Top-Rated Bookkeeping Answering Service Solutions for 2025

Best Bookkeeping Answering Service Solutions in 2025: Complete Guide for Financial Firms

Bookkeeping firms lose thousands in potential revenue when clients can’t reach them during critical tax seasons or business hours. With 73% of callers hanging up after just one ring goes unanswered, your answering strategy directly impacts your bottom line. AI-powered answering services handle calls 24/7, book appointments automatically, and never miss a potential client again.

Key advantages of modern AI answering solutions:

- Never miss another client call – 100% availability means zero lost opportunities

- Instant appointment booking – Clients schedule consultations without waiting

- Multilingual support – Serve diverse client bases in their preferred language

- SMS notifications – Get instant alerts about hot leads and urgent matters

- No training required – AI learns your business automatically from your website

Ready to discover which solution fits your bookkeeping firm’s needs and budget? Let’s explore each option’s real costs, benefits, and revenue impact.

For individuals and small bookkeeping practices (up to 5 team members), Voctiv offers a mobile app solution that’s perfect for managing client calls on the go.

The High Cost of Missed Calls in Bookkeeping

Your bookkeeping firm’s phone strategy isn’t just about customer service – it’s about revenue protection. Every missed call during tax season could be a $500-$2,000 client walking away to your competitor.

Here’s what happens when clients can’t reach you:

- Potential clients call 3-4 other bookkeepers before making a decision

- Existing clients feel neglected and consider switching services

- Time-sensitive tax questions turn into penalties for clients (and lost trust for you)

- Emergency bookkeeping needs go to firms with better availability

The solution? A reliable bookkeeping answering service that understands your industry’s unique needs and timing.

Option 1: Do Nothing (Basic Voicemail Only)

Many small bookkeeping practices rely solely on voicemail, thinking it’s the most cost-effective approach. Here’s the reality.

How Basic Voicemail Works

Callers hear your standard greeting and leave a message. You check messages periodically and return calls when possible. Simple, right?

Pros of Voicemail-Only Approach

- Extremely low cost ($10-$30/month)

- No setup or training required

- Complete control over response timing

Cons of Voicemail-Only Approach

- 67% of callers won’t leave a voicemail message

- No immediate assistance for urgent questions

- Missed opportunities during your busiest periods

- Poor client experience during tax season rushes

- No appointment scheduling capability

Missed Revenue Calculation

A typical bookkeeping practice receives 40-60 calls per month. Here’s your potential revenue loss:

- Monthly calls: 50 calls

- Percentage who won’t leave voicemail: 67% (33 lost contacts)

- Potential new clients among lost contacts: 20% (7 prospects)

- Average annual client value: $1,200

- Monthly lost revenue: $700 (7 clients × $100 monthly value)

- Annual impact: $8,400 in missed opportunities

Option 2: Hiring a Full-Time Receptionist

Some growing bookkeeping firms consider hiring dedicated front desk staff to handle all incoming calls professionally.

How a Human Receptionist Works

A trained employee answers calls during business hours, takes messages, schedules appointments, and provides basic information about your services.

Pros of Human Receptionist

- Personal touch and human connection

- Can handle complex questions with training

- Builds relationships with regular clients

- Flexible problem-solving abilities

Cons of Human Receptionist

- High cost: $35,000-$45,000 annually plus benefits

- Limited to business hours only

- Sick days and vacation coverage needed

- Requires extensive training on bookkeeping terminology

- Risk of turnover during busy tax seasons

- No availability during evenings or weekends

Missed Revenue Calculation

Even with a receptionist, after-hours calls still go unanswered:

- After-hours calls: 15 per month (30% of total)

- Conversion rate for these missed calls: 15%

- Lost prospects: 2-3 per month

- Average client value: $1,200 annually

- Monthly cost: $2,800 salary + $300 in lost after-hours revenue

- Total monthly impact: $3,100

Option 3: Traditional Answering Service

Outsourced answering services provide human operators who answer calls using your business name and follow basic scripts.

How Traditional Answering Services Work

Trained operators answer calls with your greeting, take detailed messages, and forward urgent calls based on your criteria. Most offer basic appointment scheduling.

Pros of Traditional Answering Services

- Professional call handling during business hours

- Lower cost than full-time staff

- No employee management required

- Basic message-taking and forwarding

Cons of Traditional Answering Services

- Limited bookkeeping knowledge

- Script-based responses feel impersonal

- Additional charges for after-hours service

- No integration with your scheduling system

- Quality varies between operators

- Still results in delays for client responses

Missed Revenue Calculation

Traditional services still miss opportunities due to limited availability and capabilities:

- Calls requiring immediate answers: 20% (10 calls/month)

- After-hours calls without premium service: 25% (12 calls/month)

- Combined missed opportunities: 22 calls/month

- Conversion rate for immediate-need calls: 25%

- Lost prospects: 5-6 per month

- Monthly service cost: $250 + $600 in lost revenue

- Total monthly impact: $850

Option 4: Voctiv AI Call Assistant – The Complete Solution

Modern AI technology eliminates the limitations of traditional phone solutions. Voctiv AI Call Assistant provides 24/7 coverage with bookkeeping industry knowledge at a fraction of traditional costs.

How Voctiv AI Works for Bookkeeping Firms

The AI assistant answers every call with your business name, understands bookkeeping terminology, schedules appointments directly into your calendar, and sends SMS alerts for urgent matters. It learns your business from your website and any materials you provide.

Key Benefits for Bookkeeping Practices

- 24/7 availability – Never miss calls during tax season rushes or after business hours

- Instant setup – Connect and train in minutes, not weeks

- Bookkeeping-smart responses – Understands tax deadlines, QuickBooks questions, and service pricing

- Automatic appointment booking – Clients schedule consultations without waiting for callbacks

- SMS notifications – Get instant alerts about hot leads and urgent client needs

- Multilingual support – Serve diverse client communities in their preferred language

- Self-learning system – Continuously improves based on your business content

For larger bookkeeping firms (over 5 team members), Voctiv offers custom OMNI AI Assistant solutions with advanced integrations perfect for complex workflows.

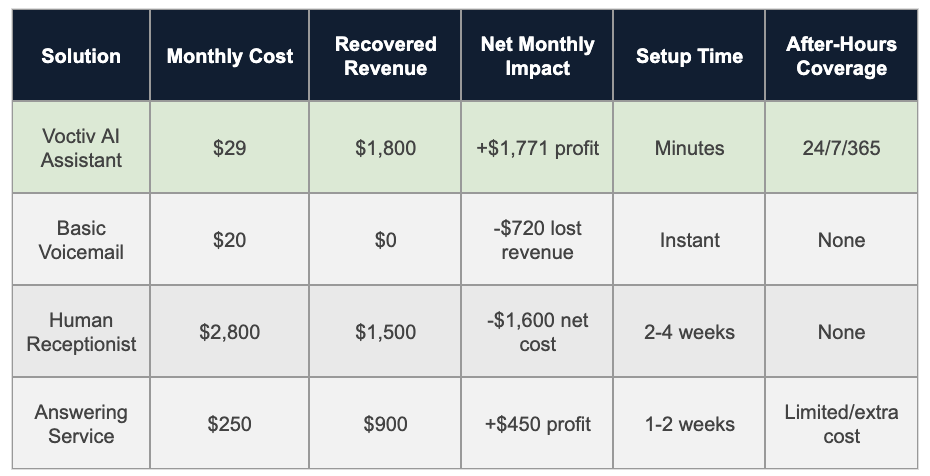

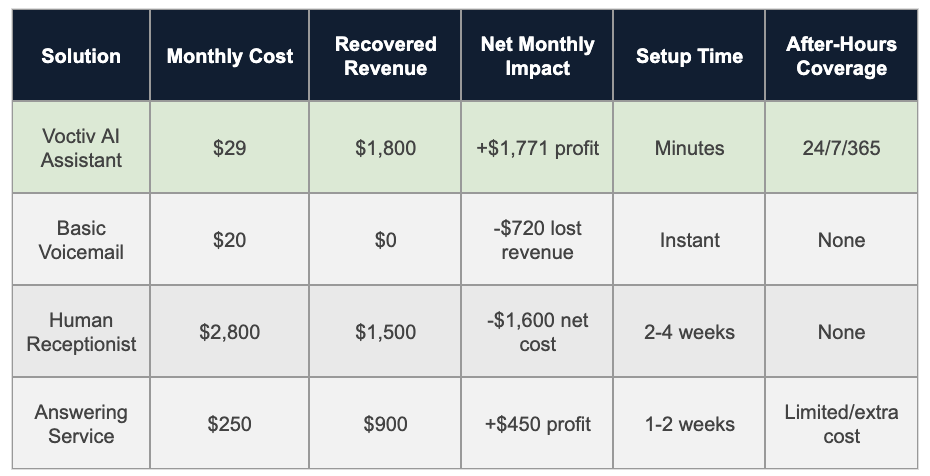

Revenue Recovery with Voctiv AI

Unlike other solutions, Voctiv captures 100% of incoming calls with intelligent responses:

- Monthly calls handled: 50 calls (100% coverage)

- New client inquiries: 15 calls/month

- Conversion rate with immediate response: 30%

- New clients acquired: 4-5 per month

- Average annual client value: $1,200

- Monthly recovered revenue: $1,800

- Monthly cost: $29

- ROI: 62x return on investment

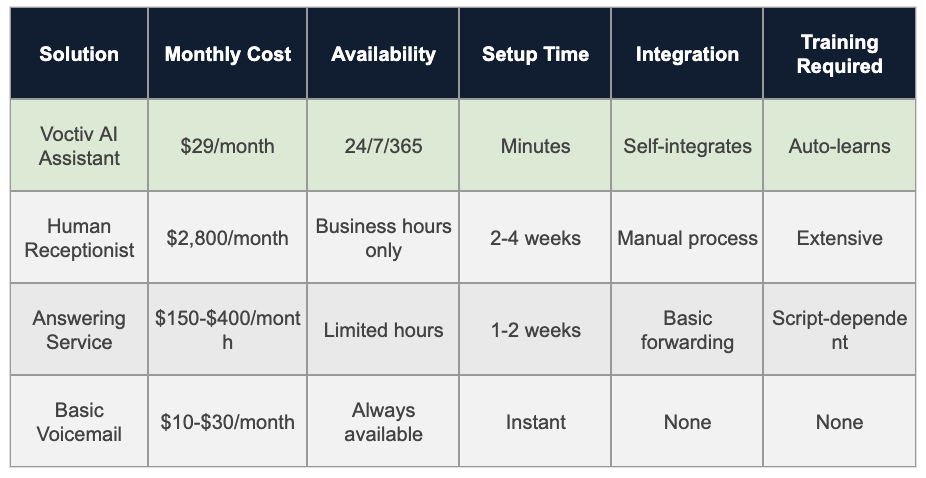

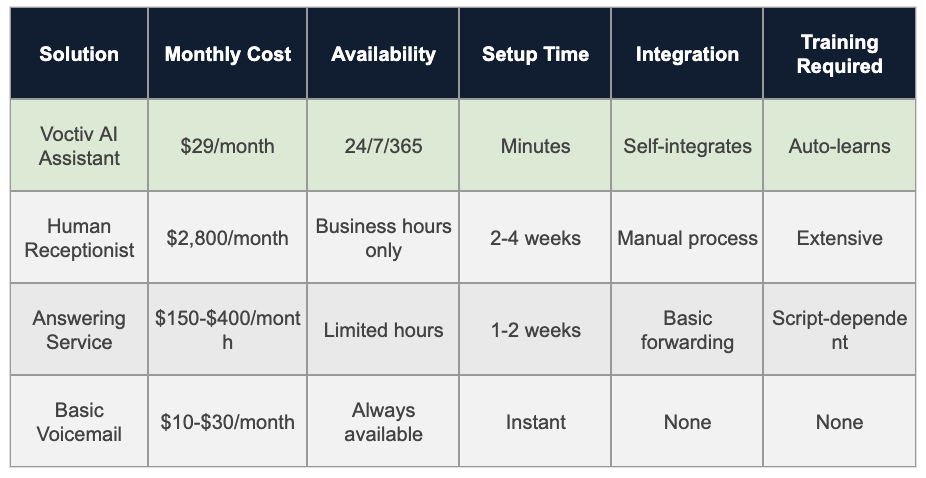

Complete Solution Comparison

Implementation Guide for Bookkeeping Firms

Setting up your bookkeeping answering service doesn’t have to be complicated. Here’s what you need to know.

Quick Setup Process

- Connect your phone number – Forward calls or get a new dedicated line

- Upload business information – Your website, service menu, and pricing details

- Set appointment preferences – Available times, meeting types, and booking rules

- Configure notifications – Choose how you want to receive lead alerts

- Test the system – Make practice calls to ensure everything works perfectly

Best Practices for Success

- Keep your service information updated seasonally (tax season vs. regular bookkeeping)

- Set realistic appointment availability to avoid overbooking

- Monitor SMS alerts during business hours for immediate follow-up opportunities

- Review call summaries weekly to identify common client questions

Frequently Asked Questions

Can an AI assistant handle complex bookkeeping questions?

Yes, but it’s designed to handle initial inquiries and appointment scheduling. For complex technical questions, it captures details and immediately notifies you via SMS, ensuring no client question goes unanswered while maintaining professional service standards.

What happens during tax season when call volume increases?

AI assistants scale automatically without additional costs. Whether you receive 50 calls or 200 calls per month, the service handles every call with the same professional quality, making it perfect for seasonal bookkeeping practices.

How quickly can clients schedule appointments?

Immediately during the call. The AI assistant checks your real-time calendar availability and books appointments instantly, eliminating phone tag and reducing the time between initial contact and consultation from days to minutes.

What’s the difference between free and premium plans?

Free plans typically include basic call handling with limited features. Premium plans at $29/month offer advanced calendar integration, SMS notifications, multilingual support, and unlimited call handling – essential features for professional bookkeeping practices.

Can the system handle multiple languages for diverse client bases?

Yes, modern AI assistants support multiple languages and can switch seamlessly based on caller preference. This feature is particularly valuable for bookkeeping practices serving immigrant communities or diverse metropolitan areas.

Start Capturing Every Lead Today

Your bookkeeping firm can’t afford to miss another call. While competitors rely on outdated voicemail systems or expensive human receptionists, smart practices are using AI to capture every opportunity 24/7.

The math is clear: at just $29/month, an AI answering service pays for itself with just one additional client while providing benefits that scale with your business growth.

Ready to transform your client communication and stop losing revenue to missed calls?

For individuals and small bookkeeping practices (up to 5 team members), get started with the mobile app that handles all your client communications professionally.

Streamline Your Business with a Tax Preparation Answering Service

Best Tax Preparation Answering Service for CPA Firms in 2025: Complete Guide

Executive Summary

Tax season doesn’t have to mean stressed clients and missed opportunities. During busy periods, CPA firms lose 20-30% of incoming calls, which translates to thousands in lost revenue each month.

Key Advantages:

- Zero missed opportunities: Handles 100% of calls with instant tax-specific responses

- Automatic appointment booking: Schedules consultations and sends immediate notifications

- Multilingual support: Serves diverse client bases without language barriers

- Cost-effective scaling: Handles unlimited calls at a fraction of traditional service costs

- Instant setup: Train on your website and documents in minutes, not weeks

Ready to see how this approach can transform your tax practice? Let’s explore the complete comparison below.

For individuals and small teams (up to 5 persons) – Mobile app solution:

Try App Free

The Hidden Cost of Missed Calls During Tax Season

Tax preparers face a unique challenge. Between January and April, call volume jumps by 300-400%. Without proper phone management, you’re leaving serious money on the table.

Here’s what most CPA firms don’t want to admit:

- 30% of callers won’t leave a voicemail when you don’t answer

- 65% won’t call back if they reach voicemail twice

- Average tax prep client value ranges from $150-$800 per return

- Lost calls = lost revenue that your competitors capture instead

Consider a small tax practice receiving 50 calls per week during peak season. Missing just 20% means losing 10 potential clients weekly. At an average value of $300 per client, that’s $3,000 in missed revenue every single week.

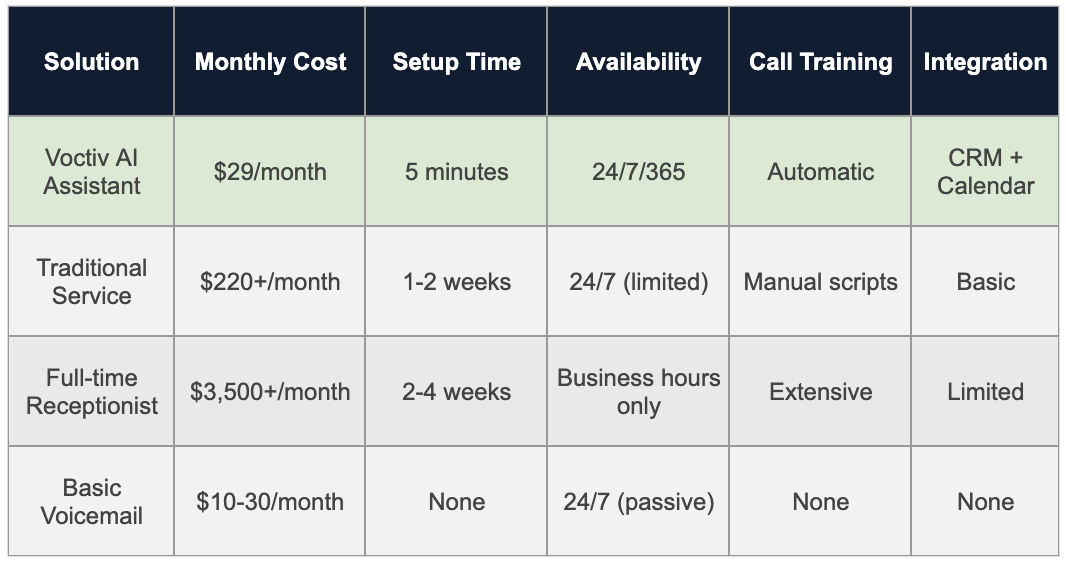

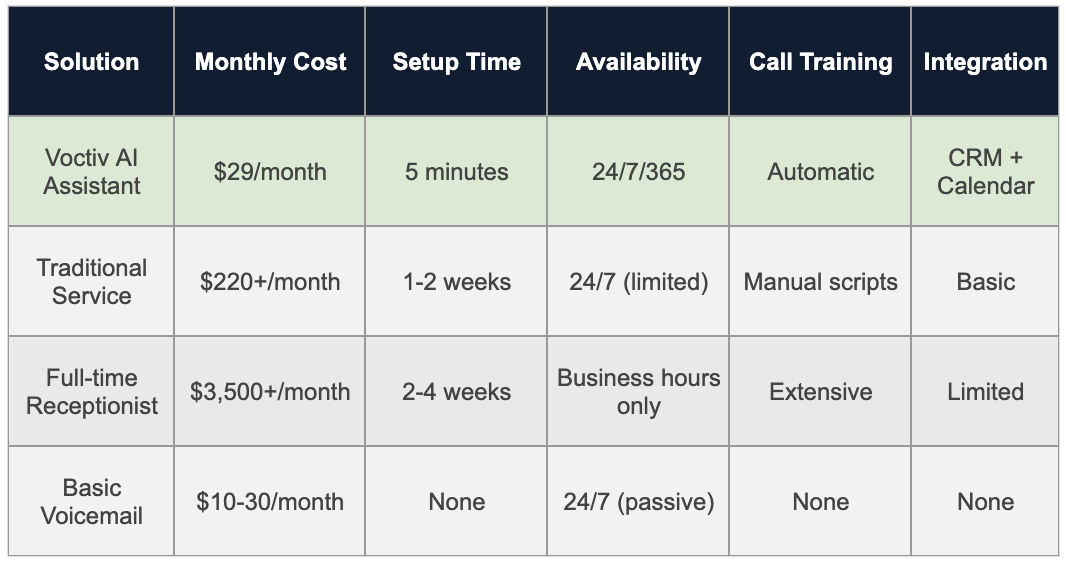

Traditional Solutions vs. Modern Tax Preparation Answering Service Needs

Option 1: Do Nothing (Voicemail Only)

Many small tax practices rely solely on voicemail, hoping clients will leave detailed messages.

Pros:

- Zero additional cost

- Simple to maintain

- No training required

Cons:

- Loses 30-40% of potential clients immediately

- Creates poor first impression

- Can’t capture urgent deadlines or questions

- No appointment scheduling capabilities

- Misses opportunities to upsell services

Revenue Impact:

Scenario: 40 calls/week during tax season, 35% don’t leave voicemail

- Missed calls per week: 14

- Average client value: $250

- Weekly lost revenue: $3,500

- 3-month tax season loss: $42,000

Option 2: Hiring a Full-Time Receptionist

The traditional approach involves hiring dedicated staff to handle phones during busy periods.

Pros:

- Human interaction for complex questions

- Can handle multiple tasks beyond phones

- Builds personal relationships with regular clients

- Available during business hours

Cons:

- High cost ($15-20/hour plus benefits)

- Requires 2-4 weeks training on tax terminology

- Limited to business hours only

- Sick days and vacation coverage needed

- May not handle peak volume efficiently

- Needs ongoing tax law update training

Revenue Impact:

Scenario: Receptionist works 8am-6pm, 15% of calls come after hours

- After-hours calls missed per week: 6

- Average client value: $300

- Weekly lost revenue: $1,800

- Plus monthly salary cost: $3,200

- Net monthly impact: $10,400 expense

Option 3: Traditional Outsourced Answering Service

Many tax preparers turn to generic answering services that handle calls for multiple industries.

Pros:

- 24/7 availability

- Lower cost than full-time staff

- Professional phone handling

- Bilingual options often available

Cons:

- Generic scripts don’t address tax-specific questions

- Can’t provide detailed service information

- Operators lack tax knowledge

- Often just takes messages without qualifying leads

- Setup takes 1-2 weeks

- Per-call charges can add up quickly

Revenue Impact:

Scenario: Service handles calls but can’t answer tax questions, 25% hang up frustrated

- Frustrated callers per week: 10

- Average client value: $275

- Weekly lost revenue: $2,750

- Monthly service cost: $350

- Total monthly impact: $11,350 loss

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant with integrations:

Book a Demo

The Perfect Solution: Voctiv AI Tax Preparation Answering Service

Voctiv AI represents an innovative approach to tax preparation answering service needs. It combines human-like intelligence with AI efficiency, specifically designed for tax professionals.

How Voctiv AI Works for Tax Preparers

Setup takes just minutes. You connect Voctiv to your business and provide information about your services. The AI trains itself on your website content, service offerings, and any additional materials you share.

When clients call, Voctiv AI:

- Answers immediately with your firm’s specific information

- Schedules appointments directly into your calendar

- Qualifies leads by asking relevant tax-related questions

- Provides service details about different tax preparation options

- Handles multiple languages for diverse client bases

- Sends instant notifications for hot leads and appointments

Key Benefits for Tax Practices

Zero Missed Revenue Potential

Unlike traditional solutions, Voctiv AI handles 100% of calls with intelligent, tax-specific responses. No potential client goes unanswered.

Instant Tax Knowledge

The AI trains on your specific services, pricing, and processes. It can explain different return types, deadlines, required documents, and pricing structures.

Appointment Automation

Clients can book consultations immediately without waiting for callbacks. You receive instant notifications with client details and scheduled times.

Lead Qualification

The AI asks strategic questions to identify high-value opportunities like business tax returns, multi-state filings, or ongoing bookkeeping services.

Multilingual Support

Serve Spanish-speaking clients, immigrants needing ITIN assistance, or any other language community in your area.

These calculations assume conservative conversion rates and account for typical call patterns during tax season. The actual revenue recovery often exceeds these projections due to improved client experience and 24/7 availability.

Implementation and Setup

Setting up Voctiv AI for your tax preparation answering service needs is remarkably simple:

Step 1: Quick Connection (2 minutes)

Connect your business phone number and provide basic information about your tax services.

Step 2: AI Training (3-5 minutes)

Share your website URL and any documents about your services. The AI learns your pricing, processes, and specializations.

Step 3: Customization (2 minutes)

Set your appointment availability and any specific responses for common tax questions.

Step 4: Go Live (Instant)

Your AI assistant is ready to handle calls immediately. No waiting periods or complex training processes.

Addressing Common Concerns About AI Phone Services

“Will clients know it’s AI?”

Voctiv AI maintains transparency while providing exceptional service. Clients appreciate getting immediate, accurate answers rather than waiting on hold or playing phone tag.

“Can it handle complex tax questions?”

The AI excels at initial qualification and appointment scheduling. For complex situations requiring professional judgment, it seamlessly schedules consultations and notifies you immediately.

“What about data security?”

The system focuses on scheduling and initial information gathering. Sensitive financial details are handled during your professional consultations, maintaining appropriate security protocols.

Frequently Asked Questions

How quickly can Voctiv AI be set up for tax season?

Setup takes just minutes. You can have your AI answering service live and handling calls within 10 minutes of starting the process. No waiting weeks for training or complex integrations.

Can the AI handle different types of tax services?

Yes, Voctiv AI learns your specific services including individual returns, business taxes, bookkeeping, tax planning, and any specialty services you offer. It provides accurate information about pricing and requirements for each service type.

What happens if a client needs immediate professional advice?

The AI identifies urgent situations and schedules priority consultations. You receive instant notifications about hot leads and time-sensitive matters, ensuring no critical deadlines are missed.

Does Voctiv AI work with existing appointment scheduling systems?

The system integrates with your calendar and can work alongside existing scheduling tools. Appointments are booked according to your availability preferences and immediately synchronized.

How does the multilingual support help tax preparers?

You can serve Spanish-speaking clients, immigrants needing ITIN assistance, or any language community in your area. This significantly expands your potential client base without hiring multilingual staff.

Transform Your Tax Practice Today

The choice is clear. While traditional tax preparation answering service options either cost too much, miss too many calls, or lack the specific knowledge your clients need, Voctiv AI delivers the perfect solution.

For less than $1 per day, you can:

- Capture 100% of incoming opportunities

- Provide 24/7 professional service

- Automatically schedule consultations

- Scale effortlessly during peak season

- Serve clients in multiple languages

Don’t let another tax season slip by with missed calls and lost revenue. Your competitors are already exploring AI solutions – staying ahead means acting now.

For individuals and small teams (up to 5 persons) – Mobile app solution:

Try App Free

For larger businesses with teams over 5 persons – Custom OMNI AI Assistant with integrations:

Book a Demo

Boost Client Satisfaction with an Accounting Firm Answering Service

Best Accounting Firm Answering Service in 2025: Complete Guide for Small CPA Practices

Executive Summary

Small accounting firms lose thousands of dollars monthly from missed calls. Traditional answering services cost too much and deliver too little. Voctiv AI Phone Assistant changes this by providing 24/7 call handling at a fraction of the cost. It trains on your business data in minutes and ensures you never miss another potential client again.

Key Advantages:

- Instant Setup: Trains on your website and business data automatically

- Multilingual Support: Handle clients in any language

- Smart Notifications: Immediate alerts for appointments and hot leads

- Cost Effective: 90% cheaper than human receptionists

- SMS Capabilities: Sends follow-up messages to prospects

Your accounting firm’s phone is ringing right now. But where are you? Meeting with a client? Reviewing tax returns? Handling payroll? Every missed call could be a new client worth thousands in annual revenue walking away to your competitor who answers their phone.

Discover how accounting firms are recovering $2,000-$4,000 monthly in previously lost revenue while cutting phone handling costs by 85%.

Mobile app for individuals and small teams (up to 5 persons)

Try App Free

The Hidden Cost of Missed Calls for Accounting Firms

Small CPA practices lose an average of $2,400 monthly from missed calls. Here’s the math that’ll shock you:

- Average accounting firm receives 45 calls per month

- 25% of calls go unanswered (that’s 11 missed calls)

- Each new client averages $2,200 annual value

- 15% of missed calls would’ve become clients

- Lost revenue: 11 × 0.15 × $2,200 = $3,630 annually per missed call period

During tax season? These numbers triple. You’re literally watching revenue walk out the door every time your phone rings unanswered.

Traditional Accounting Firm Answering Service Solutions (And Why They’re Failing)

The “Do Nothing” Voicemail Approach

How it works: Let calls go to voicemail and hope clients leave messages.

Pros:

- Cheapest option ($10-30/month)

- No setup required

- Better than nothing

Cons:

- 70% of callers hang up without leaving messages

- Creates unprofessional image for financial services

- No way to capture urgent leads

- Competitors who answer live win the business

Missed Revenue Calculation:

With 45 monthly calls and 30% going unanswered (14 calls), plus 70% not leaving voicemail (10 additional lost opportunities), you’re missing 24 potential connections monthly. At $150 average call value, that’s $3,600 monthly in lost revenue.

Hiring a Full-Time Receptionist

How it works: Employ a dedicated person to answer calls during business hours.

Pros:

- Personal touch with familiar voice

- Can handle complex scheduling

- Learns your clients over time

- Available for other office tasks

Cons:

- Expensive ($35,000-$45,000 annually with benefits)

- Limited to business hours only

- Sick days and vacation leave phones unattended

- Requires training and management

- Single point of failure

Missed Revenue Calculation:

Even with a receptionist, 20% of calls still occur after hours (9 calls monthly). These after-hours calls often represent urgent tax questions or time-sensitive business needs. Lost value: $1,350 monthly plus $3,750 monthly salary costs.

Traditional Outsourced Answering Service

How it works: Third-party service answers calls using basic scripts and forwards messages.

Pros:

- 24/7 availability

- Professional call handling

- No sick days or vacation issues

- Scalable for busy seasons

Cons:

- Expensive ($220+ monthly for basic service)

- Generic scripts that don’t capture your expertise

- Agents don’t understand accounting terminology

- 1-2 week setup process

- Limited integration with your systems

- Per-call charges add up quickly

Missed Revenue Calculation:

While coverage improves, generic scripts miss 15% of qualified leads due to poor screening (7 calls monthly). These missed opportunities cost $1,050 monthly, plus the $220+ service fee.

Why Voctiv AI Phone Assistant is Perfect for Accounting Firms

Voctiv AI isn’t just another answering service. It’s specifically designed for professional services like accounting firms that need intelligent call handling without breaking the bank.

Instant Setup That Understands Your Practice

Forget weeks of training scripts. Voctiv automatically trains itself on your website content, services, and business information in minutes. It learns your:

- Service offerings (tax prep, bookkeeping, payroll, etc.)

- Pricing structure and packages

- Seasonal availability (tax season scheduling)

- Common client questions and concerns

- Professional terminology and processes

Multilingual Client Support

Expand your client base instantly. Voctiv handles calls in multiple languages, perfect for accounting firms serving diverse communities. No more losing Spanish-speaking business owners who need bookkeeping services.

Smart Lead Qualification

Unlike basic answering services, Voctiv qualifies leads intelligently:

- Identifies high-value prospects (business owners vs. individual tax filers)

- Captures specific needs (QuickBooks cleanup, tax problem resolution)

- Schedules consultations based on your availability

- Sends immediate SMS follow-ups to hot prospects

Seamless Integration with Your Workflow

Voctiv connects with your existing tools:

- Calendar systems for appointment booking

- CRM platforms for lead management

- SMS messaging for client communication

- Instant notifications for urgent calls

Custom OMNI AI Assistant ideal for businesses with teams over 5 persons and custom integrations

Book a Demo

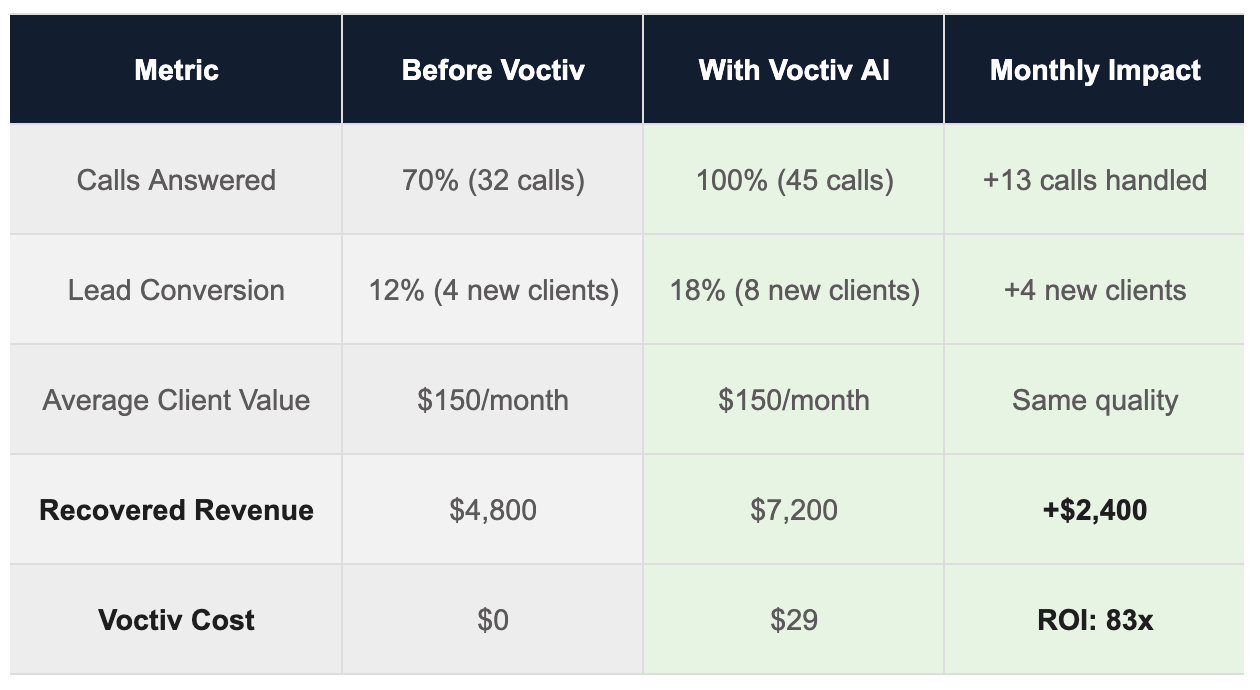

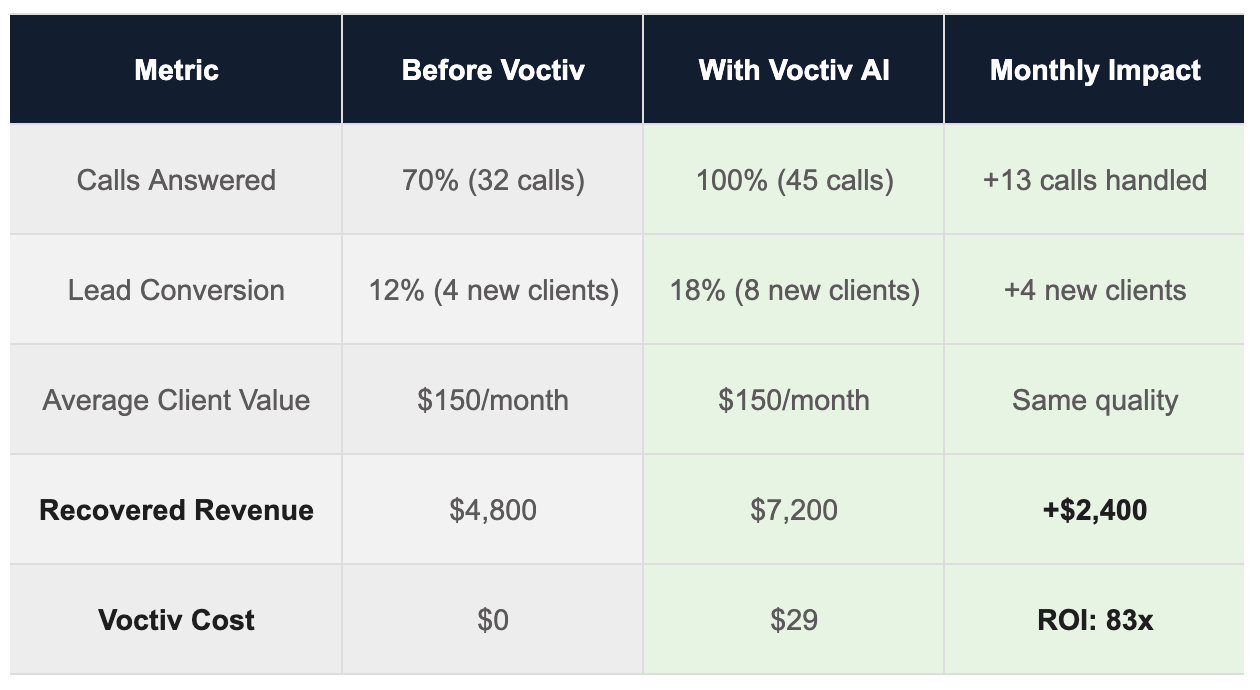

Real ROI: How Much Revenue Can Your Accounting Firm Recover?

Let’s run the numbers for a typical small accounting firm:

Conservative estimate: Voctiv recovers $2,400 monthly in previously lost revenue while costing just $29. That’s an 8,200% return on investment.

Common Objections (And Why They Don’t Apply to Voctiv)

“AI Can’t Handle Complex Accounting Questions”

You’re absolutely right. Voctiv doesn’t try to provide tax advice or handle complex accounting questions. Instead, it:

- Qualifies the caller’s needs professionally

- Schedules appointments for detailed discussions

- Captures contact information and urgency level

- Immediately notifies you of high-priority calls

“Clients Want to Talk to Real People”

They want their calls answered professionally and their needs understood. Voctiv’s natural conversation flow often surprises callers with how human-like the interaction feels. Plus, it seamlessly connects urgent calls to you directly.

“What About Client Confidentiality?”

Voctiv follows strict security protocols and focuses on business inquiries, appointment scheduling, and lead qualification – all within professional standards. It doesn’t collect or store sensitive financial information during initial calls.

Getting Started: From Setup to Success in Under 10 Minutes

Here’s exactly what happens when you activate Voctiv for your accounting firm:

- Connect your phone number (2 minutes)

- Voctiv scans your website and learns your services (3 minutes)

- Customize greeting and call flow preferences (2 minutes)

- Set up calendar integration for appointments (2 minutes)

- Test call to verify everything works (1 minute)

That’s it. Your accounting firm now has 24/7 professional call handling that costs less than a single billable hour monthly.

Frequently Asked Questions

Can Voctiv handle appointment scheduling for tax consultations?

Absolutely. Voctiv integrates with your calendar system to book consultations based on your availability. It can even handle different appointment types (tax prep, business consultations, bookkeeping setup) with appropriate time allocations.

What happens during tax season when call volume increases?

Voctiv scales automatically. Unlike human receptionists who get overwhelmed, or traditional services that charge per-call overages, Voctiv handles unlimited calls at the same flat rate. Perfect for managing seasonal demand spikes.

How does Voctiv qualify accounting leads differently than basic answering services?

Voctiv asks intelligent follow-up questions based on your services. It distinguishes between individual tax clients and business owners needing ongoing bookkeeping, captures specific pain points like QuickBooks problems, and identifies urgency levels for proper prioritization.

Can existing clients reach me directly for urgent matters?

Yes. Voctiv can be configured to recognize existing client phone numbers and either connect them directly or handle their requests with priority routing. You maintain control over who gets immediate access.

What if a caller has a complex question that requires my expertise?

Voctiv gracefully handles this by explaining that detailed questions require your personal attention, then immediately schedules a callback or consultation. It also sends you a detailed summary of the caller’s needs, so you’re prepared for the conversation.

Stop Losing Clients to Competitors Who Answer Their Phones

Every day you delay implementing professional call handling, you’re handing potential clients to competitors who answer their phones. The accounting firm down the street doesn’t have to be better than you – they just have to be available when prospects call.

Voctiv AI Phone Assistant gives your small accounting practice the professional phone presence of a large firm, at a fraction of the cost. Your clients get immediate attention, your leads get qualified properly, and you get back to doing what you do best – helping businesses with their finances.

The best time to implement an accounting firm answering service was last year. The second-best time is right now, before your next potential client calls and gets voicemail instead of professional service.

Mobile app for individuals and small teams (up to 5 persons)

Try App Free