Mortgage Broker Answering Service: How to Never Miss Another Lead in 2025

Executive Summary

You’re losing qualified mortgage leads every day because you can’t answer every call. A mortgage broker answering service can capture 100% of your leads, qualify prospects instantly, and grow your business without adding overhead costs.

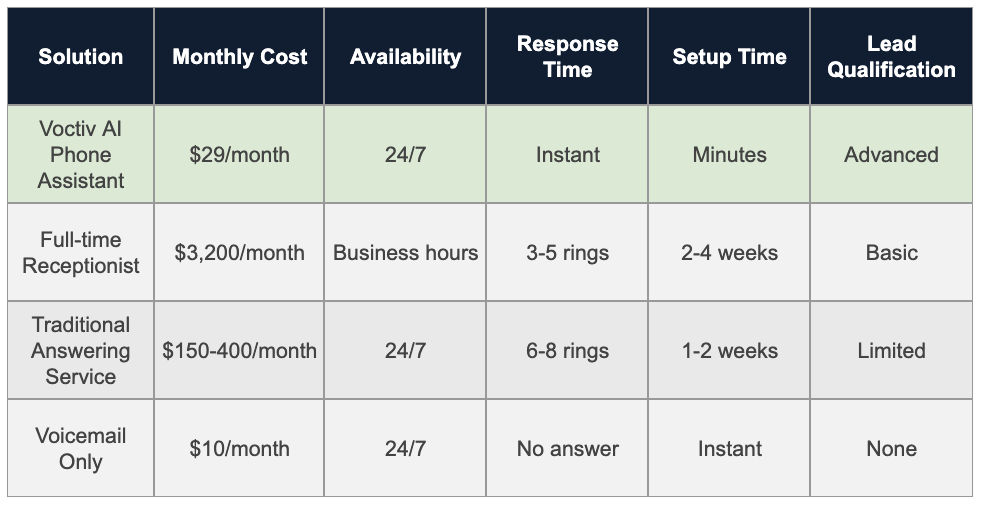

Traditional phone handling methods fail mortgage brokers when they’re most needed – during peak lending season or when you’re with clients. Here’s how your options stack up:

Voctiv’s unique advantages:

- Self-training AI – learns your business automatically from your website content

- Instant lead notifications – get SMS alerts for hot prospects immediately

- Multilingual support – handle calls in multiple languages without hiring extra staff

- Zero missed revenue – capture 100% of leads even during busy periods

- Compliance-ready – built for regulated industries like real estate and mortgage lending

Ready to stop missing leads? Discover how Voctiv transforms your phone handling strategy below.

For individuals and small teams (up to 5 persons), Voctiv offers a mobile app solution that’s perfect for growing mortgage brokers.

Why Most Mortgage Brokers Struggle with Phone Management

You’re juggling client meetings, loan processing, and regulatory compliance. When prospects call, you’re often unavailable – and that’s costing you serious money.

The mortgage industry operates on tight margins and fierce competition. Missing even one qualified lead can mean losing a $3,000-$5,000 commission. Here’s what most brokers don’t realize:

- Peak call times happen when you’re busiest – during lunch, evenings, and weekends

- Mortgage prospects shop around – they’ll call your competitor if you don’t answer

- First impression matters – voicemail doesn’t convey professionalism or urgency

- Lead qualification is critical – you need to know if it’s a tire-kicker or serious buyer

Let’s break down your current options and see what’s actually costing you revenue.

The “Do Nothing” Approach: Just Using Voicemail

Many mortgage brokers rely on voicemail as their primary call handling solution. It’s cheap, it’s easy, and it doesn’t require any setup.

How Voicemail-Only Works

Your phone rings, goes to voicemail after 4-6 rings, and hopefully the caller leaves a message. You check messages periodically and return calls when you can.

Pros of Voicemail-Only

- Extremely low cost ($10/month)

- No setup or training required

- Complete control over callback timing

- Messages saved permanently for reference

Cons of Voicemail-Only

- High abandonment rate – 80% of callers hang up without leaving messages

- No lead qualification or urgency assessment

- Unprofessional image compared to competitors

- Delayed response times frustrate time-sensitive prospects

- No way to handle simple questions immediately

Missed Revenue Calculation

Here’s what voicemail-only is actually costing you:

- Missed calls: 80% of prospects don’t leave voicemail messages

- Average calls per month: 50 mortgage inquiries

- Lost prospects: 40 potential clients (80% of 50)

- Conversion rate: 15% of qualified leads become clients

- Average commission: $3,500 per closed loan

Monthly lost revenue: 40 × 15% × $3,500 = $21,000

Annual impact: $252,000 in missed commissions

Hiring a Full-Time Receptionist

Some successful mortgage brokers hire dedicated receptionists to handle incoming calls professionally. This approach works but comes with significant overhead.

How Full-Time Receptionists Work

You hire an employee who answers calls, takes messages, schedules appointments, and performs basic lead qualification. They’re trained on your services and can handle routine inquiries.

Pros of Full-Time Receptionists

- Dedicated support for your business specifically

- Can handle complex questions with proper training

- Professional image and consistent service

- Can perform additional administrative tasks

- Direct supervision and quality control

Cons of Full-Time Receptionists

- High cost including salary, benefits, and payroll taxes

- Limited to business hours unless you hire multiple shifts

- Sick days, vacation time, and potential turnover

- Requires office space and equipment

- Long hiring and training process

- Risk of confidentiality breaches

Missed Revenue Calculation

Even with a receptionist, you’re still missing after-hours opportunities:

- After-hours calls: 30% of mortgage inquiries happen evenings/weekends

- Total monthly calls: 50 inquiries

- After-hours missed: 15 prospects (30% of 50)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly lost revenue: 15 × 15% × $3,500 = $7,875

Total monthly cost: $3,200 salary + $7,875 lost revenue = $11,075

Traditional Mortgage Broker Answering Service

Professional answering services designed for mortgage brokers offer 24/7 coverage with trained operators. They’re a step up from voicemail but still have limitations.

How Traditional Services Work

Your calls forward to a call center where trained operators answer using your business name. They take messages, schedule appointments, and provide basic information using scripts you provide.

Pros of Traditional Answering Services

- 24/7 availability including holidays

- Professional call handling and custom greetings

- Bilingual support (English/Spanish)

- Detailed call documentation and reporting

- No hiring or training hassles

- Industry-specific compliance knowledge

Cons of Traditional Answering Services

- Higher cost than basic solutions ($150-400/month)

- Limited to scripted responses – can’t handle complex questions

- Slower response times (6-8 rings typical)

- Setup time for script customization (1-2 weeks)

- Less personal than in-house staff

- Potential for miscommunication or missed details

Missed Revenue Calculation

Even professional services miss some opportunities:

- Script limitations: 15% of prospects need complex answers

- Total monthly calls: 50 inquiries

- Inadequately handled: 8 prospects (15% of 50)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly lost revenue: 8 × 15% × $3,500 = $4,200

Total monthly cost: $275 service fee + $4,200 lost revenue = $4,475

For larger businesses with teams over 5 persons, Voctiv offers a custom OMNI AI Assistant with advanced integrations.

Voctiv AI Phone Assistant: The Perfect Solution for Mortgage Brokers

Voctiv AI Phone Assistant eliminates all the problems you’ve been dealing with. It’s designed specifically for busy professionals who can’t afford to miss a single lead.

How Voctiv Works

Your AI assistant answers every call instantly, qualifies prospects using your business knowledge, and immediately notifies you about hot leads via SMS. It learns from your website content and handles calls just like an experienced team member.

Key Benefits for Mortgage Brokers

- Instant setup: Connect and train your AI in minutes, not weeks

- Zero missed calls: 100% call capture rate, 24/7/365

- Smart lead qualification: Identifies serious prospects automatically

- Immediate notifications: SMS alerts for appointments and hot leads

- Multilingual support: Handle calls in any language your clients speak

- Self-training capability: Learns your business from your existing content

- Compliance-ready: Built for regulated industries like mortgage lending

Revenue Recovery Calculation

Here’s how Voctiv transforms your business:

- Calls captured: 100% of incoming prospects

- Total monthly calls: 50 inquiries

- Previously missed: 40 prospects (from voicemail approach)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly recovered revenue: 40 × 15% × $3,500 = $21,000

Voctiv cost: $29/month

ROI: 724x return on investment

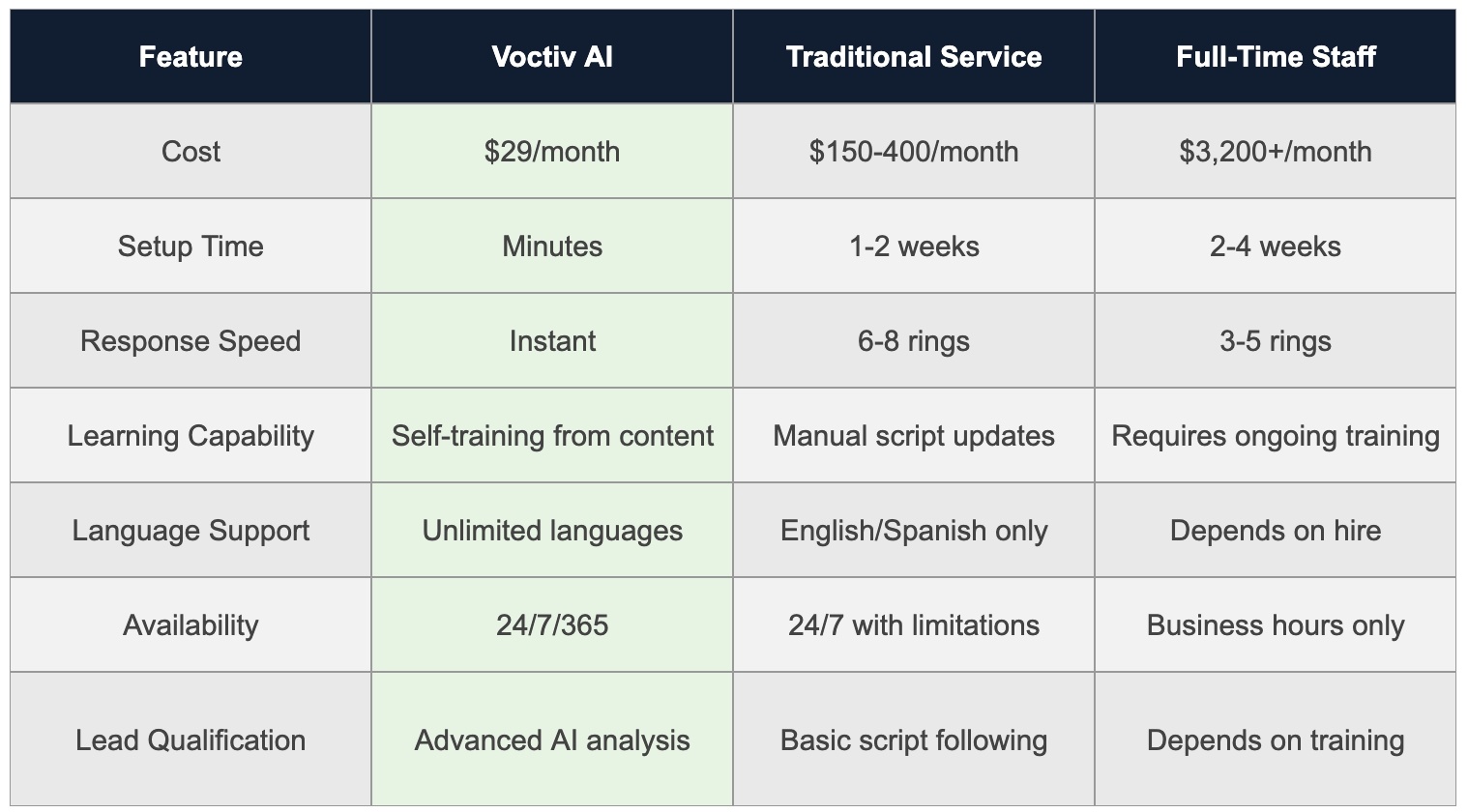

Why Voctiv Beats Traditional Solutions

Traditional answering services were designed for a different era. Voctiv’s AI technology solves problems that human operators simply can’t handle efficiently.

The difference is clear: Voctiv delivers superior results at a fraction of the cost while eliminating the management headaches of traditional solutions.

Real-World Applications for Mortgage Brokers

Here’s how Voctiv handles common mortgage broker scenarios:

Scenario 1: Rate Shopping Inquiries

Prospect calls asking about current rates. Voctiv explains your competitive advantages, gathers contact info, and immediately sends you an SMS: “Hot lead – John Smith wants rate quote for $350K purchase, pre-approved elsewhere, ready to move fast.”

Scenario 2: After-Hours Refinance Questions

Client calls at 8 PM worried about rising rates. Voctiv reassures them using your standard talking points about rate locks, schedules a callback for tomorrow morning, and sends you the details so you’re prepared.

Scenario 3: Spanish-Speaking Prospects

Voctiv seamlessly switches to Spanish, explains your services, and qualifies the lead – all while you’re in another meeting. You get a translated summary with their information.

Scenario 4: Complex Loan Scenarios

Self-employed borrower has questions about documentation. Voctiv recognizes this as a priority lead, gathers key details about their business and income, and marks them for immediate follow-up.

Getting Started with Voctiv

Setting up your AI assistant takes just minutes:

- Download the app and create your account

- Connect your phone number for call forwarding

- Let Voctiv learn from your website content automatically

- Customize responses for your specific services

- Test with a few calls to fine-tune responses

That’s it. Your AI assistant is ready to capture every lead while you focus on closing loans.

Frequently Asked Questions

Can Voctiv handle sensitive financial information securely?

Yes. Voctiv is designed for regulated industries and handles sensitive information appropriately. However, like any phone system, clients should avoid sharing account numbers or SSNs over the phone.

How does Voctiv learn about my specific loan programs?

Voctiv automatically analyzes your website content to understand your services. You can also provide additional information through the app interface to customize responses for your specific loan programs and lenders.

What happens if Voctiv can’t answer a complex question?

Voctiv intelligently recognizes when questions require your expertise. It gathers the prospect’s information, explains that you’ll provide detailed answers, and immediately notifies you via SMS for quick follow-up.

Can I customize Voctiv’s responses for different loan types?

How quickly will I see results from using Voctiv?

Most mortgage brokers see immediate improvement in lead capture rates. You’ll start getting SMS notifications for qualified prospects within hours of setup, and the AI continues learning and improving with each call.

Stop Missing Mortgage Leads Today

Every missed call is a missed commission. While your competitors rely on outdated answering services or expensive staff, you can capture 100% of your leads with Voctiv’s AI assistant.

The mortgage industry moves fast. Prospects won’t wait for callbacks – they’ll call the next broker on their list. With Voctiv, you’ll never miss another opportunity to grow your business.

Choose your solution based on your team size:

For individuals and small teams (up to 5 persons): Start with the mobile app that’s perfect for growing mortgage brokers.

For larger businesses: Get the custom OMNI AI Assistant that’s ideal for businesses with teams over 5 persons and custom integrations.