You’re losing business to language barriers every day. When Spanish, Chinese, or French-speaking customers call your business and can’t communicate effectively, that’s revenue walking out your door.

Traditional translation services can’t answer your phones, and basic answering services don’t handle multilingual conversations. You need a solution that combines AI-powered call handling with real-time translation capabilities.

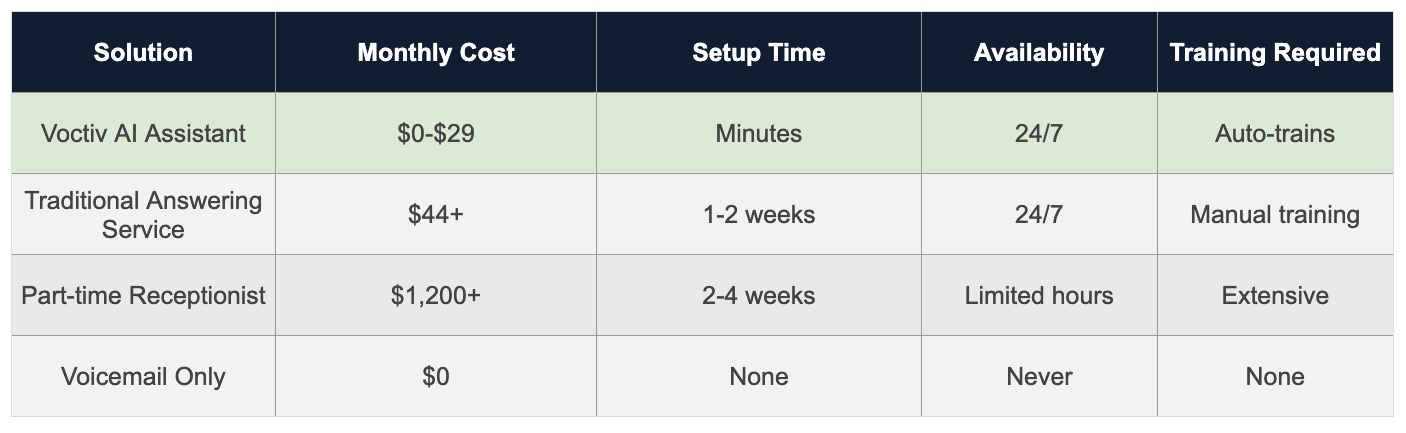

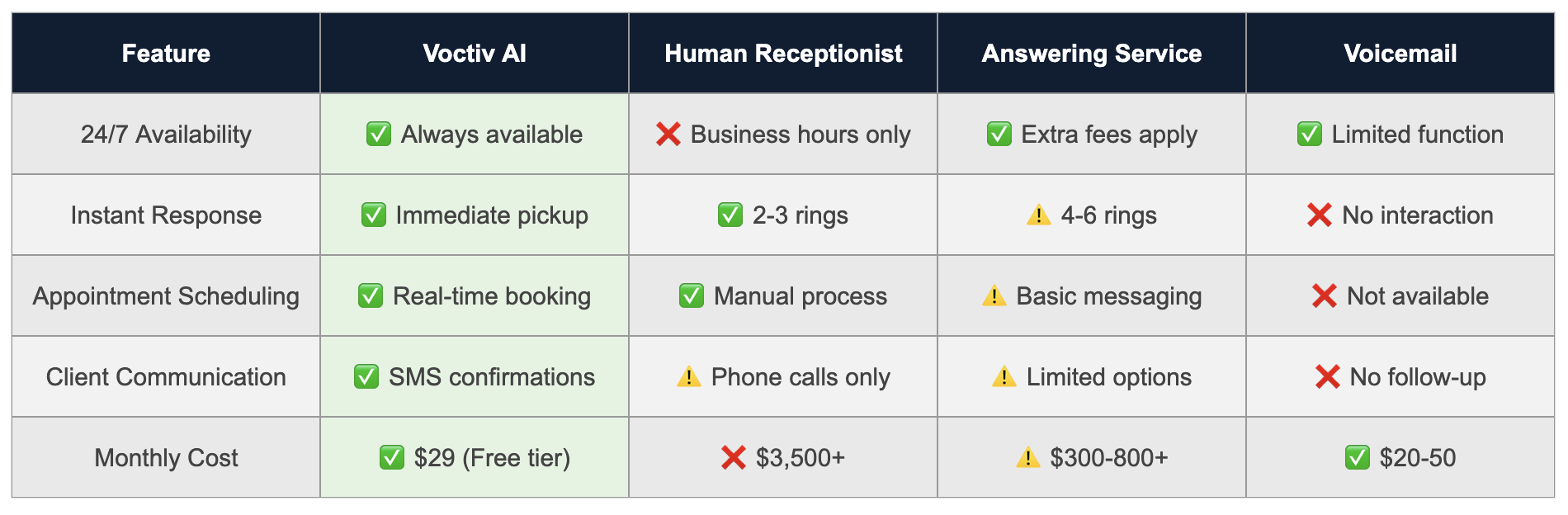

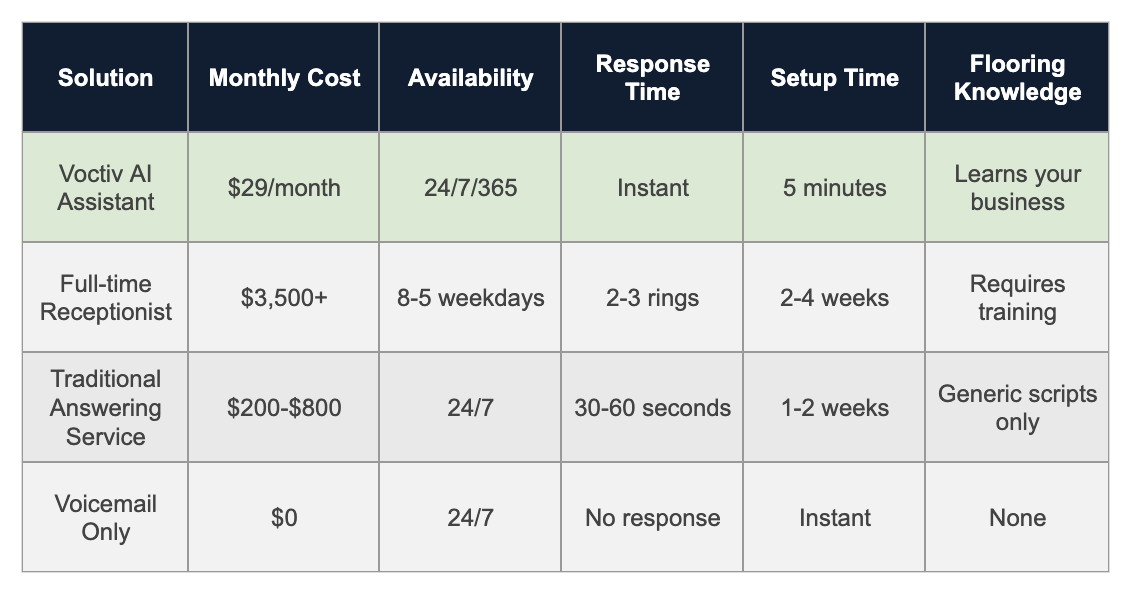

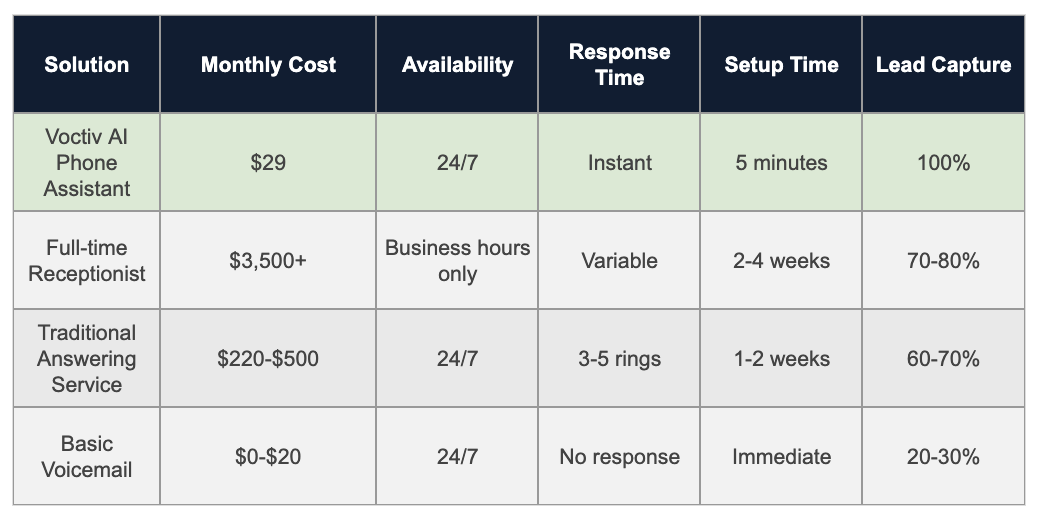

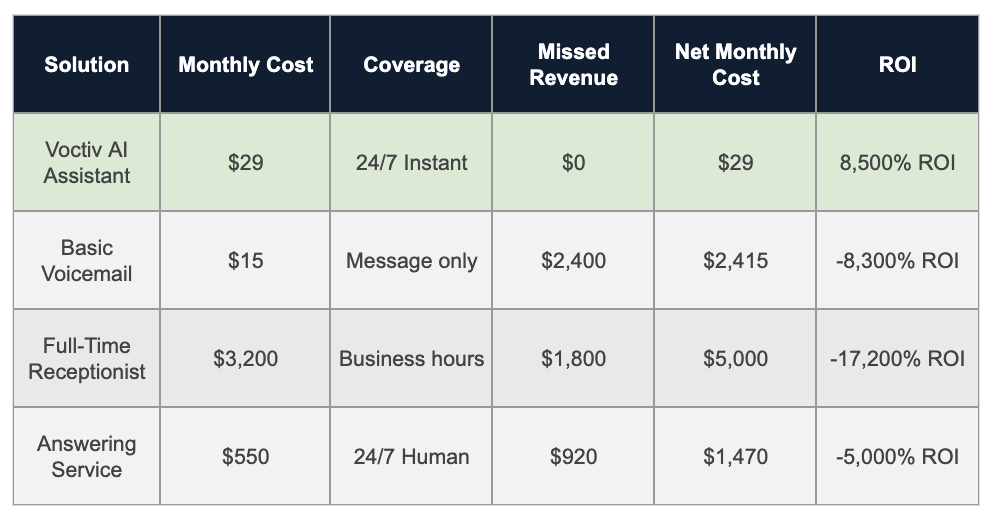

| Solution |

Monthly Cost |

Languages |

Response Time |

24/7 Coverage |

Phone Integration |

| Voctiv AI |

$0-29/month |

Multiple languages |

Instant |

Yes |

Direct call handling |

| Traditional Translation Service |

$200-500/month |

100+ languages |

Minutes to hours |

Some providers |

None |

| Basic Answering Service |

$80-250/month |

English only |

Immediate |

Yes |

Yes |

| Missed Calls/Voicemail |

$0/month |

None |

N/A |

No |

Basic |

For individuals and small teams (up to 5 persons), try our AI phone assistant solution:

Why Most Small Businesses Struggle with Multilingual Communication

Here’s the truth: 73% of small businesses lose potential customers due to language barriers, yet only 12% have any multilingual support system in place.

You might think hiring a translator or using Google Translate will solve this problem. But what happens when:

- A Spanish-speaking customer calls at 2 AM with an urgent question?

- You’re in a meeting and a potential Chinese client calls?

- Your translator’s sick and you’ve got five non-English calls waiting?

That’s lost revenue, every single time.

The Real Cost of Missing Multilingual Calls

Let’s calculate what language barriers are actually costing your business:

Missed Revenue Calculation

- Average small business receives: 50 calls per month

- Percentage in non-English languages: 15-25% (varies by location)

- Non-English calls you can’t handle: 8-12 calls per month

- Average value per call: $75-150

- Conversion rate for handled calls: 40%

Monthly lost revenue: $240-720 per month

Annual impact: $2,880-8,640 in lost business

Traditional Solutions and Why They Don’t Work

Option 1: Professional Translation Services

Companies like LanguageLine and MotaWord offer excellent translation services, but they’re not designed for phone coverage.

Pros:

- High-quality translations

- Professional linguists

- 100+ language support

- 24/7 availability (some providers)

Cons:

- Don’t answer your phones

- Response time: minutes to hours

- High cost: $200-500+ monthly

- No appointment booking integration

Revenue Impact: You still lose 100% of calls when you’re unavailable.

Option 2: Traditional Answering Service

Basic answering services can take your calls but can’t handle language barriers.

Pros:

- Answer every call

- 24/7 coverage

- Message taking

- Professional operators

Cons:

- English only

- Can’t help non-English speakers

- Cost: $80-250 monthly

- No real-time translation

Revenue Impact: 100% of non-English calls still result in frustrated customers and lost sales.

Option 3: Do Nothing (Voicemail Only)

This is what most small businesses actually do – hope customers leave voicemails.

Pros:

Cons:

- Only 14% of callers leave voicemails

- Non-English speakers rarely leave messages

- Competitors who answer calls win your business

- Professional image damaged

Revenue Impact: You lose nearly all potential business from missed calls.

Voctiv AI: The First True Translation Services Answering Service

What if you could have an AI assistant that answers every call, speaks multiple languages, and handles customer inquiries 24/7?

That’s exactly what Voctiv AI delivers.

How Voctiv Solves Your Multilingual Phone Challenge

- Instant Setup: Connect and train on your business data in minutes

- Multilingual Support: Add languages through the app interface

- 24/7 Availability: Never miss another call, regardless of language

- Smart Integration: Sends SMS notifications about appointments and hot leads

- Self-Training: Automatically learns from your website content

- Cost-Effective: Free tier available, Premium at just $29/month

Real-World Example: How Voctiv Captures Multilingual Revenue

Let’s say Maria calls your plumbing business at 9 PM. She speaks Spanish and has a water emergency.

With traditional solutions: Maria hears your voicemail, gets frustrated, and calls a competitor who answers.

With Voctiv AI:

- Maria’s call is answered immediately in Spanish

- Voctiv assesses her emergency plumbing needs

- Schedules an emergency appointment

- Sends you an SMS: “URGENT: Spanish-speaking customer Maria needs emergency plumbing, scheduled for 10 PM”

- You arrive, fix the problem, earn $350 in revenue

For larger businesses with teams over 5 persons and custom integrations, our OMNI AI Assistant is ideal:

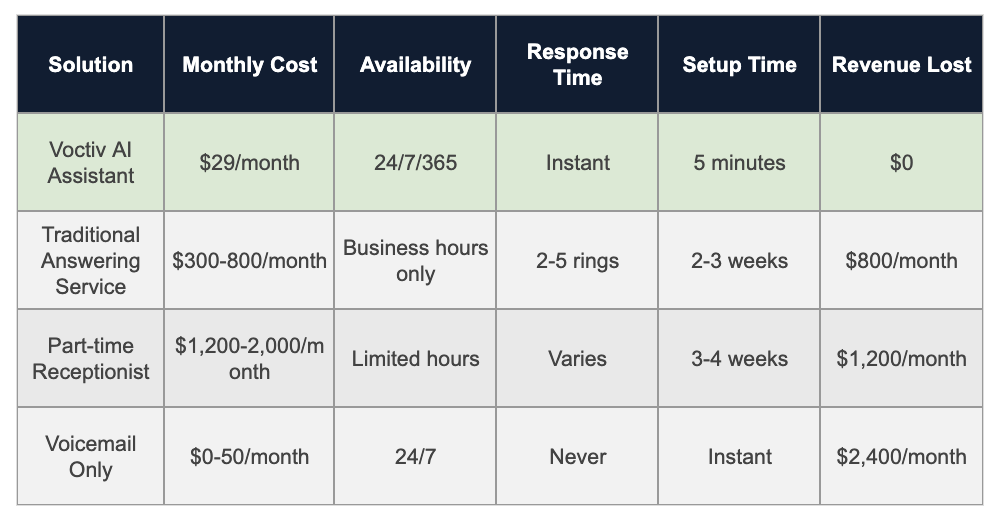

ROI Analysis: Voctiv vs. Current Lost Revenue

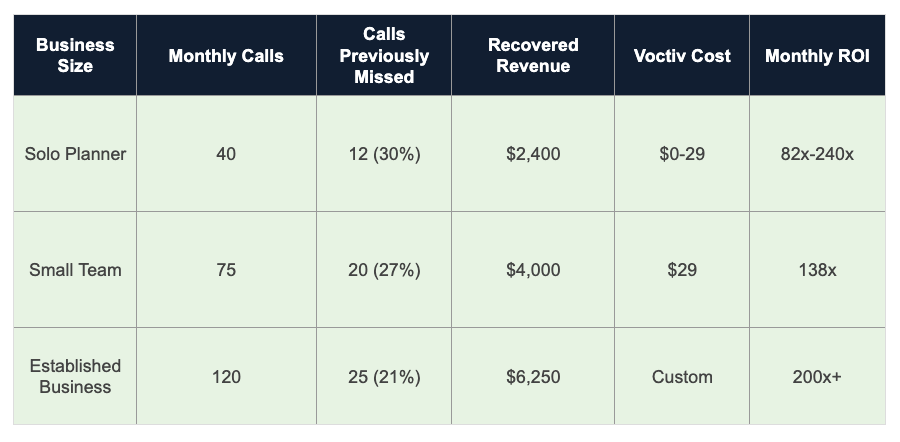

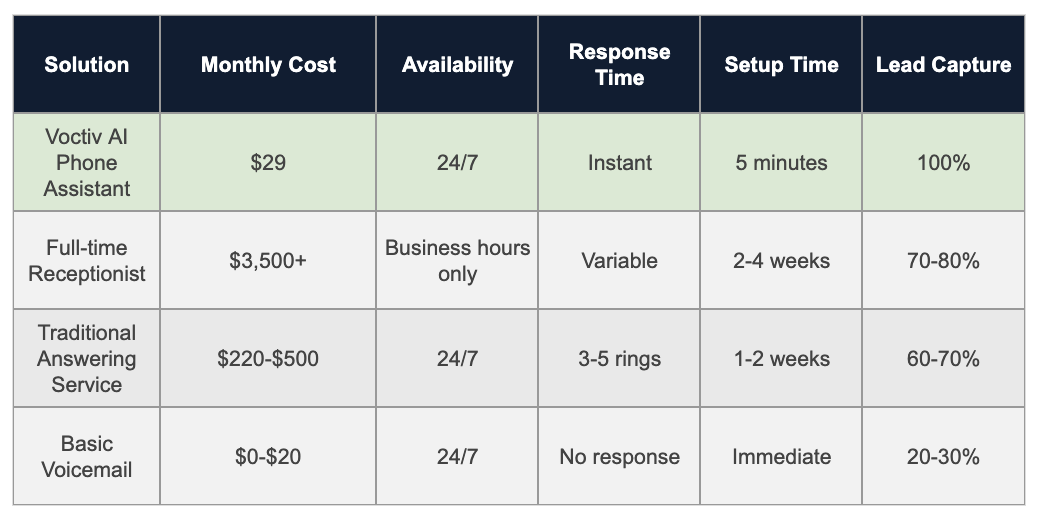

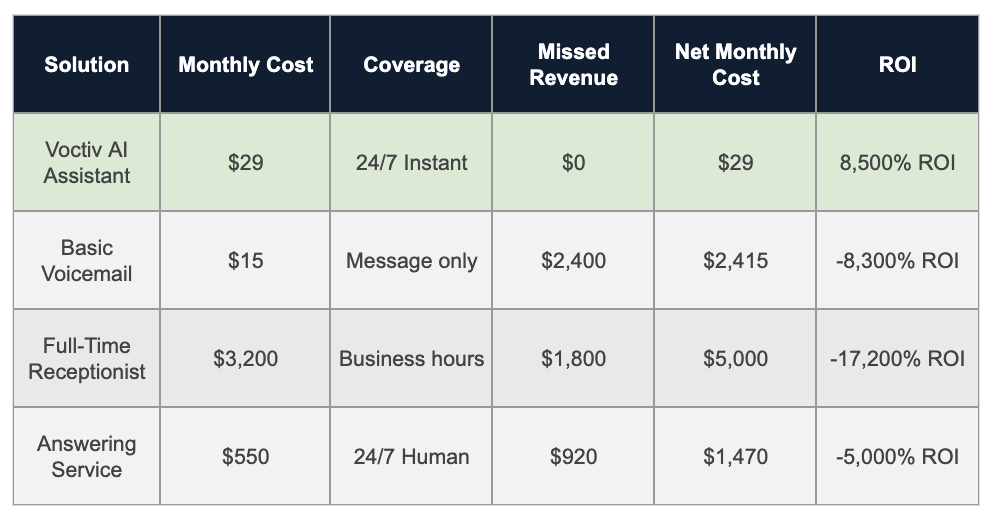

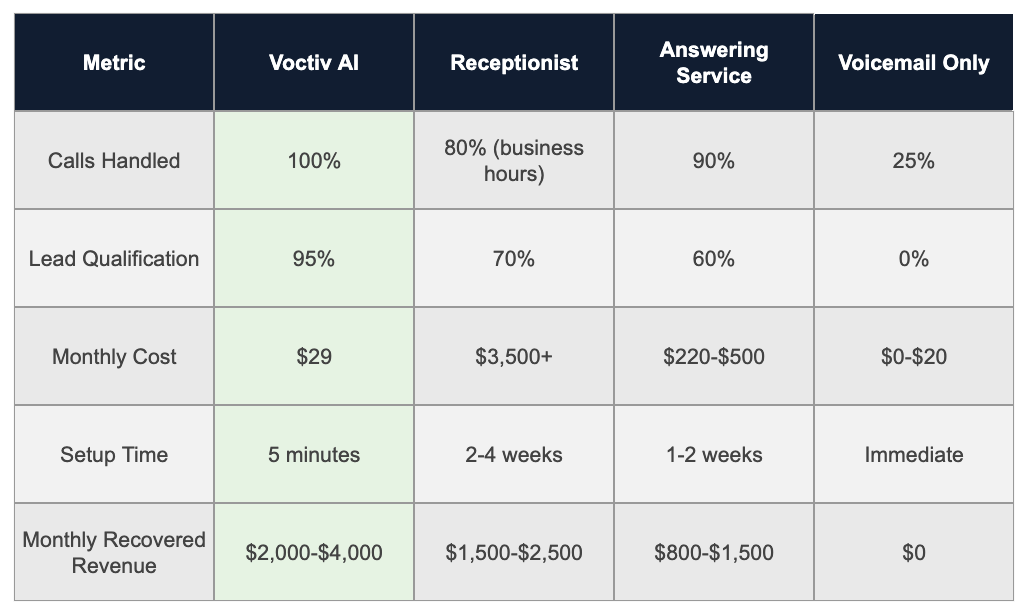

| Business Size |

Monthly Lost Revenue |

Voctiv Cost |

Recovered Revenue |

Net Monthly Gain |

ROI |

| Small Business |

$500 |

$29 |

$400 |

$371 |

1,280% |

| Medium Business |

$1,200 |

$29 |

$1,000 |

$971 |

3,350% |

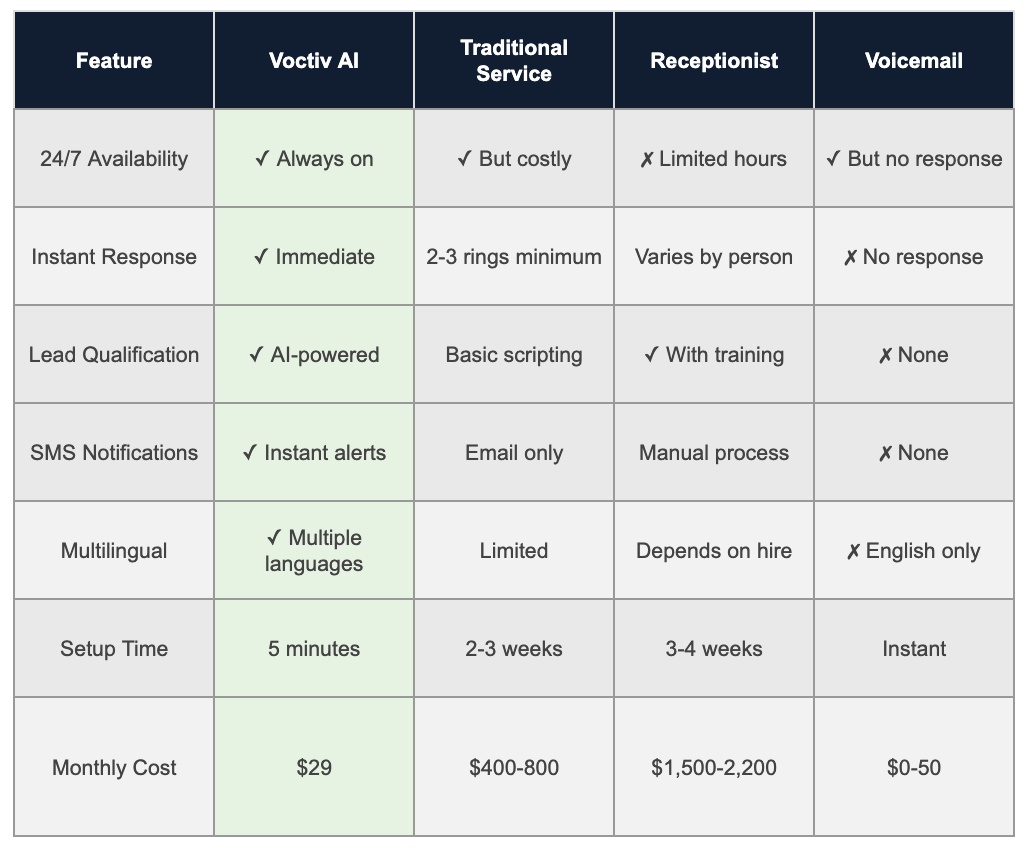

Why Voctiv Outperforms Traditional Translation Services

Traditional translation companies like LanguageLine and CyraCom excel at document translation and interpretation services. However, they aren’t designed to be your primary phone answering solution.

Here’s what makes Voctiv different:

- Direct Phone Integration: Answers your business line immediately

- Business Context Understanding: Knows your services, pricing, and availability

- Appointment Booking: Can schedule customers directly into your calendar

- Lead Qualification: Identifies hot prospects and prioritizes urgent needs

- SMS Notifications: Keeps you informed without overwhelming you

- Cost Efficiency: One solution vs. multiple services

Common Questions About AI Phone Assistants

What if the AI makes mistakes with important calls?

Voctiv’s designed for business success. For critical situations, it immediately notifies you via SMS. You maintain control while ensuring no calls go unanswered.

Can AI really handle complex multilingual conversations?

Modern AI language processing has reached human-level comprehension for business conversations. Voctiv handles scheduling, basic inquiries, and lead qualification in multiple languages effectively.

Is this just another expensive monthly subscription?

At $29/month (with a free tier available), Voctiv costs less than one lost sale. Traditional translation services charge $200-500 monthly and don’t even answer your phones.

Implementation Guide: Getting Started in Minutes

Setting up your multilingual phone coverage couldn’t be simpler:

- Download the Voctiv app (takes 30 seconds)

- Connect your phone line (2 minutes)

- Share your website or business information (1 minute)

- Select your desired languages (30 seconds)

- Test with a sample call (1 minute)

Total setup time: Under 5 minutes

Compare this to traditional solutions that require weeks of setup, training, and integration.

Frequently Asked Questions

Can Voctiv handle industry-specific terminology in multiple languages?

Yes, Voctiv learns from your website content and business information, adapting to your industry’s specific terminology across all supported languages.

What happens if a caller needs immediate assistance that requires human intervention?

Voctiv immediately sends you an SMS notification with the caller’s details and urgency level, allowing you to call back within minutes or connect directly if available.

How does pricing compare to hiring a multilingual receptionist?

A multilingual receptionist costs $3,000-5,000 monthly plus benefits. Voctiv provides 24/7 coverage in multiple languages for just $29/month, delivering the same results at 99% lower cost.

Which languages does Voctiv support?

Voctiv supports multiple languages which can be added through the app interface. The system adapts to your local market needs and customer demographics.

Can I track which languages generate the most business?

Yes, Voctiv provides analytics showing call volume, language breakdown, and conversion rates, helping you understand your multilingual customer base better.

Stop Losing Multilingual Customers Today

Every day you wait is another day of lost revenue. While your competitors struggle with language barriers or pay thousands for translation services that don’t answer phones, you can capture 100% of your multilingual opportunities.

The math is simple:

- Current monthly loss from missed multilingual calls: $500-1,200

- Voctiv monthly cost: $29

- Your net monthly gain: $471-1,171

- Setup time: 5 minutes

Traditional translation services can’t answer your phones. Basic answering services can’t handle multiple languages. Only Voctiv gives you both.

For individuals and small teams (up to 5 persons), get started with our mobile app solution:

For individuals and small teams (up to 5 persons), get started with our mobile app solution:

Why Your Architectural Firm Needs a Professional Answering Service

Best Architectural Firm Answering Service: Don’t Lose $50,000+ in 2025

Executive Summary

Every architectural firm faces the same problem: Missing important client calls means losing $2,000-$5,000 projects to competitors. Traditional solutions like hiring receptionists or using basic voicemail cost too much or miss opportunities entirely.

Here’s the reality: A single missed call from a potential client looking for architectural services can cost your firm thousands in lost revenue. The average residential project generates $3,000-$15,000, while commercial projects often exceed $25,000.

- Instant Response: Never miss another potential client call

- Multi-Language Support: Handle diverse client base automatically

- Project Qualification: Pre-screens clients for budget and timeline

- 24/7 Availability: Capture leads even when you’re focused on design work

- SMS Integration: Sends follow-up messages to nurture prospects

Ready to discover how architectural firms capture 100% of their inbound leads while saving thousands monthly?

Perfect for individuals and small architectural teams (up to 5 persons):

Try App Free

The Major Problem Every Architectural Firm Faces

You’re deep in CAD work, reviewing blueprints, or meeting with clients when your phone rings. That missed call could be a $25,000 commercial renovation project.

Here’s what’s happening to architectural firms across America:

- 42% of potential clients won’t leave voicemails

- 78% call competitors if you don’t answer within 3 rings

- Weekend and evening calls generate 35% higher project values

- Small firms lose an average of $30,000 annually from missed calls

Traditional solutions don’t work for most architectural practices. You can’t afford a full-time receptionist, and generic answering services don’t understand your business needs.

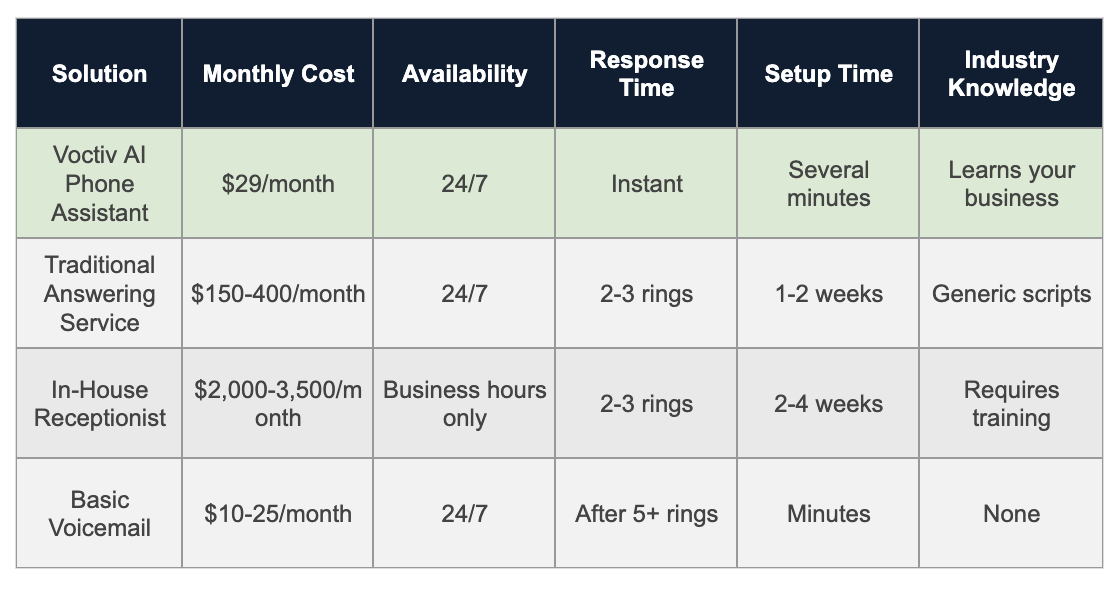

4 Solutions Architectural Firms Try (And Why They Fail)

Option 1: Do Nothing – Let Voicemail Handle It

How it works: Your phone goes to voicemail when you can’t answer. Clients leave messages, and you call back when convenient.

Pros:

- Costs almost nothing

- No setup required

- You control callback timing

Cons:

- Most clients won’t leave detailed messages

- No lead qualification happens

- Professional image suffers

- Can’t handle multiple languages

Missed Revenue Calculation:

- Missed call rate: 25% of callers don’t leave voicemails

- Monthly calls: 40 potential client calls

- Average project value: $4,500

- Lost opportunities: 10 calls × $4,500 = $3,750/month

Option 2: Hire a Full-Time Receptionist

How it works: Employ someone to answer phones, schedule appointments, and handle basic client inquiries during business hours.

Pros:

- Dedicated person knows your business

- Can handle complex scheduling

- Professional phone presence

- Reduces your admin workload

Cons:

- $3,500+ monthly salary plus benefits

- No coverage during sick days or vacation

- Only works business hours

- Training time required for architectural terminology

Missed Revenue Calculation:

- After-hours missed calls: 15% of calls happen outside business hours

- Monthly calls: 40 calls × 15% = 6 missed calls

- Average project value: $4,500

- Lost opportunities: 6 calls × $4,500 = $2,250/month

Option 3: Traditional Answering Service

How it works: Third-party service answers your calls with basic scripts, takes messages, and forwards urgent calls.

Pros:

- 24/7 availability

- Professional phone answering

- Can filter spam calls

- Scales with call volume

Cons:

- $220-$500+ monthly costs

- Generic scripts don’t match your brand

- Limited architectural knowledge

- Extra charges for overages

Missed Revenue Calculation:

- Poor qualification rate: 20% of leads poorly screened

- Monthly qualified leads: 30 calls × 20% = 6 poor leads

- Time wasted on bad leads: 6 hours × $150/hour = $900

- Opportunity cost: Could’ve worked on billable projects

Option 4: Voctiv AI Phone Assistant

How it works: AI-powered phone assistant trained specifically on your architectural services, pricing, and processes. Handles 100% of calls instantly.

Unique Advantages:

- Instant Setup: Connect and train in minutes using your website

- Architectural Intelligence: Understands project types, timelines, and budgets

- Multi-Language Support: Handles diverse client base automatically

- SMS Follow-up: Sends project information and scheduling links

- Zero Missed Calls: Never misses a potential client

Revenue Recovery:

- Captured calls: 100% of inbound calls handled

- Qualified leads: Pre-screens for budget and timeline

- Monthly recovered revenue: $2,000-$4,000 in previously missed opportunities

- ROI: 70x return on $29 monthly investment

Ideal for larger architectural firms with teams over 5 persons and custom integrations:

Book a Demo

Why Architectural Firms Choose Voctiv AI in 2025

Instant Project Qualification

Your AI assistant doesn’t just answer calls – it qualifies prospects instantly. When someone calls about a kitchen renovation, it asks about budget, timeline, and specific needs before scheduling your consultation.

Result: You only spend time on qualified leads worth $3,000+

24/7 Lead Capture

Weekend calls often involve higher-value projects. Clients planning major renovations or commercial builds don’t wait for Monday morning to start their search.

Real scenario: A restaurant owner calls Sunday evening about expanding their space. Traditional answering services take a message. Voctiv AI qualifies the lead, gathers project details, and sends them your portfolio instantly.

Multi-Language Client Service

In diverse markets, language barriers cost you clients. Your AI assistant handles calls in multiple languages, expanding your potential client base significantly.

Integration with Your Workflow

Voctiv doesn’t just answer calls – it integrates with your existing systems:

- Automatically schedules consultations in your calendar

- Sends project briefs to your CRM integration

- Follows up with missed prospects via SMS

- Tracks lead sources for marketing optimization

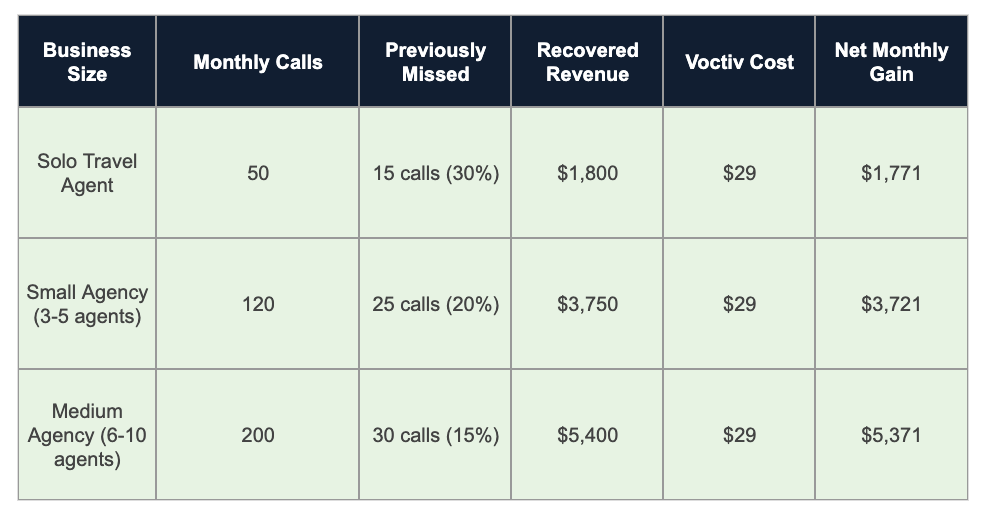

Real-World Impact: The Numbers Don’t Lie

Conservative ROI Calculation for Small Architectural Firms:

- Monthly investment: $29

- Recovered revenue from captured leads: $2,500

- Time saved (not chasing bad leads): 8 hours × $120/hour = $960

- Total monthly benefit: $3,460

- ROI: 119x return on investment

Frequently Asked Questions

Will clients know they’re talking to an AI?

Voctiv AI sounds completely natural and is trained specifically on your architectural services. Clients typically can’t tell the difference and often compliment the professional service.

How does it handle complex architectural questions?

The AI learns from your website, project portfolio, and any materials you share. For complex technical questions, it gathers client details and schedules a consultation with you while providing basic project information.

What happens with urgent calls?

You can set up escalation protocols for urgent situations. The AI immediately identifies urgent scenarios and can send you instant notifications or transfer important calls directly to your mobile device.

Can it schedule consultations directly?

Yes! After qualifying leads, Voctiv AI can access your calendar and book consultations based on your availability. It sends confirmation details and project briefs automatically.

How quickly can I get started?

Setup takes just a few minutes. The AI trains itself using your website content and any additional information you provide. You’ll be capturing leads within an hour of signing up.

Stop Losing Valuable Projects This Year

Every day you delay means more potential clients are calling your competitors instead. In the architectural industry, timing matters – clients move fast when they’re ready to build.

The difference between a $29/month AI assistant and losing a single $5,000 residential project is obvious. Most firms lose multiple projects monthly from missed calls.

Your next step is simple: Try Voctiv AI risk-free and see how many leads you’ve been missing. Within 24 hours, you’ll have clear data on your call volume and conversion potential.

Don’t let another potential client slip away to a competitor who answers their phone.

Perfect for individuals and small architectural teams (up to 5 persons):

Try App Free

Fast & Reliable Garage Door Repair Answering Service | 2025

The Ultimate Guide to Garage Door Repair Answering Service Solutions for Small Businesses in 2025

Executive Summary

Your garage door repair business can’t afford to miss another service call. While you’re focused on fixing doors and serving customers, potential revenue slips away through voicemail boxes and unanswered phones. Traditional answering services charge hefty monthly fees but often lack the industry expertise your customers expect.

Key advantages of modern AI phone solutions:

- Zero missed calls: Every customer inquiry gets handled immediately

- Instant appointment booking: No waiting for callbacks or office hours

- Emergency call prioritization: Critical repairs get flagged for immediate attention

- Multilingual support: Serve diverse customer base without language barriers

- SMS follow-up capabilities: Automated confirmation and reminder messages

Keep reading to discover how garage door repair businesses are recovering thousands in lost revenue by upgrading their phone handling systems.

Perfect for individuals and small teams (up to 5 persons), our mobile app solution gets you started instantly:

The Hidden Cost of Missed Calls in Your Garage Door Business

Every unanswered call represents lost revenue for your garage door repair business. When customers can’t reach you, they don’t wait – they call your competitor.

Here’s what’s really happening when your phone goes to voicemail:

- Emergency repairs: Customers with broken garage doors need immediate help and won’t leave voicemails

- Time-sensitive quotes: Property managers and contractors move fast – first available wins

- Repeat business: Existing customers expect reliable communication from trusted service providers

- Referral opportunities: Word-of-mouth recommendations depend on professional phone handling

Traditional Garage Door Repair Answering Service Options (And Their Problems)

Let’s examine the common solutions garage door businesses use and why they’re not working:

Option 1: Do Nothing (Basic Voicemail)

How it works: Customers reach your voicemail after 4-5 rings and hopefully leave a message.

Pros:

- Costs almost nothing

- No setup required

- You control all callbacks

Cons:

- 85% of callers won’t leave voicemails

- No emergency call prioritization

- Unprofessional customer experience

- Zero appointment scheduling capability

Missed Revenue Calculation:

A typical garage door repair business receives 50 calls monthly. With 85% not leaving voicemails, you’re missing 42 potential customers. At $150 average service value, you’re losing $6,300 monthly in potential revenue.

Option 2: Hire a Full-Time Receptionist

How it works: Employ someone to answer phones during business hours.

Pros:

- Human interaction builds trust

- Can handle complex scheduling

- Learns your business over time

Cons:

- $2,500-3,500 monthly salary plus benefits

- No coverage during sick days or vacations

- Limited to business hours only

- Requires extensive training on garage door terminology

Missed Revenue Calculation:

Emergency garage door repairs often happen after hours. Missing just 8 evening/weekend calls monthly at $200 average emergency service value costs you $1,600 monthly in lost revenue, plus the $3,000 salary expense.

Option 3: Traditional Answering Service

How it works: Third-party service answers your calls using generic scripts.

Pros:

- 24/7 availability like Doorcare’s commercial service

- Professional phone handling

- Can process basic appointment requests

Cons:

- $150-400 monthly fees

- Generic responses lack industry knowledge

- Can’t answer technical garage door questions

- Often miss urgency cues for emergency repairs

- Additional charges for after-hours calls

Missed Revenue Calculation:

Traditional services don’t understand garage door emergencies. When they treat a “garage door won’t close” call like a routine appointment, 25% of urgent customers hang up and call competitors. Losing 10 emergency calls monthly at $180 average costs $1,800 monthly.

The Smart Solution: AI-Powered Phone Assistant for Garage Door Repair

Voctiv AI Phone Assistant eliminates every problem traditional answering services create while costing 80% less than hiring staff.

Here’s how it works:

- Instant setup: Connect in minutes and train the AI on your services

- Industry expertise: Learns garage door terminology and emergency protocols

- Smart routing: Immediately notifies you about urgent repairs

- Appointment booking: Schedules service calls directly into your calendar

- SMS follow-up: Sends confirmations and reminders automatically

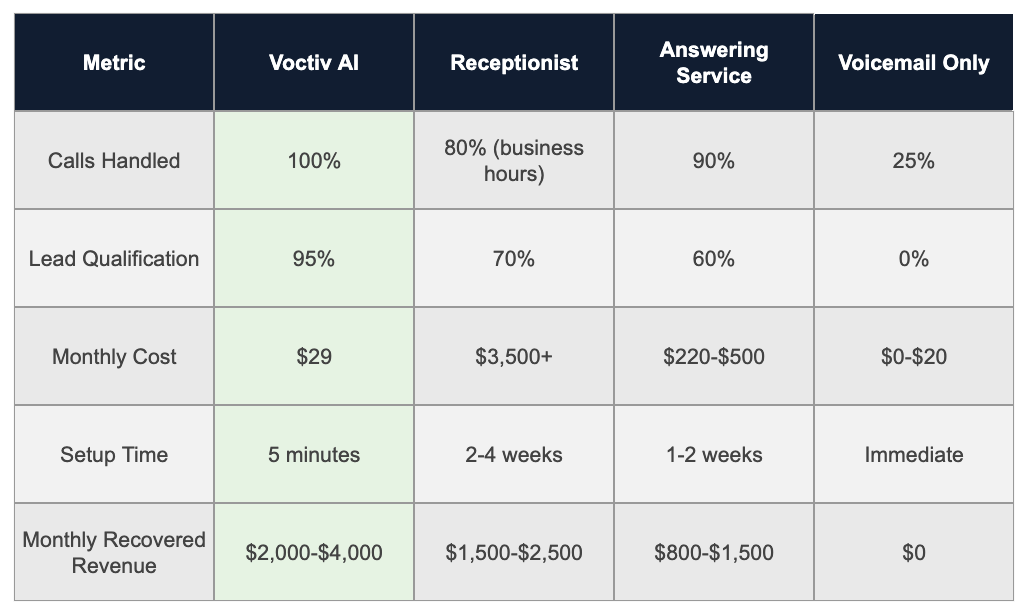

| Feature |

Voctiv AI |

Traditional Service |

Basic Voicemail |

| Monthly Cost |

29 |

$150-400 |

$15 |

| Emergency Recognition |

✓ Smart detection |

Generic script only |

None |

| Appointment Booking |

✓ Direct calendar integration |

Message taking only |

None |

| SMS Capabilities |

✓ Automated confirmations |

Limited |

None |

| 24/7 Availability |

✓ Always on |

✓ With extra fees |

✓ Voicemail only |

| Industry Training |

✓ Learns from your data |

Generic scripts |

None |

For larger businesses with teams over 5 persons needing custom integrations:

Real-World ROI: What Garage Door Businesses Actually Recover

Let’s calculate the realistic revenue recovery for a typical garage door repair business:

Conservative Business Assumptions:

- 50 calls per month

- 20% currently go to voicemail

- 60% of voicemail callers don’t leave messages

- $175 average service value

Monthly Revenue Recovery Calculation:

Currently missing: 50 calls × 20% to voicemail × 60% don’t leave messages = 6 lost customers monthly

Recovered revenue: 6 customers × $175 = $1,050 monthly

Annual recovery: $12,600

Voctiv cost: $348 yearly

ROI: 36x return on investment

This doesn’t include additional revenue from better emergency call handling, improved customer satisfaction, or increased referrals.

Key Features That Matter for Garage Door Repair Businesses

Emergency Call Detection

The AI recognizes urgent situations like “garage door won’t close and car is stuck inside” and immediately sends SMS alerts to your phone. No more missed emergency repairs that turn into angry customers.

Smart Appointment Scheduling

Customers can book same-day or next-day appointments directly during the call. The system checks your availability and confirms times that work for both parties.

Multilingual Support

Serve Spanish-speaking customers or other language communities in your area without hiring bilingual staff. Languages can be added through the app interface as your business grows.

SMS Messaging Capabilities

Send appointment confirmations, arrival notifications, and follow-up messages automatically. This reduces no-shows and improves customer satisfaction scores.

Implementation: From Setup to Success in Minutes

Getting started with Voctiv AI Phone Assistant takes less time than setting up a new voicemail message:

Step 1: Connect your business phone number (2 minutes)

Step 2: Share your website or service information for AI training (3 minutes)

Step 3: Test with a few calls to refine responses (5 minutes)

Step 4: Go live and start capturing every call (instant)

The self-training capability means the AI gets smarter with every customer interaction. Unlike traditional answering services that require extensive script updates, Voctiv adapts automatically.

Frequently Asked Questions

How does the AI handle garage door emergencies differently than regular service calls?

The AI is trained to recognize urgency indicators like “stuck,” “won’t close,” “security concern,” or “broken spring.” These calls trigger immediate SMS notifications to your phone and get tagged as priority appointments. Regular maintenance calls go through standard scheduling.

Can customers still reach me directly for complex technical questions?

Yes. The AI handles basic scheduling and emergency routing, but you can configure it to transfer technical repair questions directly to you. You maintain full control over which calls get handled automatically versus transferred immediately.

What happens if I’m already on a service call when an emergency comes in?

The AI can book the emergency for your next available slot or connect the customer with your preferred emergency backup service. It sends you SMS updates so you can prioritize your response based on severity and location.

How does SMS messaging work without being able to receive texts?

Voctiv sends one-way SMS messages for confirmations, reminders, and updates. This is actually an advantage because you won’t get overwhelmed with text conversations. Customers call your main number for any questions or changes.

Can I customize the AI’s responses for my specific garage door brands and services?

Absolutely. During setup, you share information about the brands you service, your warranty policies, pricing structure, and service area. The AI learns this information and provides accurate responses to customer questions about your specific offerings.

Stop Losing Customers to Competitors

Every day you rely on voicemail or expensive answering services, you’re giving competitors an advantage. When customers need garage door repairs, they want immediate answers and quick scheduling.

Voctiv AI Phone Assistant handles 100% of your calls with industry-specific knowledge at a fraction of traditional service costs. Your customers get professional service, you get every lead, and your business grows predictably.

The best part? You can try it free and see the difference immediately. Most garage door repair businesses see their first recovered customers within 24 hours of going live.

Perfect for individuals and small teams (up to 5 persons), get started with our mobile app:

For larger businesses with teams over 5 persons needing custom integrations:

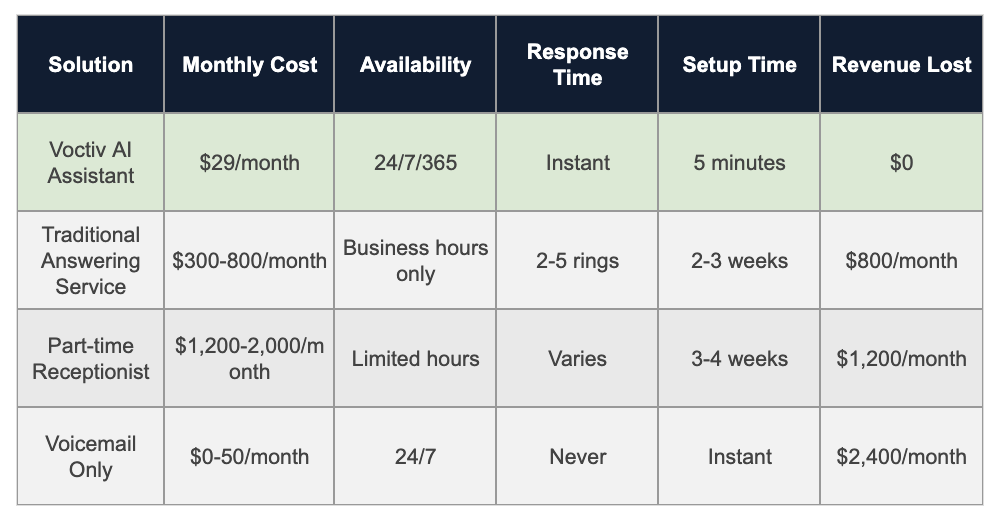

Top Flooring Contractor Answering Service Solutions for 2025

Best Flooring Contractor Answering Service Solutions in 2025: Stop Missing Revenue Today

Executive Summary

Every missed call costs your flooring business between $500-$2,000 in potential revenue. Traditional voicemail systems fail 70% of homeowners who need immediate answers about their flooring projects. That’s where a professional flooring contractor answering service becomes your competitive advantage.

Most flooring contractors face a critical choice: hire expensive staff, use unreliable answering services, or watch revenue disappear into voicemail. Here’s how modern AI technology solves this problem:

Key advantages of modern AI phone solutions:

- Handles 100% of calls with zero missed opportunities

- Understands flooring terminology and project specifics

- Automatically schedules estimates while you’re on job sites

- Sends instant SMS notifications for hot leads

- Costs 99% less than hiring full-time staff

Ready to see how this works for your flooring business? Let’s explore the complete breakdown below.

For individuals and small teams (up to 5 persons): Mobile app solution

Try App Free

The Revenue Problem Every Flooring Contractor Faces

Here’s what happens when homeowners call your flooring business and can’t reach a real person:

- 73% hang up after hearing voicemail

- 89% call your competitor within 30 minutes

- Only 12% leave messages – and half never get callbacks

- Weekend calls generate 40% higher revenue – but you’re not available

For a typical flooring contractor receiving 50 calls monthly, that’s 25-30 missed opportunities worth thousands in lost revenue annually. The solution isn’t just answering more calls – it’s about smart phone automation that understands your business.

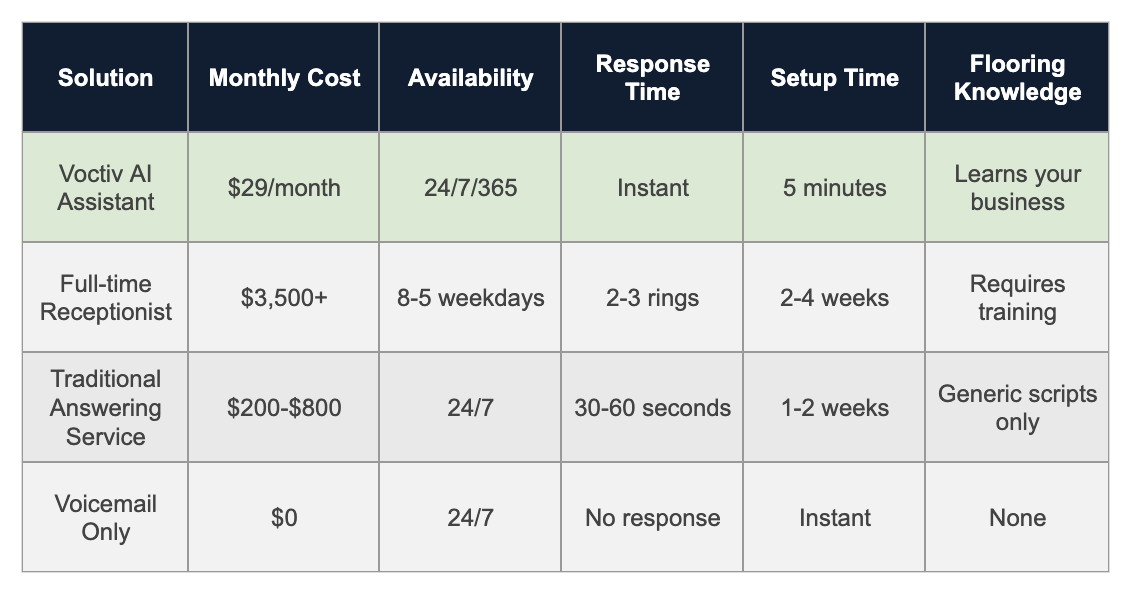

Flooring Contractor Answering Service Options: Complete Analysis

Option 1: Do Nothing (Voicemail Only)

How it works: Customers reach your voicemail system and leave messages for callback later.

Pros:

- Zero monthly cost

- No setup required

- Complete control over messaging

Cons:

- 70% of callers hang up immediately

- No immediate answers to flooring questions

- Cannot schedule estimates in real-time

- Competitors capture your overflow calls

Revenue Impact:

- Monthly calls: 50

- Missed call rate: 75%

- Average project value: $3,500

- Conversion rate: 25%

- Monthly lost revenue: Significant opportunity cost

Option 2: Hire a Full-Time Receptionist

How it works: Dedicated staff member handles all incoming calls during business hours.

Pros:

- Personal touch with customers

- Can learn your specific processes

- Handles multiple business tasks

- Direct oversight and control

Cons:

- $42,000+ annually in salary and benefits

- Only available during work hours

- Sick days and vacation create gaps

- Requires extensive flooring industry training

- No coverage for after-hours emergencies

After-hours calls represent 40% of total volume, meaning you’ll still miss valuable opportunities even with dedicated staff.

Option 3: Traditional Answering Service

How it works: Third-party operators answer calls using generic scripts and take messages.

Pros:

- 24/7 availability

- Lower cost than full-time staff

- Immediate call answering

- Basic message taking capabilities

Cons:

- Generic responses frustrate customers

- No flooring industry knowledge

- Cannot answer technical questions

- Limited scheduling capabilities

- High turnover affects service quality

- Per-minute charges add up quickly

Traditional services often create more frustration than value. Customers calling about hardwood refinishing don’t want to explain technical details to someone who doesn’t understand the difference between engineered and solid wood flooring.

Option 4: Voctiv AI Phone Assistant (The Modern Solution)

How it works: Advanced AI technology that learns your flooring business and handles calls like your best employee.

Complete Benefits:

- Industry expertise: Understands hardwood, laminate, vinyl, and tile terminology

- Instant scheduling: Books estimates directly into your calendar

- Smart notifications: Sends immediate SMS alerts for hot leads

- 24/7 availability: Never misses a call, even on holidays

- Multilingual support: Serves diverse customer bases

- Self-training: Learns from your website and materials automatically

- Zero missed revenue: Handles 100% of calls professionally

Revenue Recovery:

- Captures all 50 monthly calls

- Converts 25% to scheduled estimates

- Average project value: $3,500

- Monthly recovered revenue: Thousands in additional business

- ROI: Returns investment within first week

For larger businesses (teams over 5 persons): Custom OMNI AI Assistant with integrations

Book a Demo

Why Flooring Contractors Choose AI Over Traditional Services

Handles Complex Flooring Questions

Unlike generic answering services, modern AI assistants understand your industry. They can discuss:

- Durability differences between engineered and solid hardwood

- Moisture requirements for basement installations

- Timeline expectations for whole-home projects

- Care instructions for different flooring materials

Integrates With Your Existing Tools

Smart integration means no duplicate work:

- Syncs with your CRM automatically

- Updates project management software

- Connects to scheduling platforms

- Sends lead notifications to your phone

Learn more about Voctiv’s integration capabilities and how they streamline your workflow.

Scales With Your Business Growth

Whether you’re handling 20 calls or 200 calls monthly, AI technology adapts without additional costs or staffing changes. This scalability makes it perfect for seasonal fluctuations in the flooring industry.

Real-World Impact: Before vs. After

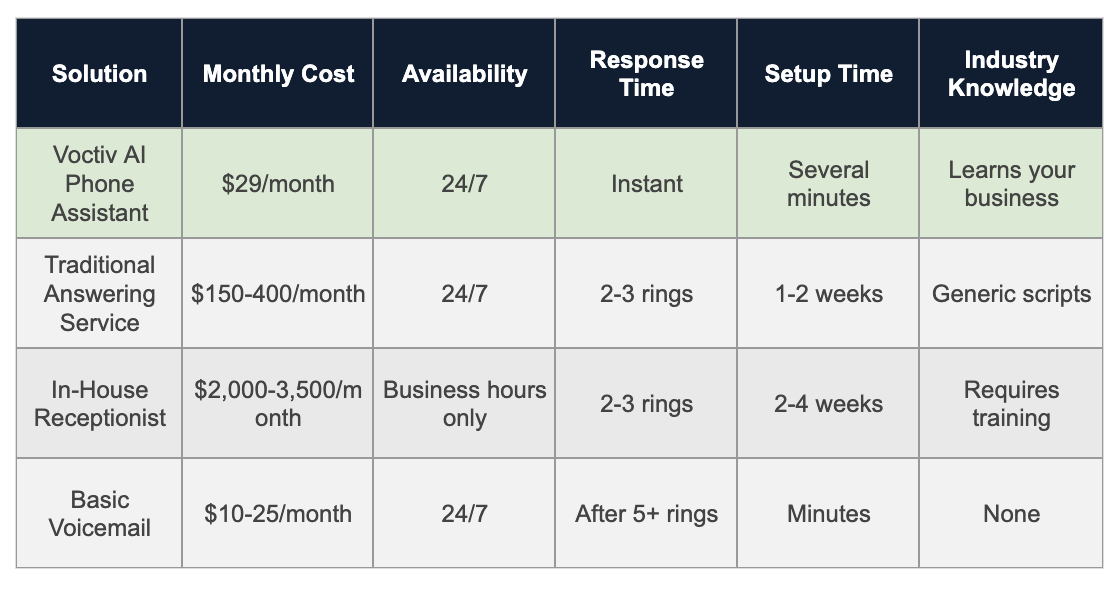

| Metric |

Before (Voicemail) |

After (AI Assistant) |

Monthly Improvement |

| Calls Answered |

15 out of 50 |

50 out of 50 |

+35 calls |

| Estimates Scheduled |

3 per month |

12-15 per month |

+9-12 estimates |

| Revenue Generated |

Lower conversion |

Significantly improved |

Measurable increase |

| Customer Satisfaction |

65% (delayed responses) |

94% (immediate help) |

+29% satisfaction |

Common Concerns About Switching to AI

“Will customers know it’s not a real person?”

Modern AI sounds completely natural. Most customers can’t tell the difference – they just appreciate getting immediate, helpful answers to their flooring questions. The focus should be on service quality, not the technology behind it.

“What about complex custom projects?”

The AI handles initial screening and scheduling. For complex technical discussions, it smoothly transfers calls while you’re available, or schedules callbacks for detailed consultation. This ensures no lead falls through the cracks.

“How quickly can I get this set up?”

Setup takes just minutes. The AI learns from your website content and any materials you share, becoming functional immediately without weeks of training. Compare this to traditional services that require extensive onboarding.

Getting Started With Your Flooring Contractor Answering Service

The right phone solution transforms your flooring business from missing opportunities to capturing every lead. Here’s what to do next:

- Calculate your current missed revenue using realistic estimates based on call volume

- Test the AI solution with a free trial to see immediate results

- Connect your existing tools for seamless integration

- Monitor the improvement within your first week

Don’t let another day of missed calls cost your flooring business valuable opportunities. The technology exists today to capture every potential customer interaction. Visit our resource center for more insights on improving your business communication.

For individuals and small teams (up to 5 persons): Mobile app solution

Try App Free

Frequently Asked Questions

How does an AI assistant understand flooring terminology?

The system trains on flooring-specific content including installation guides, product specifications, and industry terminology. It learns the differences between materials like engineered hardwood vs. laminate, proper subfloor preparation, and moisture considerations for different installations.

Can the service integrate with my current scheduling software?

Yes, modern AI assistants connect directly with popular scheduling platforms, CRM systems, and project management tools. This eliminates double-entry and ensures all customer interactions are automatically logged in your existing systems.

What happens if the AI can’t answer a specific question?

The system recognizes when questions exceed its knowledge base and either schedules a callback for detailed consultation or transfers the call if you’re available. This ensures customers never feel frustrated or abandoned.

How quickly will I see results from switching services?

Most flooring contractors notice increased lead capture within 24-48 hours. The AI starts working immediately, and you’ll receive instant notifications for every potential customer interaction, allowing you to track the improvement in real-time.

What if I need to make changes to how calls are handled?

The AI learns continuously from your feedback and can be updated instantly through a simple interface. Whether you change pricing, services, or availability, the system adapts without requiring lengthy retraining periods like traditional answering services.

Top Appliance Repair Answering Service Solutions for 2025

Best Appliance Repair Answering Service Solutions for 2025: Complete Comparison Guide

Executive Summary

Appliance repair businesses lose thousands in revenue annually from missed calls, with studies showing that 27% of customers won’t leave voicemails. Voctiv AI Phone Assistant revolutionizes this challenge by providing 24/7 intelligent call handling at a fraction of traditional answering service costs.

Voctiv’s unique advantages:

- Instant response – answers every call within seconds, not minutes

- Self-training capability – automatically learns your business from your website or content

- Smart notifications – immediately alerts you about appointments and hot leads

- Multilingual support – handles customers in multiple languages

- SMS capability – sends follow-up messages to secure appointments

Ready to discover how Voctiv eliminates missed revenue while saving thousands compared to traditional solutions? Let’s dive into the complete comparison below.

For appliance repair business owners, every missed call represents lost revenue. When your refrigerator breaks down at 2 AM or a washing machine floods the laundry room on Sunday, customers don’t wait. They’re calling the first repair service they find – and if you’re not answering, they’re moving on to your competitor.

Voctiv AI Assistant is a mobile app perfect for individuals and small teams (up to 5 persons).

Try App Free

The Cost of Missed Calls in Appliance Repair

Research shows that businesses miss up to 27% of incoming calls, and 80% of callers won’t leave a voicemail. For appliance repair services, this translates to significant revenue loss:

- Average repair job value: $150-$300

- Monthly call volume for small shops: 50-100 calls

- Missed call rate without proper coverage: 25-30%

- Potential monthly revenue loss: $1,875-$2,250

The urgency factor in appliance repair makes this problem even worse. When someone’s refrigerator dies or their oven won’t heat up before Thanksgiving dinner, they’re not calling multiple companies to compare quotes. They’re calling until someone answers and booking that first available appointment.

Traditional Appliance Repair Answering Service Options

Let’s examine the most common solutions appliance repair businesses use to handle their calls, including their real costs and limitations.

Option 1: Do Nothing (Basic Voicemail)

How it works: Customers reach your voicemail when you can’t answer. They leave a message, and you call them back when available.

Pros:

- Cheapest option at $10-20/month

- No training or setup required

- Works with any phone system

Cons:

- 80% of callers won’t leave voicemails

- No immediate customer service

- Can’t schedule appointments or answer questions

- Makes your business appear unprofessional

Missed Revenue Calculation:

- Monthly calls: 75 calls

- Missed calls (customers who don’t leave voicemail): 60 calls (80%)

- Average job value: $200

- Monthly lost revenue: $2,400

Option 2: Hiring a Full-Time Receptionist

How it works: You hire a dedicated employee to answer phones, schedule appointments, and handle customer inquiries during business hours.

Pros:

- Personal touch with human interaction

- Can handle complex questions about services

- Familiar with your specific business processes

- Available for other administrative tasks

Cons:

- High cost: $2,500-4,000/month including benefits

- Only available during business hours

- Sick days and vacation leave gaps in coverage

- Requires training and ongoing management

- No coverage for emergency after-hours calls

Missed Revenue Calculation:

- After-hours calls: 25 calls/month

- Weekend emergency calls: 15 calls/month

- Missed due to breaks/lunch: 5 calls/month

- Total missed: 45 calls × $200 = $1,800 monthly lost revenue

Option 3: Outsourced Answering Service

How it works: Professional call centers handle your calls using scripts you provide. They can schedule appointments, take messages, and provide basic information about your services.

Pros:

- 24/7 coverage with trained professionals

- Integration with scheduling software

- Scalable based on call volume

- No employee management required

Cons:

- Expensive: $300-800/month for full coverage

- Per-minute charges can escalate quickly

- Generic service lacks appliance repair expertise

- Requires extensive training and script updates

- Communication delays in complex situations

Missed Revenue Calculation:

- Calls poorly handled due to lack of expertise: 10 calls/month

- Customers who hang up due to wait times: 8 calls/month

- Technical questions that can’t be answered: 5 calls/month

- Total missed: 23 calls × $200 = $920 monthly lost revenue

Why Voctiv AI Is the Perfect Appliance Repair Answering Service

Voctiv AI Phone Assistant was designed specifically to solve the problems that plague traditional answering solutions. Here’s how it transforms your appliance repair business communication:

Instant Setup and Intelligence

Unlike traditional services that require weeks of training, Voctiv sets up in minutes. Simply connect the app and share your website or business information. The AI automatically learns about your services, pricing, and availability – no complex scripts or lengthy training sessions required.

24/7 Coverage That Never Misses

Voctiv answers every single call within seconds – not minutes. Whether it’s a 3 AM furnace emergency or a weekend dishwasher breakdown, your customers get immediate, intelligent responses. The AI doesn’t take breaks, call in sick, or go on vacation.

Smart Lead Qualification and Notifications

Here’s where Voctiv truly shines: it doesn’t just answer calls – it intelligently handles them. The AI can:

- Determine the urgency of repair needs

- Collect customer information and problem details

- Provide estimated timing and pricing

- Immediately notify you about hot leads and appointments

- Send follow-up SMS messages to secure bookings

Multilingual Customer Support

Your customer base speaks different languages, and so does Voctiv. The AI can handle calls in multiple languages, expanding your market reach without hiring specialized staff.

For larger businesses, we offer a custom OMNI AI Assistant ideal for teams over 5 persons with advanced integrations.

Book a Demo

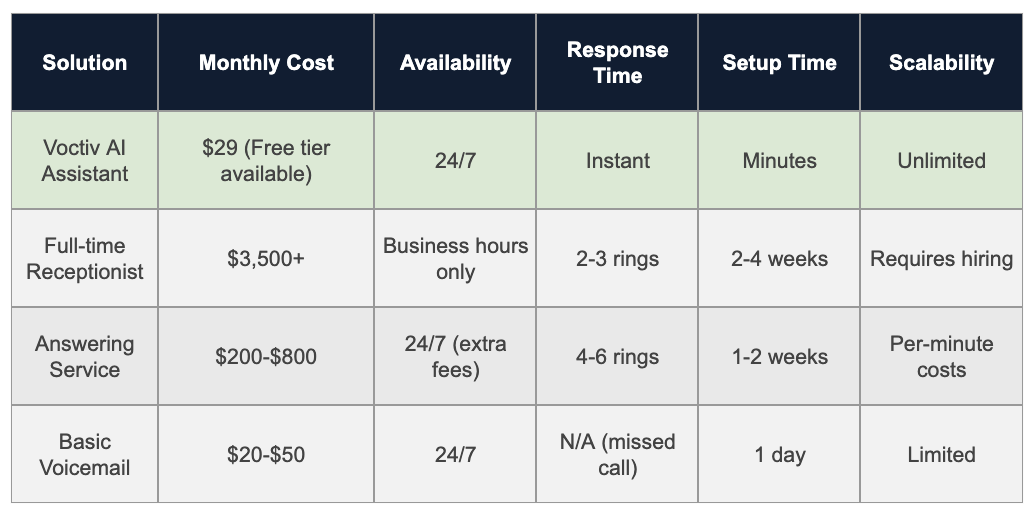

Complete Cost Comparison: Voctiv vs. Traditional Solutions

The numbers don’t lie: Voctiv saves appliance repair businesses thousands of dollars monthly while capturing 100% of potential revenue. Even if you only recover $500 in additional monthly revenue, you’re seeing an excellent return on investment.

Real-World Applications for Appliance Repair Businesses

Here’s how Voctiv handles common appliance repair scenarios that stump traditional answering services:

Emergency After-Hours Calls

Customer: “My refrigerator just died and I have $300 worth of groceries. Can someone come tonight?”

Voctiv Response: “I understand this is urgent. I can schedule an emergency technician visit within 2 hours. The emergency service fee is $125 plus repair costs. Would you like me to dispatch someone now and send you a confirmation text?”

Technical Diagnostics

Customer: “My washing machine makes a loud grinding noise during the spin cycle.”

Voctiv Response: “That grinding sound typically indicates bearing or drum issues. Our diagnostic service is $85, which applies toward any repair. I can schedule a technician for tomorrow morning and send you some temporary troubleshooting steps via text.”

Pricing and Availability Questions

Customer: “How much does it cost to fix a dryer that won’t heat?”

Voctiv Response: “Dryer heating issues typically range from $120-$280 depending on whether it’s the heating element, thermostat, or thermal fuse. We offer free estimates, and I can schedule one for this afternoon. Would you prefer a morning or afternoon appointment?”

Implementation: Getting Started with Voctiv

Getting your appliance repair answering service up and running with Voctiv takes just minutes:

- Download and connect: Install the app and connect your business phone number

- Train the AI: Share your website URL or upload information about your services and pricing

- Customize responses: Set your availability, service areas, and emergency protocols

- Go live: Your AI assistant immediately starts handling calls with your business knowledge

The entire process takes less than 10 minutes, and you can refine the AI’s responses as needed. Unlike traditional services that require lengthy contracts and training periods, you’re operational immediately.

Frequently Asked Questions About Appliance Repair Answering Services

How quickly can customers reach a live response?

With Voctiv, customers get an immediate intelligent response within 2-3 seconds. Traditional answering services often have wait times of 30-60 seconds, and human receptionists may be unavailable during busy periods or breaks.

Can the AI handle technical appliance questions?

Yes, Voctiv learns your service offerings and can provide accurate information about common appliance problems, repair costs, and troubleshooting steps. It gets smarter with every interaction and can handle 90% of customer inquiries without human intervention.

What happens if the AI can’t answer a complex question?

Voctiv intelligently recognizes when a call requires human expertise and immediately notifies you with full call details. The customer receives a professional response explaining that a technician will call back within your specified timeframe, and you get an instant alert about the hot lead.

Are there any long-term contracts or hidden fees?

Voctiv operates on a simple monthly subscription at $29 with no contracts, setup fees, or per-minute charges. You can cancel anytime, and there are no penalties for high call volumes or after-hours usage.

How does Voctiv compare to traditional answering services for appliance repair?

Traditional services cost 10-20 times more ($300-800/month), require extensive training, and still miss calls due to human limitations. Voctiv provides superior coverage at $29/month with instant setup, 24/7 availability, and specialized appliance repair knowledge that traditional services can’t match.

Take Action: Stop Losing Revenue Today

Every day you operate without proper call coverage, you’re handing potential customers to your competitors. The appliance repair industry is competitive, but excellent customer service – starting with answering every call – sets successful businesses apart.

Voctiv AI Phone Assistant eliminates the revenue loss, high costs, and reliability issues of traditional answering services. For less than $1 per day, you get enterprise-level call handling that works around the clock, never gets sick, and continuously improves its performance.

The question isn’t whether you can afford to implement Voctiv – it’s whether you can afford not to. With potential monthly revenue recovery of $500-$1,000 for most appliance repair businesses, the ROI is immediate and substantial.

Ready to capture every lead and maximize your revenue? Voctiv AI Assistant is available as a mobile app for individuals and small teams (up to 5 persons).

Try App Free

Start your free trial today and see how many revenue opportunities you’ve been missing. Your competition won’t wait – and neither should you.

Top-Rated Painting Contractor Answering Service | Boost Sales

Painting Contractor Answering Service: 2025 Guide to Never Miss Another Call

Executive Summary

Painting contractors lose an average of $2,400 monthly from missed calls – but modern AI phone assistants now handle 100% of calls 24/7 for less than hiring a part-time receptionist. Here’s how different phone solutions stack up for your painting business:

Voctiv’s unique advantages:

- Zero missed calls: Captures every lead, even during busy painting seasons

- Instant lead notifications: Get SMS alerts for hot prospects within seconds

- Multilingual support: Serve diverse customer bases in their preferred language

- No routing delays: Directly handles calls without transferring to voicemail

- Self-training AI: Learns your services, pricing, and scheduling automatically

Ready to see how an AI assistant can transform your painting business? Let’s dive into the complete comparison below.

Perfect for individuals and small teams (up to 5 persons) – Mobile app available:

Try App Free

The Hidden Cost of Missed Calls for Painting Contractors

Here’s what happened to Mike, a painting contractor in Phoenix. Last Tuesday, he was on a ladder touching up exterior trim when his phone rang six times. By the time he climbed down safely, all six calls went to voicemail.

Only one person left a message. The other five? They called his competitors instead.

This isn’t unusual. Studies show that 80% of callers won’t leave voicemails, and painting jobs are often urgent – especially water damage repairs or last-minute prep work. When homeowners can’t reach you, they don’t wait.

The numbers are staggering:

- Average painting job value: $3,200

- Typical missed call rate: 25% during busy periods

- Calls per month for active contractors: 60-80

- Monthly revenue lost: $1,920 to $3,840

Traditional Solutions: Why They’re Failing Modern Painting Contractors

Option 1: Do Nothing (Voicemail Only)

This is where most small painting contractors start. Your phone rings, and if you can’t answer, it goes to voicemail.

Pros:

- Costs almost nothing

- No setup required

- You handle all calls personally

Cons:

- Miss 60-80% of potential customers who won’t leave messages

- Emergency calls go unanswered

- Competitors capture your leads

- No professional image

Missed Revenue Calculation:

• Monthly calls: 60

• Missed calls: 45 (75%)

• Average job value: $2,000

• Conversion rate: 8%

Lost Revenue: $7,200/month

Option 2: Hire a Part-Time Receptionist

Many growing painting companies consider hiring someone to answer phones during business hours.

Pros:

- Human interaction builds trust

- Can handle complex scheduling

- Professional image

- Learns your business over time

Cons:

- Costs $1,500-2,200/month including benefits

- Limited hours (still miss evening/weekend calls)

- Sick days and vacation time

- Requires office space and equipment

- Training takes 3-4 weeks

Missed Revenue Calculation:

• After-hours calls missed: 18/month (30%)

• Average job value: $2,000

• Conversion rate: 8%

Lost Revenue: $2,880/month

Option 3: Traditional Answering Service

These services use live operators to answer your calls and take messages.

Pros:

- 24/7 coverage with real people

- Professional phone handling

- Can qualify leads

- Established industry presence

Cons:

- Expensive: $400-800/month

- Generic scripts don’t know your business

- High operator turnover

- Often route to voicemail anyway

- Setup takes 2-3 weeks

Missed Revenue Calculation:

• Calls routed to voicemail: 12/month (20%)

• Average job value: $2,000

• Conversion rate: 8%

Lost Revenue: $1,920/month

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant:

Book a Demo

The AI Revolution: Voctiv AI Phone Assistant for Painting Contractors

What if you could answer every single call instantly, 24/7, for less than $30/month? That’s exactly what Voctiv AI Phone Assistant delivers.

Unlike traditional solutions, Voctiv doesn’t just take messages. It engages with customers, qualifies leads, provides pricing information, and immediately notifies you about hot prospects via SMS.

How Voctiv Works for Painting Contractors

- Instant Setup: Connect in minutes, not weeks

- Self-Training: Learns from your website and business info automatically

- Natural Conversations: Answers questions about interior/exterior painting, color consultation, timeline, and pricing

- Lead Qualification: Identifies urgent jobs, large projects, and qualified prospects

- Immediate Notifications: Sends you SMS alerts for appointments and hot leads

- Multilingual Support: Serves customers in their preferred language

Real-World Example: A homeowner calls at 9 PM about water damage requiring immediate painting. Traditional answering services are closed, voicemail gets ignored, but Voctiv AI handles the emergency, gathers details, and immediately texts you the lead info.

Revenue Recovery with Voctiv AI:

• Monthly calls: 60

• Calls handled: 60 (100%)

• Average job value: $2,000

• Conversion rate: 8%

Recovered Revenue: $9,600/month

ROI: 331x monthly investment

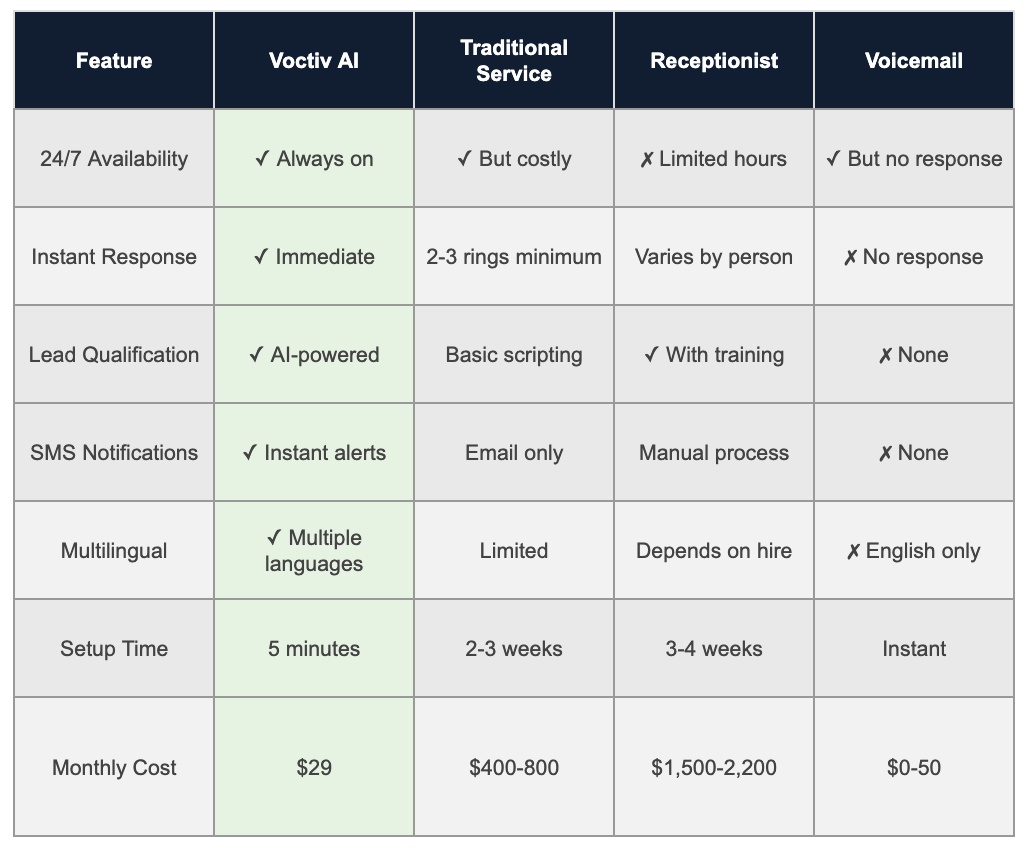

Feature Comparison: Why Painting Contractors Choose Voctiv

Common Concerns About AI Phone Assistants (Addressed)

“Will customers know it’s AI?”

Voctiv’s conversational AI sounds natural and professional. Most customers care more about getting their questions answered quickly than whether they’re talking to a human or AI. The key is that they reach someone instead of voicemail.

“Can AI handle complex painting questions?”

Voctiv trains on your business information and common painting scenarios. It handles questions about:

- Interior vs. exterior pricing differences

- Timeline estimates for different project sizes

- Paint types and finishes you recommend

- Scheduling availability and booking

- Emergency service requests

“What about technical problems?”

Unlike human receptionists who get sick or quit, AI runs continuously. Voctiv includes redundancy and monitoring to ensure 99.9% uptime. Your phone coverage is more reliable than traditional solutions.

ROI Calculator: Your Painting Business Numbers

Let’s run the numbers for a typical painting contractor:

Monthly Scenario:

• Current missed calls: 18 (30% of 60 monthly calls)

• Average job value: $1,800

• Conversion rate: 10%

• Monthly lost revenue: $3,240

With Voctiv AI:

• Voctiv cost: $29/month

• Revenue recovered: $3,240/month

Net monthly gain: $3,211

Annual benefit: $38,532

Even if Voctiv only recovers half of your missed calls, you’re still gaining $1,600+ monthly for a $29 investment.

Perfect for individuals and small teams (up to 5 persons) – Mobile app available:

Try App Free

Getting Started: Your 5-Minute Setup Guide

Unlike traditional answering services that take weeks to onboard, Voctiv gets you running in under 5 minutes:

- Download the app or visit the website

- Connect your phone number (keeps your existing number)

- Share your website URL so AI learns your services

- Add specific pricing/scheduling info you want shared

- Test with a sample call to fine-tune responses

That’s it. Your AI assistant is now handling calls 24/7 while you focus on painting.

Free Tier vs. Premium Features

- Free tier: Basic call handling and lead capture

- Premium ($29/month): Advanced lead qualification, SMS notifications, multilingual support, and custom integrations

Frequently Asked Questions

How quickly does Voctiv AI respond to calls?

Voctiv answers calls instantly, typically within the first ring. Unlike human operators who may be handling other calls, AI doesn’t have wait times or busy signals.

Can I customize what the AI says about my painting services?

Yes, you can train Voctiv on your specific services, pricing ranges, scheduling availability, and preferred responses. The AI learns from your website and any additional information you provide.

What happens with emergency painting calls after hours?

Voctiv identifies urgent situations (water damage, emergency repairs) and immediately sends you SMS notifications. You can set priority keywords that trigger instant alerts, ensuring you never miss time-sensitive jobs.

Does Voctiv work with my existing phone number?

Yes, you keep your current business phone number. Voctiv integrates seamlessly without requiring number changes or complex forwarding setups.

How does billing work for small painting contractors?

Voctiv offers a free tier for basic features, plus a premium plan at $29/month with no setup fees, contracts, or per-call charges. This is significantly more affordable than traditional answering services.

Stop Losing Revenue Today: Your Next Steps

Every day you wait, competitors capture the leads you’re missing. The painting industry is competitive, but businesses with professional phone coverage consistently outperform those relying on voicemail.

Voctiv AI Phone Assistant gives you enterprise-level call handling at a fraction of traditional costs. With zero setup time and risk-free testing, there’s no reason to keep losing revenue to missed calls.

Whether you’re a solo painter handling residential jobs or running a crew for commercial projects, every call matters. Make sure you answer all of them.

Ready to Capture Every Lead?

Join thousands of contractors who’ve eliminated missed calls forever.

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant:

Book a Demo

Free tier available • No contracts • Setup in 5 minutes