Loan Officer AI Phone Assistant: 2025 Complete Guide to Never Missing Another Client Call

Executive Summary

Loan officers lose thousands in potential revenue monthly due to missed calls and delayed responses. Traditional phone management solutions fail to provide the speed and 24/7 availability that mortgage clients demand in today’s competitive market.

Key Advantages:

- Zero missed calls – Captures every potential client 24/7

- Instant loan pre-qualification – Handles initial client screening

- SMS follow-up capabilities – Sends appointment confirmations and reminders

- Multilingual support – Serves diverse client populations

- Immediate hot lead notifications – Alerts you to high-value prospects

Discover how Voctiv’s AI technology eliminates missed revenue while reducing your workload by 70%.

Perfect for individual loan officers and small teams (up to 5 people)

The Hidden Cost of Missed Calls in Mortgage Lending

You know that feeling when you’re deep in paperwork and your phone rings? Most loan officers can’t answer every call immediately. But here’s the shocking truth: every missed call costs you an average of $2,500 in potential commission.

Mortgage clients don’t wait around. They call the next lender on their list. With interest rates fluctuating daily, borrowers want answers now – not when you’re free to call back.

Research shows that 80% of mortgage shoppers contact multiple lenders within 24 hours. The first loan officer who responds professionally gets the deal. It’s that simple.

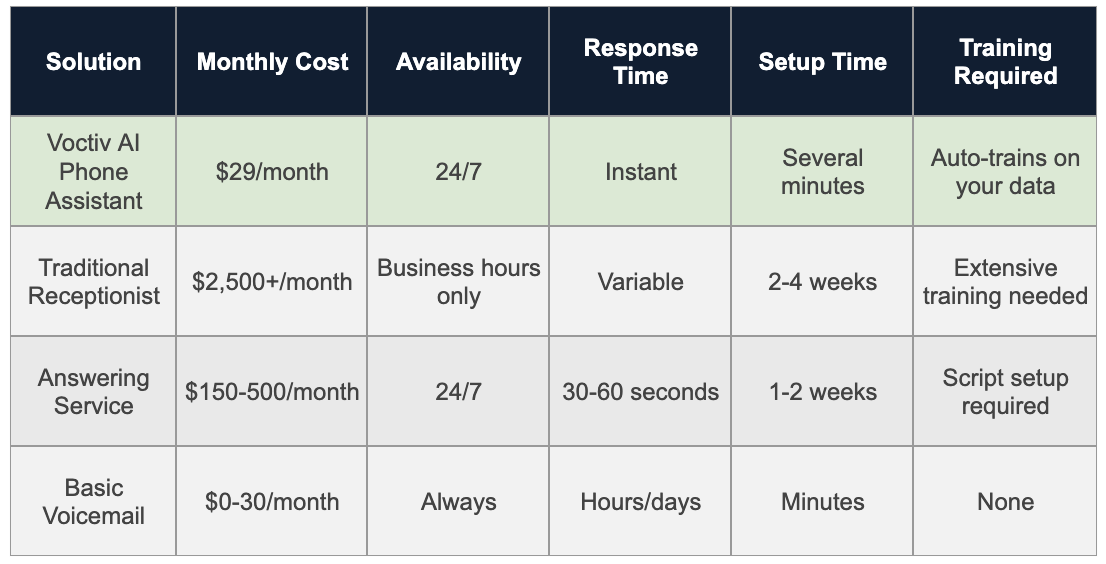

Why Traditional Solutions Fail Loan Officers

The “Do Nothing” Approach: Voicemail Only

Many loan officers rely on voicemail because it’s cheap and easy. But this approach is killing your business potential.

Pros:

- No additional cost

- Simple to set up

- Better than no message system

Cons:

- Clients rarely leave detailed messages

- No way to capture lead information

- Looks unprofessional in competitive markets

- Can’t handle urgent time-sensitive inquiries

Missed Revenue Calculation:

If you receive 40 calls monthly and miss 50% due to being unavailable, that’s 20 missed opportunities. With a 15% conversion rate and average loan value of $350,000 (earning $3,500 commission), you’re losing $5,250 monthly in potential revenue.

Hiring a Full-Time Receptionist

A dedicated receptionist sounds professional, but the costs add up quickly for solo practitioners and small teams.

Pros:

- Professional phone presence

- Can handle appointment scheduling

- Provides human interaction

- Can learn your specific processes

Cons:

- Expensive ($2,500-4,000 monthly salary plus benefits)

- Limited to business hours only

- Requires extensive mortgage industry training

- May not handle loan-specific questions properly

- Sick days and vacation time create coverage gaps

Missed Revenue Calculation:

Even with a receptionist, you’ll miss 30% of calls during off-hours and weekends. That’s 12 missed calls monthly, potentially costing you $3,150 in lost commissions.

Traditional Answering Services

Generic answering services seem like a middle-ground solution, but they’re not designed for the mortgage industry’s unique needs.

Pros:

- 24/7 availability

- Professional phone answering

- Message taking and forwarding

- More affordable than full-time staff

Cons:

- Operators don’t understand mortgage terminology

- Can’t pre-qualify borrowers

- No loan-specific question handling

- Generic scripts sound impersonal

- Monthly fees of $150-500 plus per-call charges

Missed Revenue Calculation:

Generic operators miss 20% of leads due to poor qualification and unprofessional handling. That’s 8 missed conversions monthly, costing approximately $2,100 in lost business.

The Perfect Solution: Voctiv AI Loan Officer Assistant

Voctiv AI changes everything. It’s not just another answering service – it’s a specialized AI assistant that understands the mortgage industry inside and out.

How Voctiv Works for Loan Officers

Setup takes just minutes. You connect your phone number and share your website or basic business information. The AI automatically learns about your services, rates, and processes.

When clients call, they hear your personalized greeting and can immediately ask questions about:

- Current interest rates

- Loan programs available

- Pre-qualification requirements

- Documentation needed

- Timeline expectations

The AI doesn’t just take messages – it engages callers in meaningful conversations, captures complete contact information, and identifies hot leads immediately.

Key Features That Set Voctiv Apart

Instant Hot Lead Notifications: Get text alerts within seconds when high-value prospects call. No more waiting hours to discover someone’s ready to move forward.

Multilingual Capabilities: Serve Spanish-speaking clients, Asian communities, and other demographics that competitors can’t handle effectively.

SMS Follow-up: Send appointment confirmations, rate updates, and document reminders automatically. Keep clients engaged throughout the loan process.

Self-Training Technology: The AI gets smarter with every call, learning your preferred responses and adapting to your business style.

Complete ROI Analysis for Loan Officers

| Metric | Without Voctiv | With Voctiv AI | Monthly Impact |

|---|---|---|---|

| Monthly Calls Received | 40 | 40 | Same volume |

| Calls Successfully Handled | 20 (50%) | 40 (100%) | +20 opportunities |

| Conversion Rate | 15% | 18% | +3% due to better service |

| Closed Loans | 3 | 7.2 | +4.2 additional loans |

| Commission per Loan | $3,500 | $3,500 | Same rate |

| Monthly Revenue Recovery | $10,500 | $25,200 | +$14,700 |

| ROI on $29 Investment | N/A | 507x | 50,700% return |

Conservative estimate: Voctiv pays for itself within the first hour of use. The technology captures leads you’d otherwise lose forever.

Perfect for larger mortgage teams and brokerages with custom integration needs

Real-World Applications for Mortgage Professionals

Scenario 1: Weekend Rate Shopping

It’s Saturday morning. Interest rates just dropped, and your phone’s ringing with rate shoppers. With Voctiv, these callers get immediate rate quotes and can schedule Monday consultations – all while you’re enjoying family time.

Scenario 2: After-Hours Client Concerns

A client calls at 9 PM worried about their loan approval. Voctiv provides reassurance, captures their specific concerns, and sends you a detailed summary. By morning, you’re ready with solutions instead of playing phone tag.

Scenario 3: Referral Partner Coverage

Your real estate agent refers an urgent buyer. Even if you’re in a closing, Voctiv captures the lead, begins pre-qualification, and ensures the referral feels valued immediately.

Implementation: Getting Started in Minutes

Voctiv’s setup process is designed for busy loan officers who need results immediately:

- Sign up – Create your account in under 2 minutes

- Connect your phone – Forward calls or use their number

- Share your website – AI learns your services automatically

- Customize responses – Add specific rates, programs, and policies

- Go live – Start capturing leads immediately

No technical expertise required. No lengthy training sessions. Just intelligent call handling from day one.

Addressing Common Concerns

“Will clients know it’s AI?”

Voctiv’s conversational AI sounds natural and professional. Clients appreciate getting immediate answers rather than waiting for callbacks. The focus is on helping, not hiding the technology.

“Can it handle complex mortgage questions?”

Yes. The AI understands loan programs, qualification requirements, and documentation needs. For complex scenarios, it captures detailed information and ensures you have everything needed for follow-up.

“What about compliance concerns?”

Voctiv focuses on information gathering and initial qualification. It doesn’t provide official loan commitments or financial advice – that’s your expertise. It simply ensures no potential client slips through the cracks.

Frequently Asked Questions

How quickly can I see results with Voctiv?

Most loan officers see immediate improvements in lead capture. Within the first week, you’ll notice fewer missed opportunities and better lead qualification. Full ROI typically shows within 30 days.

Can Voctiv integrate with my existing CRM?

Yes. Voctiv captures lead information that easily transfers to most CRM systems. For larger teams, custom integrations are available to streamline your workflow completely.

What happens if someone needs immediate assistance?

Voctiv identifies urgent situations and sends immediate notifications. Hot leads trigger instant alerts, so you can respond to time-sensitive opportunities within minutes.

How does pricing work for multiple loan officers?

Individual loan officers use the mobile app for $29/month. Larger teams and brokerages get custom pricing with additional features like lead distribution and advanced analytics.

Can I customize responses for different loan programs?

Absolutely. Voctiv learns your specific loan programs, rates, and qualification criteria. You can customize responses for FHA, VA, conventional, jumbo, and specialty programs.

Stop Losing Loans to Competitors

Every day you wait is money left on the table. While you’re missing calls, your competitors are capturing leads and closing loans.

Voctiv AI Phone Assistant gives you the competitive advantage you need. It’s not just about answering calls – it’s about winning more business by being available when clients need you most.

The mortgage industry rewards speed and professionalism. Voctiv delivers both, 24/7, for less than you’d spend on coffee each month.

Ready to capture every lead and maximize your loan volume?

Perfect for individual loan officers and small teams (up to 5 people)