revenue that your competitors capture instead

Consider a small tax practice receiving 50 calls per week during peak season. Missing just 20% means losing 10 potential clients weekly. At an average value of $300 per client, that’s $3,000 in missed revenue every single week.

Traditional Solutions vs. Modern Tax Preparation Answering Service Needs

Option 1: Do Nothing (Voicemail Only)

Many small tax practices rely solely on voicemail, hoping clients will leave detailed messages.

Pros:

- Zero additional cost

- Simple to maintain

- No training required

Cons:

- Loses 30-40% of potential clients immediately

- Creates poor first impression

- Can’t capture urgent deadlines or questions

- No appointment scheduling capabilities

- Misses opportunities to upsell services

Revenue Impact:

Scenario: 40 calls/week during tax season, 35% don’t leave voicemail

- Missed calls per week: 14

- Average client value: $250

- Weekly lost revenue: $3,500

- 3-month tax season loss: $42,000

Option 2: Hiring a Full-Time Receptionist

The traditional approach involves hiring dedicated staff to handle phones during busy periods.

Pros:

- Human interaction for complex questions

- Can handle multiple tasks beyond phones

- Builds personal relationships with regular clients

- Available during business hours

Cons:

- High cost ($15-20/hour plus benefits)

- Requires 2-4 weeks training on tax terminology

- Limited to business hours only

- Sick days and vacation coverage needed

- May not handle peak volume efficiently

- Needs ongoing tax law update training

Revenue Impact:

Scenario: Receptionist works 8am-6pm, 15% of calls come after hours

- After-hours calls missed per week: 6

- Average client value: $300

- Weekly lost revenue: $1,800

- Plus monthly salary cost: $3,200

- Net monthly impact: $10,400 expense

Option 3: Traditional Outsourced Answering Service

Many tax preparers turn to generic answering services that handle calls for multiple industries.

Pros:

- 24/7 availability

- Lower cost than full-time staff

- Professional phone handling

- Bilingual options often available

Cons:

- Generic scripts don’t address tax-specific questions

- Can’t provide detailed service information

- Operators lack tax knowledge

- Often just takes messages without qualifying leads

- Setup takes 1-2 weeks

- Per-call charges can add up quickly

Revenue Impact:

Scenario: Service handles calls but can’t answer tax questions, 25% hang up frustrated

- Frustrated callers per week: 10

- Average client value: $275

- Weekly lost revenue: $2,750

- Monthly service cost: $350

- Total monthly impact: $11,350 loss

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant with integrations:

Book a Demo

The Perfect Solution: Voctiv AI Tax Preparation Answering Service

Voctiv AI represents an innovative approach to tax preparation answering service needs. It combines human-like intelligence with AI efficiency, specifically designed for tax professionals.

How Voctiv AI Works for Tax Preparers

Setup takes just minutes. You connect Voctiv to your business and provide information about your services. The AI trains itself on your website content, service offerings, and any additional materials you share.

When clients call, Voctiv AI:

- Answers immediately with your firm’s specific information

- Schedules appointments directly into your calendar

- Qualifies leads by asking relevant tax-related questions

- Provides service details about different tax preparation options

- Handles multiple languages for diverse client bases

- Sends instant notifications for hot leads and appointments

Key Benefits for Tax Practices

Zero Missed Revenue Potential

Unlike traditional solutions, Voctiv AI handles 100% of calls with intelligent, tax-specific responses. No potential client goes unanswered.

Instant Tax Knowledge

The AI trains on your specific services, pricing, and processes. It can explain different return types, deadlines, required documents, and pricing structures.

Appointment Automation

Clients can book consultations immediately without waiting for callbacks. You receive instant notifications with client details and scheduled times.

Lead Qualification

The AI asks strategic questions to identify high-value opportunities like business tax returns, multi-state filings, or ongoing bookkeeping services.

Multilingual Support

Serve Spanish-speaking clients, immigrants needing ITIN assistance, or any other language community in your area.

These calculations assume conservative conversion rates and account for typical call patterns during tax season. The actual revenue recovery often exceeds these projections due to improved client experience and 24/7 availability.

Implementation and Setup

Setting up Voctiv AI for your tax preparation answering service needs is remarkably simple:

Step 1: Quick Connection (2 minutes)

Connect your business phone number and provide basic information about your tax services.

Step 2: AI Training (3-5 minutes)

Share your website URL and any documents about your services. The AI learns your pricing, processes, and specializations.

Step 3: Customization (2 minutes)

Set your appointment availability and any specific responses for common tax questions.

Step 4: Go Live (Instant)

Your AI assistant is ready to handle calls immediately. No waiting periods or complex training processes.

Addressing Common Concerns About AI Phone Services

“Will clients know it’s AI?”

Voctiv AI maintains transparency while providing exceptional service. Clients appreciate getting immediate, accurate answers rather than waiting on hold or playing phone tag.

“Can it handle complex tax questions?”

The AI excels at initial qualification and appointment scheduling. For complex situations requiring professional judgment, it seamlessly schedules consultations and notifies you immediately.

“What about data security?”

The system focuses on scheduling and initial information gathering. Sensitive financial details are handled during your professional consultations, maintaining appropriate security protocols.

Frequently Asked Questions

How quickly can Voctiv AI be set up for tax season?

Setup takes just minutes. You can have your AI answering service live and handling calls within 10 minutes of starting the process. No waiting weeks for training or complex integrations.

Can the AI handle different types of tax services?

Yes, Voctiv AI learns your specific services including individual returns, business taxes, bookkeeping, tax planning, and any specialty services you offer. It provides accurate information about pricing and requirements for each service type.

What happens if a client needs immediate professional advice?

The AI identifies urgent situations and schedules priority consultations. You receive instant notifications about hot leads and time-sensitive matters, ensuring no critical deadlines are missed.

Does Voctiv AI work with existing appointment scheduling systems?

The system integrates with your calendar and can work alongside existing scheduling tools. Appointments are booked according to your availability preferences and immediately synchronized.

How does the multilingual support help tax preparers?

You can serve Spanish-speaking clients, immigrants needing ITIN assistance, or any language community in your area. This significantly expands your potential client base without hiring multilingual staff.

Transform Your Tax Practice Today

The choice is clear. While traditional tax preparation answering service options either cost too much, miss too many calls, or lack the specific knowledge your clients need, Voctiv AI delivers the perfect solution.

For less than $1 per day, you can:

- Capture 100% of incoming opportunities

- Provide 24/7 professional service

- Automatically schedule consultations

- Scale effortlessly during peak season

- Serve clients in multiple languages

Don’t let another tax season slip by with missed calls and lost revenue. Your competitors are already exploring AI solutions – staying ahead means acting now.

For individuals and small teams (up to 5 persons) – Mobile app solution:

Try App Free

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant with integrations:

Book a Demo

Boost Client Satisfaction with an Accounting Firm Answering Service

Best Accounting Firm Answering Service in 2025: Complete Guide for Small CPA Practices

Executive Summary

Small accounting firms lose thousands of dollars monthly from missed calls. Traditional answering services cost too much and deliver too little. Voctiv AI Phone Assistant changes this by providing 24/7 call handling at a fraction of the cost. It trains on your business data in minutes and ensures you never miss another potential client again.

Key Advantages:

- Instant Setup: Trains on your website and business data automatically

- Multilingual Support: Handle clients in any language

- Smart Notifications: Immediate alerts for appointments and hot leads

- Cost Effective: 90% cheaper than human receptionists

- SMS Capabilities: Sends follow-up messages to prospects

Your accounting firm’s phone is ringing right now. But where are you? Meeting with a client? Reviewing tax returns? Handling payroll? Every missed call could be a new client worth thousands in annual revenue walking away to your competitor who answers their phone.

Discover how accounting firms are recovering $2,000-$4,000 monthly in previously lost revenue while cutting phone handling costs by 85%.

Mobile app for individuals and small teams (up to 5 persons)

Try App Free

The Hidden Cost of Missed Calls for Accounting Firms

Small CPA practices lose an average of $2,400 monthly from missed calls. Here’s the math that’ll shock you:

- Average accounting firm receives 45 calls per month

- 25% of calls go unanswered (that’s 11 missed calls)

- Each new client averages $2,200 annual value

- 15% of missed calls would’ve become clients

- Lost revenue: 11 × 0.15 × $2,200 = $3,630 annually per missed call period

During tax season? These numbers triple. You’re literally watching revenue walk out the door every time your phone rings unanswered.

Traditional Accounting Firm Answering Service Solutions (And Why They’re Failing)

The “Do Nothing” Voicemail Approach

How it works: Let calls go to voicemail and hope clients leave messages.

Pros:

- Cheapest option ($10-30/month)

- No setup required

- Better than nothing

Cons:

- 70% of callers hang up without leaving messages

- Creates unprofessional image for financial services

- No way to capture urgent leads

- Competitors who answer live win the business

Missed Revenue Calculation:

With 45 monthly calls and 30% going unanswered (14 calls), plus 70% not leaving voicemail (10 additional lost opportunities), you’re missing 24 potential connections monthly. At $150 average call value, that’s $3,600 monthly in lost revenue.

Hiring a Full-Time Receptionist

How it works: Employ a dedicated person to answer calls during business hours.

Pros:

- Personal touch with familiar voice

- Can handle complex scheduling

- Learns your clients over time

- Available for other office tasks

Cons:

- Expensive ($35,000-$45,000 annually with benefits)

- Limited to business hours only

- Sick days and vacation leave phones unattended

- Requires training and management

- Single point of failure

Missed Revenue Calculation:

Even with a receptionist, 20% of calls still occur after hours (9 calls monthly). These after-hours calls often represent urgent tax questions or time-sensitive business needs. Lost value: $1,350 monthly plus $3,750 monthly salary costs.

Traditional Outsourced Answering Service

How it works: Third-party service answers calls using basic scripts and forwards messages.

Pros:

- 24/7 availability

- Professional call handling

- No sick days or vacation issues

- Scalable for busy seasons

Cons:

- Expensive ($220+ monthly for basic service)

- Generic scripts that don’t capture your expertise

- Agents don’t understand accounting terminology

- 1-2 week setup process

- Limited integration with your systems

- Per-call charges add up quickly

Missed Revenue Calculation:

While coverage improves, generic scripts miss 15% of qualified leads due to poor screening (7 calls monthly). These missed opportunities cost $1,050 monthly, plus the $220+ service fee.

Why Voctiv AI Phone Assistant is Perfect for Accounting Firms

Voctiv AI isn’t just another answering service. It’s specifically designed for professional services like accounting firms that need intelligent call handling without breaking the bank.

Instant Setup That Understands Your Practice

Forget weeks of training scripts. Voctiv automatically trains itself on your website content, services, and business information in minutes. It learns your:

- Service offerings (tax prep, bookkeeping, payroll, etc.)

- Pricing structure and packages

- Seasonal availability (tax season scheduling)

- Common client questions and concerns

- Professional terminology and processes

Multilingual Client Support

Expand your client base instantly. Voctiv handles calls in multiple languages, perfect for accounting firms serving diverse communities. No more losing Spanish-speaking business owners who need bookkeeping services.

Smart Lead Qualification

Unlike basic answering services, Voctiv qualifies leads intelligently:

- Identifies high-value prospects (business owners vs. individual tax filers)

- Captures specific needs (QuickBooks cleanup, tax problem resolution)

- Schedules consultations based on your availability

- Sends immediate SMS follow-ups to hot prospects

Seamless Integration with Your Workflow

Voctiv connects with your existing tools:

- Calendar systems for appointment booking

- CRM platforms for lead management

- SMS messaging for client communication

- Instant notifications for urgent calls

Custom OMNI AI Assistant ideal for businesses with teams over 5 persons and custom integrations

Book a Demo

Real ROI: How Much Revenue Can Your Accounting Firm Recover?

Let’s run the numbers for a typical small accounting firm:

Conservative estimate: Voctiv recovers $2,400 monthly in previously lost revenue while costing just $29. That’s an 8,200% return on investment.

Common Objections (And Why They Don’t Apply to Voctiv)

“AI Can’t Handle Complex Accounting Questions”

You’re absolutely right. Voctiv doesn’t try to provide tax advice or handle complex accounting questions. Instead, it:

- Qualifies the caller’s needs professionally

- Schedules appointments for detailed discussions

- Captures contact information and urgency level

- Immediately notifies you of high-priority calls

“Clients Want to Talk to Real People”

They want their calls answered professionally and their needs understood. Voctiv’s natural conversation flow often surprises callers with how human-like the interaction feels. Plus, it seamlessly connects urgent calls to you directly.

“What About Client Confidentiality?”

Voctiv follows strict security protocols and focuses on business inquiries, appointment scheduling, and lead qualification – all within professional standards. It doesn’t collect or store sensitive financial information during initial calls.

Getting Started: From Setup to Success in Under 10 Minutes

Here’s exactly what happens when you activate Voctiv for your accounting firm:

- Connect your phone number (2 minutes)

- Voctiv scans your website and learns your services (3 minutes)

- Customize greeting and call flow preferences (2 minutes)

- Set up calendar integration for appointments (2 minutes)

- Test call to verify everything works (1 minute)

That’s it. Your accounting firm now has 24/7 professional call handling that costs less than a single billable hour monthly.

Frequently Asked Questions

Can Voctiv handle appointment scheduling for tax consultations?

Absolutely. Voctiv integrates with your calendar system to book consultations based on your availability. It can even handle different appointment types (tax prep, business consultations, bookkeeping setup) with appropriate time allocations.

What happens during tax season when call volume increases?

Voctiv scales automatically. Unlike human receptionists who get overwhelmed, or traditional services that charge per-call overages, Voctiv handles unlimited calls at the same flat rate. Perfect for managing seasonal demand spikes.

How does Voctiv qualify accounting leads differently than basic answering services?

Voctiv asks intelligent follow-up questions based on your services. It distinguishes between individual tax clients and business owners needing ongoing bookkeeping, captures specific pain points like QuickBooks problems, and identifies urgency levels for proper prioritization.

Can existing clients reach me directly for urgent matters?

Yes. Voctiv can be configured to recognize existing client phone numbers and either connect them directly or handle their requests with priority routing. You maintain control over who gets immediate access.

What if a caller has a complex question that requires my expertise?

Voctiv gracefully handles this by explaining that detailed questions require your personal attention, then immediately schedules a callback or consultation. It also sends you a detailed summary of the caller’s needs, so you’re prepared for the conversation.

Stop Losing Clients to Competitors Who Answer Their Phones

Every day you delay implementing professional call handling, you’re handing potential clients to competitors who answer their phones. The accounting firm down the street doesn’t have to be better than you – they just have to be available when prospects call.

Voctiv AI Phone Assistant gives your small accounting practice the professional phone presence of a large firm, at a fraction of the cost. Your clients get immediate attention, your leads get qualified properly, and you get back to doing what you do best – helping businesses with their finances.

The best time to implement an accounting firm answering service was last year. The second-best time is right now, before your next potential client calls and gets voicemail instead of professional service.

Mobile app for individuals and small teams (up to 5 persons)

Try App Free

Expert Bankruptcy Attorney Answering Service: 24/7 Client Support

Ultimate Guide to Bankruptcy Attorney Answering Service in 2025: Maximize Client Acquisition

Executive Summary

Bankruptcy attorneys face unique challenges when potential clients call in distress, needing immediate help beyond business hours. A dedicated bankruptcy attorney answering service ensures every call gets professional handling, protecting your reputation while maximizing revenue opportunities. Voctiv AI Phone Assistant offers a revolutionary solution that guarantees 24/7 call coverage at a fraction of traditional costs.

- Never miss a potential client – Voctiv handles 100% of calls 24/7/365

- Instant appointment scheduling – Convert callers to consultations automatically

- Multilingual support – Serve diverse client populations without additional staff

- Bankruptcy-specific training – AI understands Chapter 7, 11, and 13 terminology

- Immediate deployment – Set up in minutes with zero downtime

Discover how Voctiv AI Phone Assistant is transforming client acquisition for bankruptcy attorneys nationwide while dramatically reducing operational costs.

Ideal for solo practitioners and small firms (up to 5 attorneys)

Try App Free

The Hidden Cost of Missed Calls for Bankruptcy Attorneys

In bankruptcy law, a missed call isn’t just an inconvenience—it’s potentially thousands in lost revenue. People seeking bankruptcy protection are often in crisis, and if they can’t reach you immediately, they’ll quickly call the next attorney on their list.

Recent industry data shows the average bankruptcy case generates between $1,500-$4,000 in revenue for attorneys. Yet many firms unknowingly lose 30-40% of potential clients simply because they can’t answer every call, especially those coming after hours or during peak periods.

For bankruptcy attorneys, timing is critical. Clients facing foreclosure, wage garnishment, or creditor harassment need immediate answers. When they call a bankruptcy attorney answering service and reach a responsive professional voice, their anxiety decreases and their trust in your firm increases.

Learn more about bankruptcy law fundamentals and how proper client communication can improve outcomes.

Traditional Call Handling Solutions: A Revenue Drain

The Voicemail Approach: Lost Revenue