Best Notary Answering Service Solutions for 2025: Never Miss Another Client Call

Executive Summary

Running a successful notary business means being available when clients need you most. Traditional phone handling methods cause notary businesses to lose 20-30% of potential revenue through missed calls. Voctiv AI Phone Assistant revolutionizes client communication by ensuring 100% call handling at a fraction of traditional costs.

Voctiv’s unique advantages:

- Instant setup – Train on your business in minutes

- 24/7 availability – Never miss emergency notarizations

- Multilingual support – Serve diverse client base

- Smart appointment booking – Automatic scheduling and SMS notifications

- 100% call handling – Zero missed revenue potential

Discover how Voctiv AI can transform your notary business and recover thousands in lost revenue below.

Mobile app for individuals and small teams (up to 5 persons)

Why Notary Businesses Struggle with Phone Management

The notary industry faces unique challenges that make traditional phone handling methods inadequate. Unlike other businesses, notaries often work irregular hours, handle emergency requests, and serve clients who need immediate assistance.

Here’s what happens when you can’t answer every call:

- Lost emergency appointments – Real estate closings and legal documents can’t wait

- Missed repeat business – Clients expect reliability and quick response

- Reduced referrals – Poor accessibility hurts word-of-mouth marketing

- Competitive disadvantage – Clients choose more accessible notaries

Small notary businesses typically receive 30-80 calls per month, with each potential appointment worth $75-$200. Missing just 20% of these calls means losing $450-$3,200 monthly.

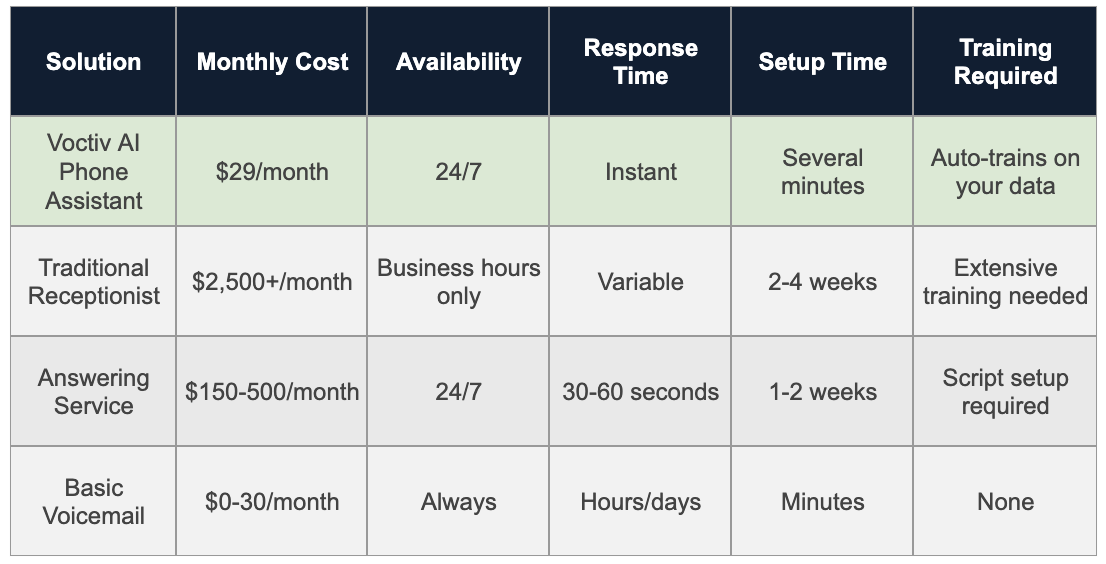

Traditional Solutions and Their Hidden Costs

Option 1: Do Nothing (Voicemail Only)

Many notaries rely solely on voicemail, hoping clients will leave messages and wait for callbacks.

How it works: Clients reach voicemail, leave messages, and you call back when available.

Pros:

- Minimal cost ($10-$30 monthly)

- Easy to set up

- No training required

Cons:

- High abandonment rate – 75% of callers won’t leave messages

- Delayed response times frustrate clients

- No appointment scheduling capability

- Professional image suffers

- Can’t handle multiple languages

Missed Revenue Calculation:

With 50 monthly calls at $125 average value:

- Missed calls: 30% (15 calls)

- Lost revenue: 15 × $125 = $1,875 monthly

- Annual loss: $22,500

Option 2: Hire a Receptionist

Some successful notaries hire full-time or part-time receptionists to handle calls and schedule appointments.

How it works: Employee answers calls, schedules appointments, and manages your calendar during business hours.

Pros:

- Human interaction builds trust

- Can handle complex scheduling

- Grows with your business

- Handles multiple tasks beyond phones

Cons:

- Expensive ($2,500-$4,000 monthly with benefits)

- Limited to business hours only

- Requires training and management

- Sick days and vacation coverage needed

- Potential for human error

- Payroll taxes and HR responsibilities

Missed Revenue Calculation:

With 70 monthly calls at $150 average value:

- After-hours missed calls: 15% (10 calls)

- Lost revenue: 10 × $150 = $1,500 monthly

- Net cost including salary: $4,000+ monthly

Option 3: Outsourced Answering Service

Generic answering services provide 24/7 call handling but lack industry-specific knowledge.

How it works: Third-party service answers calls, takes messages, and forwards urgent requests according to your instructions.

Pros:

- 24/7 availability

- Professional answering

- No hiring or training hassles

- Scalable service levels

Cons:

- Expensive ($150-$400 monthly plus per-call fees)

- Generic scripts don’t understand notary needs

- Long setup and training process

- Limited integration with your systems

- Per-call charges add up quickly

- No automatic appointment booking

Missed Revenue Calculation:

With 60 monthly calls at $135 average value:

- Mishandled calls due to lack of expertise: 10% (6 calls)

- Lost revenue: 6 × $135 = $810 monthly

- Total cost with service fees: $350+ monthly

The Perfect Solution: Voctiv AI Notary Phone Assistant

Voctiv AI Assistant revolutionizes phone management for notary businesses by combining 24/7 availability, industry expertise, and intelligent automation at a fraction of traditional costs.

How it works: The AI assistant automatically trains on your business information, handles all incoming calls with natural conversation, schedules appointments, and sends SMS notifications for urgent matters.

Key Benefits for Notary Businesses:

- Instant setup – Connect and train in minutes using your website or business documents

- 24/7 availability – Never miss emergency notarizations or after-hours requests

- Multilingual support – Serve diverse communities with automatic language detection

- Smart appointment booking – Integrates with your calendar and sends confirmation texts

- Professional image – Consistent, knowledgeable responses every time

- Scalable pricing – Free tier available, premium at just $29/month

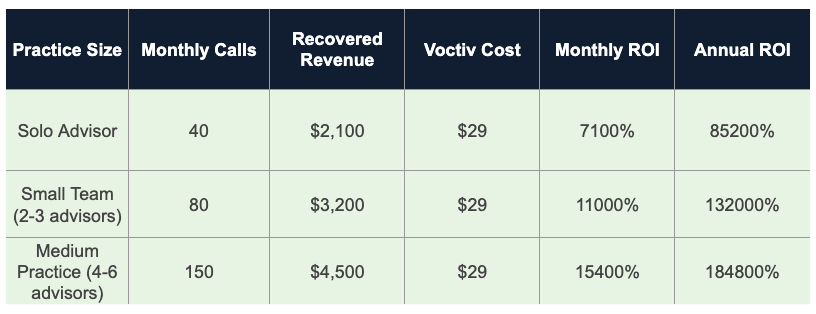

ROI Analysis: Voctiv vs. Lost Revenue

Here’s how Voctiv AI pays for itself by eliminating missed calls:

| Business Size | Monthly Calls | Avg Call Value | Recovered Revenue | Monthly ROI |

|---|---|---|---|---|

| Small Notary | 40 | $100 | $2,000 | 69x |

| Medium Notary | 70 | $150 | $4,200 | 145x |

| Large Notary | 100 | $175 | $5,250 | 181x |

*Calculations based on 20% missed call rate without Voctiv, reduced to 0% with 24/7 AI coverage

Custom OMNI AI Assistant ideal for businesses with teams over 5 persons and custom integrations

Real-World Applications for Notary Businesses

Voctiv AI handles the most common notary business scenarios with ease:

Emergency Real Estate Closings

When title companies need last-minute notarizations, Voctiv AI immediately captures the request, checks your availability, and books the appointment while sending you an instant SMS alert.

Multilingual Client Support

With automatic language detection, your AI assistant can communicate with Spanish, Chinese, or other language-speaking clients, expanding your market reach significantly.

After-Hours Appointment Scheduling

Clients calling at 8 PM for next-day services get immediate assistance instead of waiting for callbacks, improving customer satisfaction and reducing appointment cancellations.

Addressing Common Concerns

Will clients know it’s AI?

Voctiv AI uses natural conversation patterns that feel human. Most clients appreciate the immediate response and professional service, regardless of whether they realize it’s AI-powered.

What about complex scheduling requests?

The AI handles standard appointments automatically and flags complex requests for your review. You receive SMS notifications for any situation requiring personal attention.

How secure is client information?

All calls and data are handled with enterprise-grade security. The AI doesn’t store sensitive personal information beyond what’s necessary for appointment scheduling.

Getting Started with Voctiv AI

Setting up your notary answering service takes just minutes:

- Sign up – Create your account and choose your plan

- Train the AI – Upload your website URL or business documents

- Configure settings – Set your availability, pricing, and service areas

- Test the system – Make a few test calls to ensure everything works perfectly

- Go live – Start capturing every call and growing your business

The entire process takes less than 30 minutes, and you’ll immediately start capturing calls that would otherwise go to voicemail.

Frequently Asked Questions

Can Voctiv AI handle mobile notary scheduling?

Yes, Voctiv AI can schedule mobile appointments by checking your availability, confirming the client’s location, and booking the service. It automatically sends SMS confirmations with your contact information and appointment details.

What happens if a client needs immediate emergency notarization?

The AI immediately recognizes urgent requests and sends you an instant SMS alert while keeping the client on the line. You can choose to take the call directly or have the AI schedule the earliest available appointment.

Does the AI understand different types of notarization services?

Absolutely. During setup, you train the AI on your specific services, whether that’s real estate closings, loan signings, general notarizations, or specialized documents. It learns your pricing and scheduling requirements for each service type.

How does billing work for the AI answering service?

Voctiv offers a free tier for basic usage and a premium plan at $29/month for unlimited calls and advanced features. There are no per-call charges or hidden fees, making it predictable and affordable for any notary business.

Can I customize the AI’s responses for my notary business?

Yes, the AI learns from your business website, service descriptions, and any additional training materials you provide. You can customize greetings, service explanations, and even add your unique selling points to every conversation.

Transform Your Notary Business Today

Every day you wait to implement a professional answering service, you’re losing potential revenue to missed calls. Voctiv AI eliminates this problem completely while costing less than a single lost appointment.

With 24/7 availability, multilingual support, and intelligent appointment booking, you’ll capture every opportunity and grow your notary business faster than ever before.

Don’t let another client slip away because you couldn’t answer the phone. Join successful notaries who’ve already discovered the competitive advantage of AI-powered phone management.

Mobile app for individuals and small teams (up to 5 persons)

The Ultimate Loan Officer Answering Service Guide for 2025

Loan Officer AI Phone Assistant: 2025 Complete Guide to Never Missing Another Client Call

Executive Summary

Loan officers lose thousands in potential revenue monthly due to missed calls and delayed responses. Traditional phone management solutions fail to provide the speed and 24/7 availability that mortgage clients demand in today’s competitive market.

Key Advantages:

- Zero missed calls – Captures every potential client 24/7

- Instant loan pre-qualification – Handles initial client screening

- SMS follow-up capabilities – Sends appointment confirmations and reminders

- Multilingual support – Serves diverse client populations

- Immediate hot lead notifications – Alerts you to high-value prospects

Discover how Voctiv’s AI technology eliminates missed revenue while reducing your workload by 70%.

Perfect for individual loan officers and small teams (up to 5 people)

The Hidden Cost of Missed Calls in Mortgage Lending

You know that feeling when you’re deep in paperwork and your phone rings? Most loan officers can’t answer every call immediately. But here’s the shocking truth: every missed call costs you an average of $2,500 in potential commission.

Mortgage clients don’t wait around. They call the next lender on their list. With interest rates fluctuating daily, borrowers want answers now – not when you’re free to call back.

Research shows that 80% of mortgage shoppers contact multiple lenders within 24 hours. The first loan officer who responds professionally gets the deal. It’s that simple.

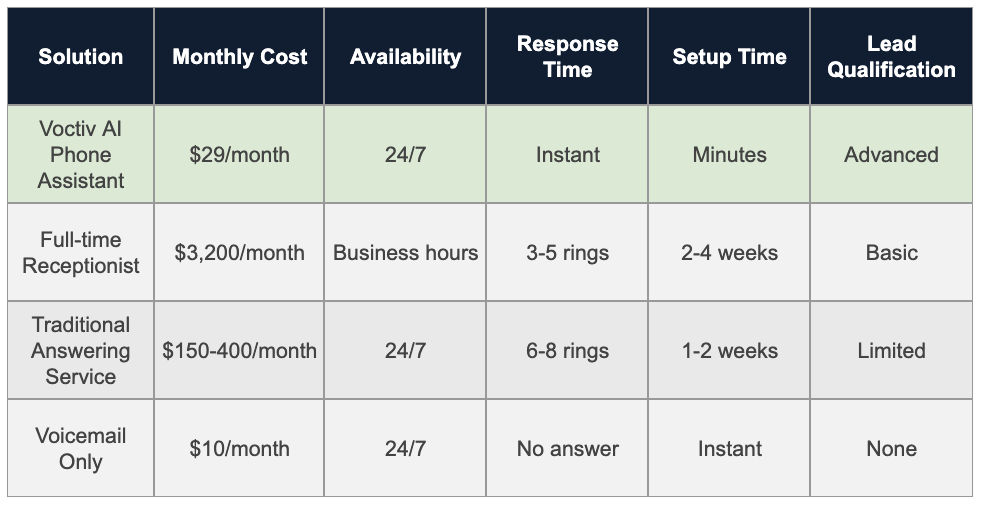

Why Traditional Solutions Fail Loan Officers

The “Do Nothing” Approach: Voicemail Only

Many loan officers rely on voicemail because it’s cheap and easy. But this approach is killing your business potential.

Pros:

- No additional cost

- Simple to set up

- Better than no message system

Cons:

- Clients rarely leave detailed messages

- No way to capture lead information

- Looks unprofessional in competitive markets

- Can’t handle urgent time-sensitive inquiries

Missed Revenue Calculation:

If you receive 40 calls monthly and miss 50% due to being unavailable, that’s 20 missed opportunities. With a 15% conversion rate and average loan value of $350,000 (earning $3,500 commission), you’re losing $5,250 monthly in potential revenue.

Hiring a Full-Time Receptionist

A dedicated receptionist sounds professional, but the costs add up quickly for solo practitioners and small teams.

Pros:

- Professional phone presence

- Can handle appointment scheduling

- Provides human interaction

- Can learn your specific processes

Cons:

- Expensive ($2,500-4,000 monthly salary plus benefits)

- Limited to business hours only

- Requires extensive mortgage industry training

- May not handle loan-specific questions properly

- Sick days and vacation time create coverage gaps

Missed Revenue Calculation:

Even with a receptionist, you’ll miss 30% of calls during off-hours and weekends. That’s 12 missed calls monthly, potentially costing you $3,150 in lost commissions.

Traditional Answering Services

Generic answering services seem like a middle-ground solution, but they’re not designed for the mortgage industry’s unique needs.

Pros:

- 24/7 availability

- Professional phone answering

- Message taking and forwarding

- More affordable than full-time staff

Cons:

- Operators don’t understand mortgage terminology

- Can’t pre-qualify borrowers

- No loan-specific question handling

- Generic scripts sound impersonal

- Monthly fees of $150-500 plus per-call charges

Missed Revenue Calculation:

Generic operators miss 20% of leads due to poor qualification and unprofessional handling. That’s 8 missed conversions monthly, costing approximately $2,100 in lost business.

The Perfect Solution: Voctiv AI Loan Officer Assistant

Voctiv AI changes everything. It’s not just another answering service – it’s a specialized AI assistant that understands the mortgage industry inside and out.

How Voctiv Works for Loan Officers

Setup takes just minutes. You connect your phone number and share your website or basic business information. The AI automatically learns about your services, rates, and processes.

When clients call, they hear your personalized greeting and can immediately ask questions about:

- Current interest rates

- Loan programs available

- Pre-qualification requirements

- Documentation needed

- Timeline expectations

The AI doesn’t just take messages – it engages callers in meaningful conversations, captures complete contact information, and identifies hot leads immediately.

Key Features That Set Voctiv Apart

Instant Hot Lead Notifications: Get text alerts within seconds when high-value prospects call. No more waiting hours to discover someone’s ready to move forward.

Multilingual Capabilities: Serve Spanish-speaking clients, Asian communities, and other demographics that competitors can’t handle effectively.

SMS Follow-up: Send appointment confirmations, rate updates, and document reminders automatically. Keep clients engaged throughout the loan process.

Self-Training Technology: The AI gets smarter with every call, learning your preferred responses and adapting to your business style.

Complete ROI Analysis for Loan Officers

| Metric | Without Voctiv | With Voctiv AI | Monthly Impact |

|---|---|---|---|

| Monthly Calls Received | 40 | 40 | Same volume |

| Calls Successfully Handled | 20 (50%) | 40 (100%) | +20 opportunities |

| Conversion Rate | 15% | 18% | +3% due to better service |

| Closed Loans | 3 | 7.2 | +4.2 additional loans |

| Commission per Loan | $3,500 | $3,500 | Same rate |

| Monthly Revenue Recovery | $10,500 | $25,200 | +$14,700 |

| ROI on $29 Investment | N/A | 507x | 50,700% return |

Conservative estimate: Voctiv pays for itself within the first hour of use. The technology captures leads you’d otherwise lose forever.

Perfect for larger mortgage teams and brokerages with custom integration needs

Real-World Applications for Mortgage Professionals

Scenario 1: Weekend Rate Shopping

It’s Saturday morning. Interest rates just dropped, and your phone’s ringing with rate shoppers. With Voctiv, these callers get immediate rate quotes and can schedule Monday consultations – all while you’re enjoying family time.

Scenario 2: After-Hours Client Concerns

A client calls at 9 PM worried about their loan approval. Voctiv provides reassurance, captures their specific concerns, and sends you a detailed summary. By morning, you’re ready with solutions instead of playing phone tag.

Scenario 3: Referral Partner Coverage

Your real estate agent refers an urgent buyer. Even if you’re in a closing, Voctiv captures the lead, begins pre-qualification, and ensures the referral feels valued immediately.

Implementation: Getting Started in Minutes

Voctiv’s setup process is designed for busy loan officers who need results immediately:

- Sign up – Create your account in under 2 minutes

- Connect your phone – Forward calls or use their number

- Share your website – AI learns your services automatically

- Customize responses – Add specific rates, programs, and policies

- Go live – Start capturing leads immediately

No technical expertise required. No lengthy training sessions. Just intelligent call handling from day one.

Addressing Common Concerns

“Will clients know it’s AI?”

Voctiv’s conversational AI sounds natural and professional. Clients appreciate getting immediate answers rather than waiting for callbacks. The focus is on helping, not hiding the technology.

“Can it handle complex mortgage questions?”

Yes. The AI understands loan programs, qualification requirements, and documentation needs. For complex scenarios, it captures detailed information and ensures you have everything needed for follow-up.

“What about compliance concerns?”

Voctiv focuses on information gathering and initial qualification. It doesn’t provide official loan commitments or financial advice – that’s your expertise. It simply ensures no potential client slips through the cracks.

Frequently Asked Questions

How quickly can I see results with Voctiv?

Most loan officers see immediate improvements in lead capture. Within the first week, you’ll notice fewer missed opportunities and better lead qualification. Full ROI typically shows within 30 days.

Can Voctiv integrate with my existing CRM?

Yes. Voctiv captures lead information that easily transfers to most CRM systems. For larger teams, custom integrations are available to streamline your workflow completely.

What happens if someone needs immediate assistance?

Voctiv identifies urgent situations and sends immediate notifications. Hot leads trigger instant alerts, so you can respond to time-sensitive opportunities within minutes.

How does pricing work for multiple loan officers?

Individual loan officers use the mobile app for $29/month. Larger teams and brokerages get custom pricing with additional features like lead distribution and advanced analytics.

Can I customize responses for different loan programs?

Absolutely. Voctiv learns your specific loan programs, rates, and qualification criteria. You can customize responses for FHA, VA, conventional, jumbo, and specialty programs.

Stop Losing Loans to Competitors

Every day you wait is money left on the table. While you’re missing calls, your competitors are capturing leads and closing loans.

Voctiv AI Phone Assistant gives you the competitive advantage you need. It’s not just about answering calls – it’s about winning more business by being available when clients need you most.

The mortgage industry rewards speed and professionalism. Voctiv delivers both, 24/7, for less than you’d spend on coffee each month.

Ready to capture every lead and maximize your loan volume?

Perfect for individual loan officers and small teams (up to 5 people)

2025’s Best Mortgage Broker Answering Service: Top Solutions

Mortgage Broker Answering Service: How to Never Miss Another Lead in 2025

Executive Summary

You’re losing qualified mortgage leads every day because you can’t answer every call. A mortgage broker answering service can capture 100% of your leads, qualify prospects instantly, and grow your business without adding overhead costs.

Traditional phone handling methods fail mortgage brokers when they’re most needed – during peak lending season or when you’re with clients. Here’s how your options stack up:

Voctiv’s unique advantages:

- Self-training AI – learns your business automatically from your website content

- Instant lead notifications – get SMS alerts for hot prospects immediately

- Multilingual support – handle calls in multiple languages without hiring extra staff

- Zero missed revenue – capture 100% of leads even during busy periods

- Compliance-ready – built for regulated industries like real estate and mortgage lending

Ready to stop missing leads? Discover how Voctiv transforms your phone handling strategy below.

For individuals and small teams (up to 5 persons), Voctiv offers a mobile app solution that’s perfect for growing mortgage brokers.

Why Most Mortgage Brokers Struggle with Phone Management

You’re juggling client meetings, loan processing, and regulatory compliance. When prospects call, you’re often unavailable – and that’s costing you serious money.

The mortgage industry operates on tight margins and fierce competition. Missing even one qualified lead can mean losing a $3,000-$5,000 commission. Here’s what most brokers don’t realize:

- Peak call times happen when you’re busiest – during lunch, evenings, and weekends

- Mortgage prospects shop around – they’ll call your competitor if you don’t answer

- First impression matters – voicemail doesn’t convey professionalism or urgency

- Lead qualification is critical – you need to know if it’s a tire-kicker or serious buyer

Let’s break down your current options and see what’s actually costing you revenue.

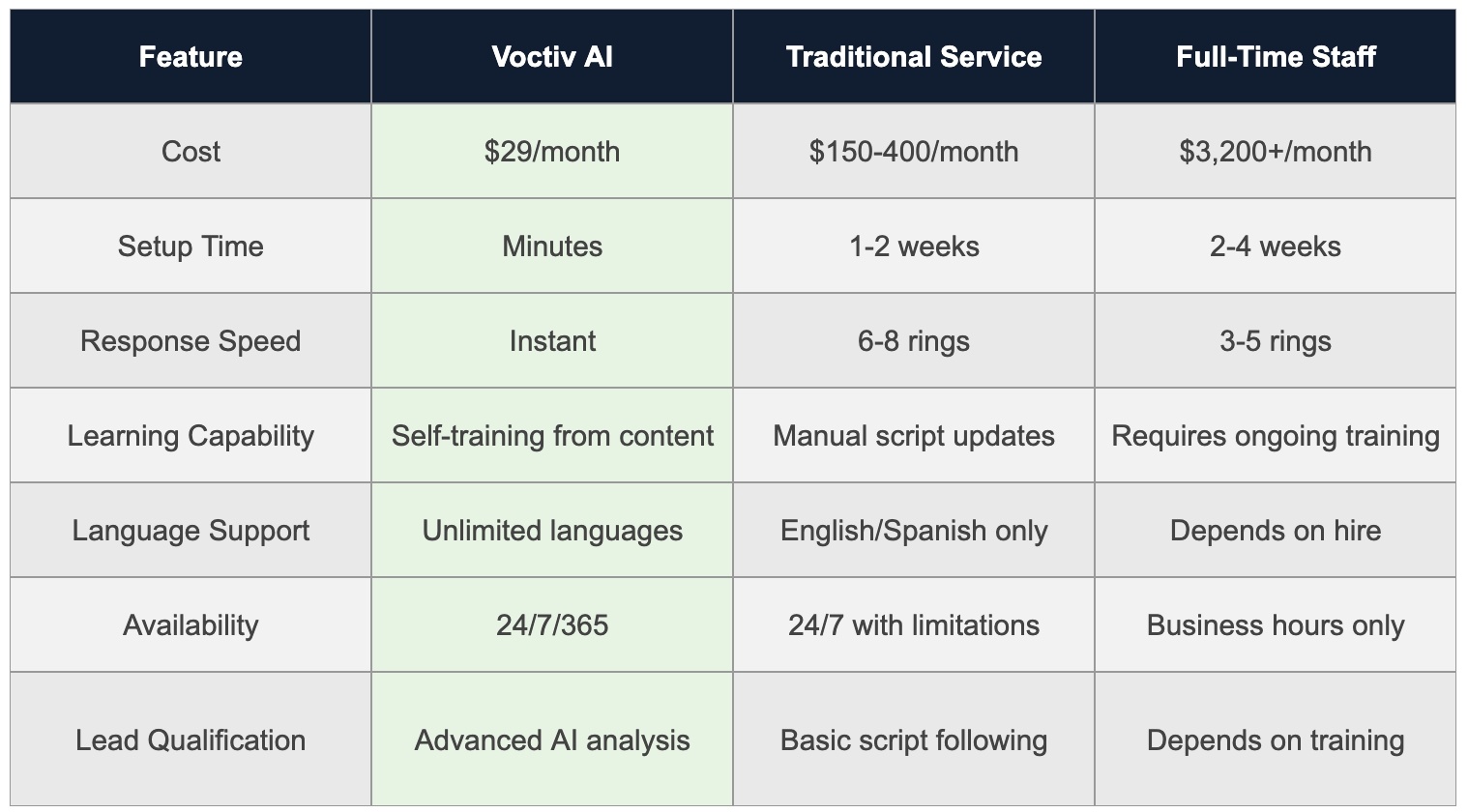

The “Do Nothing” Approach: Just Using Voicemail

Many mortgage brokers rely on voicemail as their primary call handling solution. It’s cheap, it’s easy, and it doesn’t require any setup.

How Voicemail-Only Works

Your phone rings, goes to voicemail after 4-6 rings, and hopefully the caller leaves a message. You check messages periodically and return calls when you can.

Pros of Voicemail-Only

- Extremely low cost ($10/month)

- No setup or training required

- Complete control over callback timing

- Messages saved permanently for reference

Cons of Voicemail-Only

- High abandonment rate – 80% of callers hang up without leaving messages

- No lead qualification or urgency assessment

- Unprofessional image compared to competitors

- Delayed response times frustrate time-sensitive prospects

- No way to handle simple questions immediately

Missed Revenue Calculation

Here’s what voicemail-only is actually costing you:

- Missed calls: 80% of prospects don’t leave voicemail messages

- Average calls per month: 50 mortgage inquiries

- Lost prospects: 40 potential clients (80% of 50)

- Conversion rate: 15% of qualified leads become clients

- Average commission: $3,500 per closed loan

Monthly lost revenue: 40 × 15% × $3,500 = $21,000

Annual impact: $252,000 in missed commissions

Hiring a Full-Time Receptionist

Some successful mortgage brokers hire dedicated receptionists to handle incoming calls professionally. This approach works but comes with significant overhead.

How Full-Time Receptionists Work

You hire an employee who answers calls, takes messages, schedules appointments, and performs basic lead qualification. They’re trained on your services and can handle routine inquiries.

Pros of Full-Time Receptionists

- Dedicated support for your business specifically

- Can handle complex questions with proper training

- Professional image and consistent service

- Can perform additional administrative tasks

- Direct supervision and quality control

Cons of Full-Time Receptionists

- High cost including salary, benefits, and payroll taxes

- Limited to business hours unless you hire multiple shifts

- Sick days, vacation time, and potential turnover

- Requires office space and equipment

- Long hiring and training process

- Risk of confidentiality breaches

Missed Revenue Calculation

Even with a receptionist, you’re still missing after-hours opportunities:

- After-hours calls: 30% of mortgage inquiries happen evenings/weekends

- Total monthly calls: 50 inquiries

- After-hours missed: 15 prospects (30% of 50)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly lost revenue: 15 × 15% × $3,500 = $7,875

Total monthly cost: $3,200 salary + $7,875 lost revenue = $11,075

Traditional Mortgage Broker Answering Service

Professional answering services designed for mortgage brokers offer 24/7 coverage with trained operators. They’re a step up from voicemail but still have limitations.

How Traditional Services Work

Your calls forward to a call center where trained operators answer using your business name. They take messages, schedule appointments, and provide basic information using scripts you provide.

Pros of Traditional Answering Services

- 24/7 availability including holidays

- Professional call handling and custom greetings

- Bilingual support (English/Spanish)

- Detailed call documentation and reporting

- No hiring or training hassles

- Industry-specific compliance knowledge

Cons of Traditional Answering Services

- Higher cost than basic solutions ($150-400/month)

- Limited to scripted responses – can’t handle complex questions

- Slower response times (6-8 rings typical)

- Setup time for script customization (1-2 weeks)

- Less personal than in-house staff

- Potential for miscommunication or missed details

Missed Revenue Calculation

Even professional services miss some opportunities:

- Script limitations: 15% of prospects need complex answers

- Total monthly calls: 50 inquiries

- Inadequately handled: 8 prospects (15% of 50)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly lost revenue: 8 × 15% × $3,500 = $4,200

Total monthly cost: $275 service fee + $4,200 lost revenue = $4,475

For larger businesses with teams over 5 persons, Voctiv offers a custom OMNI AI Assistant with advanced integrations.

Voctiv AI Phone Assistant: The Perfect Solution for Mortgage Brokers

Voctiv AI Phone Assistant eliminates all the problems you’ve been dealing with. It’s designed specifically for busy professionals who can’t afford to miss a single lead.

How Voctiv Works

Your AI assistant answers every call instantly, qualifies prospects using your business knowledge, and immediately notifies you about hot leads via SMS. It learns from your website content and handles calls just like an experienced team member.

Key Benefits for Mortgage Brokers

- Instant setup: Connect and train your AI in minutes, not weeks

- Zero missed calls: 100% call capture rate, 24/7/365

- Smart lead qualification: Identifies serious prospects automatically

- Immediate notifications: SMS alerts for appointments and hot leads

- Multilingual support: Handle calls in any language your clients speak

- Self-training capability: Learns your business from your existing content

- Compliance-ready: Built for regulated industries like mortgage lending

Revenue Recovery Calculation

Here’s how Voctiv transforms your business:

- Calls captured: 100% of incoming prospects

- Total monthly calls: 50 inquiries

- Previously missed: 40 prospects (from voicemail approach)

- Conversion rate: 15% become clients

- Average commission: $3,500 per loan

Monthly recovered revenue: 40 × 15% × $3,500 = $21,000

Voctiv cost: $29/month

ROI: 724x return on investment

Why Voctiv Beats Traditional Solutions

Traditional answering services were designed for a different era. Voctiv’s AI technology solves problems that human operators simply can’t handle efficiently.

The difference is clear: Voctiv delivers superior results at a fraction of the cost while eliminating the management headaches of traditional solutions.

Real-World Applications for Mortgage Brokers

Here’s how Voctiv handles common mortgage broker scenarios:

Scenario 1: Rate Shopping Inquiries

Prospect calls asking about current rates. Voctiv explains your competitive advantages, gathers contact info, and immediately sends you an SMS: “Hot lead – John Smith wants rate quote for $350K purchase, pre-approved elsewhere, ready to move fast.”

Scenario 2: After-Hours Refinance Questions

Client calls at 8 PM worried about rising rates. Voctiv reassures them using your standard talking points about rate locks, schedules a callback for tomorrow morning, and sends you the details so you’re prepared.

Scenario 3: Spanish-Speaking Prospects

Voctiv seamlessly switches to Spanish, explains your services, and qualifies the lead – all while you’re in another meeting. You get a translated summary with their information.

Scenario 4: Complex Loan Scenarios

Self-employed borrower has questions about documentation. Voctiv recognizes this as a priority lead, gathers key details about their business and income, and marks them for immediate follow-up.

Getting Started with Voctiv

Setting up your AI assistant takes just minutes:

- Download the app and create your account

- Connect your phone number for call forwarding

- Let Voctiv learn from your website content automatically

- Customize responses for your specific services

- Test with a few calls to fine-tune responses

That’s it. Your AI assistant is ready to capture every lead while you focus on closing loans.

Frequently Asked Questions

Can Voctiv handle sensitive financial information securely?

Yes. Voctiv is designed for regulated industries and handles sensitive information appropriately. However, like any phone system, clients should avoid sharing account numbers or SSNs over the phone.

How does Voctiv learn about my specific loan programs?

Voctiv automatically analyzes your website content to understand your services. You can also provide additional information through the app interface to customize responses for your specific loan programs and lenders.

What happens if Voctiv can’t answer a complex question?

Voctiv intelligently recognizes when questions require your expertise. It gathers the prospect’s information, explains that you’ll provide detailed answers, and immediately notifies you via SMS for quick follow-up.

Can I customize Voctiv’s responses for different loan types?

How quickly will I see results from using Voctiv?

Most mortgage brokers see immediate improvement in lead capture rates. You’ll start getting SMS notifications for qualified prospects within hours of setup, and the AI continues learning and improving with each call.

Stop Missing Mortgage Leads Today

Every missed call is a missed commission. While your competitors rely on outdated answering services or expensive staff, you can capture 100% of your leads with Voctiv’s AI assistant.

The mortgage industry moves fast. Prospects won’t wait for callbacks – they’ll call the next broker on their list. With Voctiv, you’ll never miss another opportunity to grow your business.

Choose your solution based on your team size:

For individuals and small teams (up to 5 persons): Start with the mobile app that’s perfect for growing mortgage brokers.

For larger businesses: Get the custom OMNI AI Assistant that’s ideal for businesses with teams over 5 persons and custom integrations.

How a Financial Advisor Answering Service Boosts Your Practice

Financial Advisor Answering Service: 2025 Complete Guide to Never Missing Another Client Call

Executive Summary

Financial advisors lose an average of $50,000 annually from missed client calls, making reliable phone coverage essential for business growth. Voctiv AI Phone Assistant revolutionizes client communication by ensuring 100% call handling without the costs or limitations of traditional solutions.

Voctiv’s unique advantages:

- Multilingual support – serve diverse client bases effortlessly

- Self-training capability – learns your business automatically from your website

- Instant SMS notifications – get alerted immediately about appointments and hot leads

- Zero missed calls – 100% availability without human limitations

- Professional financial knowledge – understands industry terminology and client needs

Discover how Voctiv AI transforms your client communication while dramatically reducing costs below.

For individuals and small teams (up to 5 persons), our mobile app provides the perfect solution to get started immediately.

The Hidden Cost of Missed Calls in Financial Advisory

You’ve built your reputation on trust and availability, but every missed call represents lost opportunity. Financial advisors typically handle 40-80 client calls monthly, with each conversation potentially worth $150-300 in immediate business value.

Here’s what happens when you can’t answer:

- Prospective clients call competitors who answer immediately

- Existing clients feel neglected and consider switching advisors

- Urgent financial decisions get delayed, costing clients money

- Your professional image suffers in a relationship-driven industry

The solution isn’t working longer hours – it’s ensuring every call gets answered professionally, even when you’re unavailable.

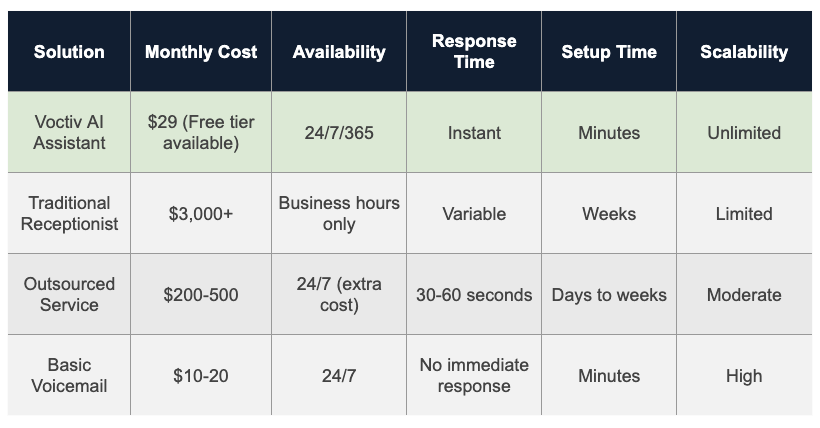

Traditional Financial Advisor Answering Service Options (And Their Limitations)

Option 1: Do Nothing (Voicemail Only)

How it works: Rely on voicemail when unavailable, hoping clients leave messages and wait for callbacks.

Pros:

- Minimal cost ($10-20/month)

- Easy setup

- No training required

Cons:

- 70% of callers hang up without leaving voicemail

- No immediate response capability

- Poor professional image

- Can’t handle urgent client needs

- No appointment scheduling assistance

Missed Revenue Calculation:

- Missed calls: 25% of total calls (industry average)

- Monthly call volume: 50 calls

- Missed calls per month: 12-13 calls

- Average value per call: $175

- Monthly lost revenue: $2,100-2,275

Option 2: Hire a Full-Time Receptionist

How it works: Employ a dedicated person to handle all incoming calls during business hours.

Pros:

- Personal touch with familiar voice

- Can handle complex scheduling

- Learns your specific procedures

- Can perform additional office tasks

Cons:

- High cost ($35,000-50,000 annually plus benefits)

- Limited to business hours only

- Sick days and vacation coverage needed

- Requires office space and equipment

- May lack financial industry knowledge

- Can’t scale during busy periods

Missed Revenue Calculation:

- After-hours missed calls: 15% of total calls

- Monthly call volume: 60 calls

- Missed calls per month: 9 calls

- Average value per call: $175

- Monthly lost revenue: $1,575

Option 3: Outsourced Answering Service

How it works: Third-party service answers calls using scripts you provide, then forwards messages or transfers important calls.

Pros:

- 24/7 availability possible

- Professional phone handling

- Multiple agents for busy periods

- Some industry specialization available

Cons:

- High monthly costs ($250-600+ per month)

- Per-minute charges add up quickly

- Generic scripts sound impersonal

- Long training periods (2-4 weeks)

- High agent turnover affects consistency

- Extra fees for after-hours service

- Limited understanding of complex financial topics

Missed Revenue Calculation:

- Script limitations cause: 10% of calls poorly handled

- Monthly call volume: 60 calls

- Poorly handled calls per month: 6 calls

- Average value per call: $175

- Monthly lost revenue: $1,050

Voctiv AI: The Perfect Financial Advisor Answering Service Solution

Voctiv AI Phone Assistant eliminates every limitation of traditional solutions while delivering superior results at a fraction of the cost. Here’s how it transforms your practice:

Intelligent Call Handling That Understands Finance

Unlike generic answering services, Voctiv AI trains itself on your specific services and industry knowledge. It understands financial terminology, can discuss your investment approaches, and handles client questions with the expertise they expect from your practice.

24/7 Availability Without Extra Costs

Your AI assistant never sleeps, takes breaks, or goes on vacation. Whether it’s a weekend emergency or an after-hours inquiry from an overseas client, every call gets answered professionally.

Instant Notifications for Hot Leads

When high-value prospects call, you’ll know immediately via SMS. This lets you follow up while their interest is peak, dramatically improving conversion rates.

Multi-Language Client Support

Expand your client base by serving non-English speaking prospects and clients. Voctiv AI handles multiple languages seamlessly, opening new market opportunities.

Setup in Minutes, Not Weeks

Connect Voctiv to your phone system and share your website or service information. The AI trains itself automatically – no lengthy onboarding processes or script writing required.

For businesses with teams over 5 persons requiring custom integrations, our enterprise solution provides comprehensive OMNI AI Assistant capabilities.

Real-World Financial Impact: ROI Analysis

Let’s calculate the actual return on investment for a typical financial advisory practice:

Conservative assumptions used:

- Only 15% of calls would have been missed without AI assistance

- Average value per call: $175 (accounting for mix of prospects and existing clients)

- Conversion rate factors in typical lead quality and market conditions

- Revenue calculations exclude referrals generated by improved client satisfaction

Even with these conservative estimates, Voctiv AI pays for itself within the first recovered call each month.

Implementation: Getting Started with Voctiv AI

Setting up your AI assistant takes just minutes:

- Connect your phone system – works with existing VoIP or traditional phone services

- Share your business information – upload your website URL or key service documents

- Customize notification preferences – choose how you want to receive alerts about important calls

- Test and refine – make practice calls to ensure optimal performance

The AI begins learning immediately and improves with every interaction. No technical expertise required.

Addressing Common Concerns

Will clients know they’re talking to AI?

Voctiv AI is designed to sound natural and professional. Most callers appreciate the immediate response and knowledgeable assistance, regardless of whether it’s AI or human.

What about complex financial questions?

The AI handles routine inquiries and appointment scheduling while seamlessly identifying when calls need your personal attention. You get notified immediately for complex situations.

Can it integrate with my existing calendar and CRM?

Yes, Voctiv AI works with popular financial advisor tools and can be customized for your specific workflow needs.

Frequently Asked Questions

How quickly can I start using Voctiv AI for my financial advisory practice?

You can have Voctiv AI answering your calls within minutes of signing up. The system trains itself automatically using your website content or any documents you share about your services.

What’s the difference between the free tier and premium version?

The free tier provides basic call handling capabilities, while the $29/month premium version includes advanced features like multilingual support, custom integrations, and priority SMS notifications for hot leads.

Does Voctiv AI understand financial industry terminology?

Yes, Voctiv AI is specifically trained to understand financial services terminology and can discuss investment approaches, retirement planning, and other advisory topics at an appropriate level for client interactions.

Can the AI handle appointment scheduling?

Absolutely. Voctiv AI can schedule appointments, send confirmation details via SMS, and integrate with your existing calendar system to prevent double-bookings.

What happens if a client has an urgent financial emergency?

The AI is programmed to recognize urgent situations and immediately notify you via SMS while keeping the client on the line. You can then take over the call directly or provide specific guidance through the AI.

Transform Your Financial Advisory Practice Today

The financial advisory industry is built on relationships and trust. Every missed call damages both. Voctiv AI ensures you never lose another opportunity while reducing costs and improving client satisfaction.

Your competitors are still using outdated phone systems or expensive human services. This gives you a significant advantage in client acquisition and retention.

Don’t let another valuable client call go to voicemail. Start capturing every opportunity with Voctiv AI’s intelligent financial advisor answering service.

For individuals and small teams (up to 5 persons), get started with our mobile app solution today.