Best Wealth Management Answering Service 2025: Compare AI vs Traditional Solutions

Executive Summary

Wealth management firms can’t afford to miss client calls when markets fluctuate or portfolios need immediate attention. Every missed call could mean losing a $500,000 portfolio to a competitor who answers 24/7.

Key advantages of Voctiv AI for wealth management:

- Instant client inquiry handling – No waiting for callbacks during market volatility

- Multilingual support – Serve diverse client portfolios in their preferred language

- Compliance-friendly – Captures detailed call logs for regulatory requirements

- SMS notifications – Immediately alerts you about urgent portfolio discussions

- Self-training capability – Learns your firm’s services and investment philosophy automatically

Discover how wealth management firms prevent thousands in lost revenue annually with 24/7 AI call coverage below.

For individuals and small wealth management teams (up to 5 persons), Voctiv offers a mobile app solution:

Why Wealth Management Firms Need Professional Call Handling

Your clients trust you with their life savings. When they call about market concerns or portfolio changes, they expect immediate professional responses – not voicemail.

The harsh reality: Wealth management prospects typically call 3-5 firms before making a decision. The first firm that answers professionally often wins the client.

Research shows that 73% of potential clients won’t leave voicemails for financial services. They’ll simply call your competitor instead.

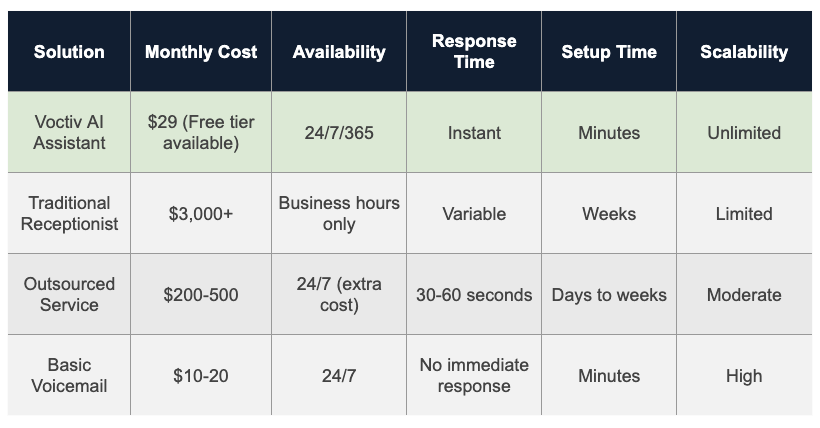

Voicemail-Only Approach: The Revenue Killer

Many smaller wealth management firms rely solely on voicemail systems. Here’s why this approach costs you clients:

Pros of Voicemail Systems:

- Extremely low monthly cost ($10-50)

- Simple setup process

- Works 24/7 for message recording

Cons of Voicemail-Only:

- Zero real-time client interaction during urgent situations

- Prospects hang up without leaving messages 68% of the time

- No ability to schedule consultations immediately

- Unprofessional image for high-net-worth client expectations

- Delayed response times frustrate time-sensitive inquiries

Revenue Impact of Voicemail-Only:

Conservative assumptions for mid-sized wealth management firm:

- Monthly prospect calls: 50

- Calls resulting in voicemail only: 35 (70%)

- Voicemails never returned by prospects: 25 (73%)

- Average new client portfolio value: $150,000

- Annual management fee: 1.2%

Monthly lost revenue from missed connections: $2,250

Annual revenue loss: $27,000

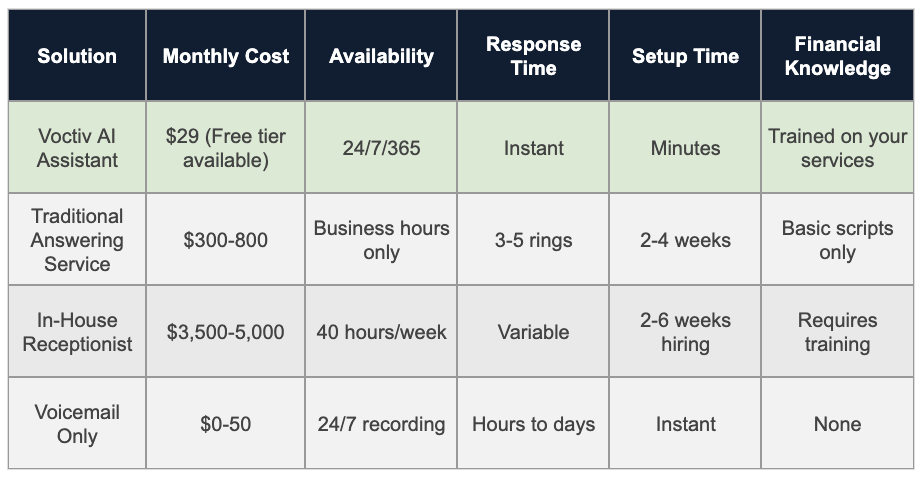

Traditional Answering Services: Expensive and Limited

Standard call center services offer human operators but come with significant drawbacks for wealth management needs.

Pros of Traditional Services:

- Human interaction feels personal

- Can handle basic appointment scheduling

- Available during extended business hours

Cons of Traditional Services:

- High monthly costs ($300-800 for quality service)

- Limited financial industry knowledge

- Script-based responses sound generic and unprofessional

- Long training periods (2-4 weeks) for your specific services

- No true 24/7 coverage (premium rates for nights/weekends)

- High employee turnover requires constant retraining

Revenue Impact from Service Limitations:

Even with answering services, wealth management firms lose prospects due to:

- Generic responses that don’t address specific investment concerns

- Inability to answer basic questions about your firm’s philosophy

- 15-20% of calls still go unanswered during peak times

- Weekend and holiday coverage gaps

Estimated monthly missed revenue: $1,200-2,000

For larger wealth management businesses with teams over 5 persons, Voctiv offers a custom OMNI AI Assistant that’s ideal for complex integrations:

Hiring In-House Receptionists: The Traditional Trap

Many growing wealth management firms consider hiring dedicated receptionists. While this provides human interaction, it’s often the most expensive option with significant limitations.

Pros of In-House Receptionists:

- Direct control over training and quality

- Can learn your firm’s specific investment approaches

- Builds relationships with regular clients

- Handles multiple administrative tasks

Cons of In-House Staff:

- Extremely high costs ($3,500-5,000/month with benefits)

- Zero coverage during sick days, vacations, breaks

- Limited to 40 hours/week availability

- Lengthy hiring and training process (2-6 weeks)

- No weekend or after-hours coverage without additional hires

- Employee turnover disrupts client relationships

Hidden Revenue Loss from Coverage Gaps:

Coverage gaps occur during:

- Lunch breaks (1 hour daily)

- Sick days (average 6 days/year)

- Vacation time (10-15 days/year)

- All evenings and weekends

- Training periods for new hires

Estimated coverage gaps: 35% of business hours

Monthly missed revenue from gaps: $1,800-3,200

Voctiv AI: The Perfect Wealth Management Solution

Voctiv AI Phone Assistant eliminates every problem that traditional solutions create while providing 100% call coverage at a fraction of the cost.

How Voctiv Works for Wealth Management Firms:

Setup takes minutes, not weeks:

- Connect your business phone number

- Upload your website content or service descriptions

- AI automatically learns your investment philosophy and services

- Start handling calls professionally within minutes

Intelligent call handling includes:

- Professional greetings customized to your firm’s tone

- Answering common questions about your services and approach

- Immediate appointment scheduling for consultations

- Capturing detailed client information and investment goals

- Instant SMS notifications to you about urgent calls

- Multilingual support for diverse client bases

Why Voctiv Eliminates Missed Revenue:

True 24/7/365 availability means:

- Zero missed calls – every prospect gets immediate professional attention

- After-hours inquiries are captured and prioritized

- Weekend market concerns are addressed professionally

- Holiday coverage without premium rates

- Instant response times build trust with high-net-worth prospects

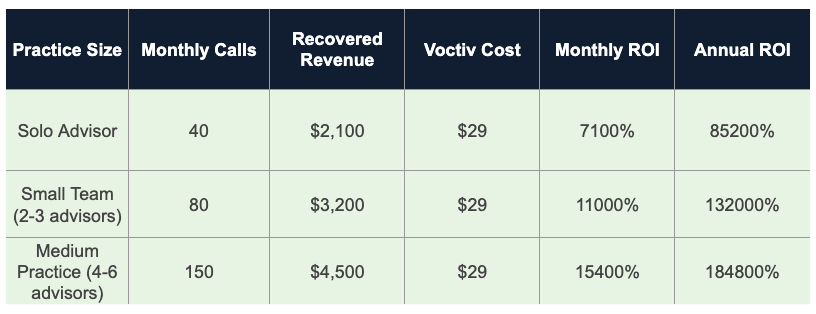

Real-World Impact: Revenue Recovery

Here’s how Voctiv AI transforms wealth management firm performance with realistic expectations:

Small Wealth Management Firm (1-3 advisors):

Before Voctiv:

- Monthly prospect calls: 30

- Calls answered professionally: 18 (60%)

- Missed revenue from poor call handling: $1,500/month

After Voctiv implementation:

- Professional response rate: 100%

- Monthly recovered revenue: $1,500

- ROI: 5,100% ($1,500 recovered ÷ $29 cost)

Medium Wealth Management Firm (4-8 advisors):

Before Voctiv:

- Monthly prospect calls: 75

- Professional handling rate: 65%

- Missed revenue from gaps: $3,200/month

After Voctiv implementation:

- Monthly recovered revenue: $3,200

- ROI: 11,000% ($3,200 recovered ÷ $29 cost)

- Annual revenue protection: $38,400

Common Objections About AI Call Handling

Wealth management professionals often worry about AI replacing human interaction. Here’s why those concerns don’t apply to Voctiv:

“Clients Want to Speak with Humans”

Reality: Clients want immediate, knowledgeable responses. Voctiv provides instant professional interaction while immediately connecting urgent calls to you via SMS notification.

“AI Can’t Handle Complex Financial Questions”

Reality: Voctiv doesn’t provide financial advice. It professionally captures client information, schedules consultations, and immediately notifies you about important discussions. Complex questions get personal attention faster than ever.

“Setup Must Be Complicated”

Reality: Voctiv trains itself using your website content. Setup takes minutes, not weeks like traditional answering services require.

Frequently Asked Questions

“How quickly can Voctiv learn about our wealth management services?”

Voctiv’s self-training capability analyzes your website content and any additional materials you provide within minutes. The AI immediately understands your investment philosophy, service offerings, and firm personality to provide consistent professional responses.

“Can Voctiv handle calls in languages other than English?”

Yes, Voctiv supports multilingual conversations. You can add languages through the app interface to serve diverse client portfolios in their preferred language, which is especially valuable for wealth management firms serving international clients.

“What happens if a client has an urgent portfolio concern after hours?”

Voctiv immediately sends you SMS notifications about urgent calls and captures all client information professionally. You’ll know about important situations in real-time and can respond appropriately. The AI doesn’t provide investment advice but ensures no urgent communication goes unnoticed.

“How does pricing work for wealth management firms with multiple advisors?”

Small teams (up to 5 persons) can use the mobile app starting with a free tier, then $29/month for premium features. Larger firms benefit from custom OMNI AI Assistant solutions with advanced integrations tailored to complex wealth management operations.

“Can Voctiv integrate with our existing CRM and scheduling systems?”

Yes, Voctiv offers integration capabilities especially with the custom OMNI solution for larger wealth management firms. The AI can work with your existing systems to streamline appointment scheduling and client information management.

Transform Your Wealth Management Firm’s Call Handling Today

Every day you delay implementing professional call handling, you’re losing potential clients to competitors who answer immediately and professionally.

Voctiv AI eliminates the choice between expensive human staffing and missed revenue. You get 100% call coverage, professional client interaction, and immediate notifications about important calls – all for less than the cost of a business lunch.

The math is simple: Even recovering one additional $150,000 client portfolio annually pays for Voctiv for 15 years. Most wealth management firms see that return within the first month.

Stop losing prospects to voicemail and start capturing every opportunity with professional 24/7 coverage.

For individuals and small wealth management teams (up to 5 persons), Voctiv offers a mobile app solution: